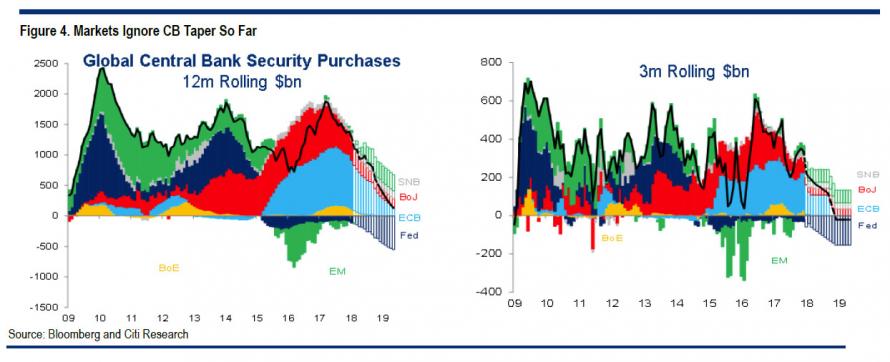

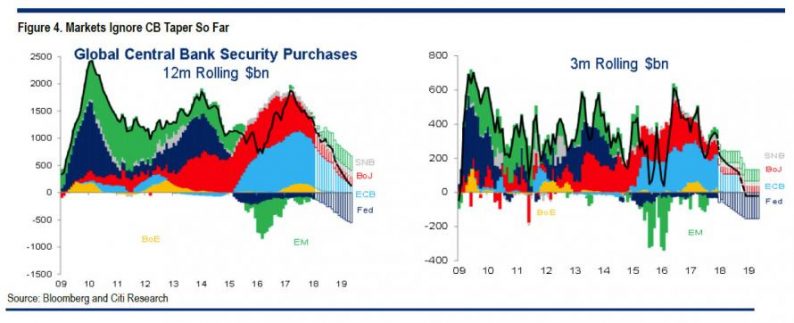

This is the most important chart in the World:

It illustrates the $2Tn “taper” that is about to take place and is, in fact, taking place right now and projected to accelerate rapidly into 2019 at which point (gasp!) Central Banks will become net sellers of assets and there is NO WAY that doesn’t depress prices, even with a theoretical $2Tn being repatriated from overseas accounts on the Corporate side.

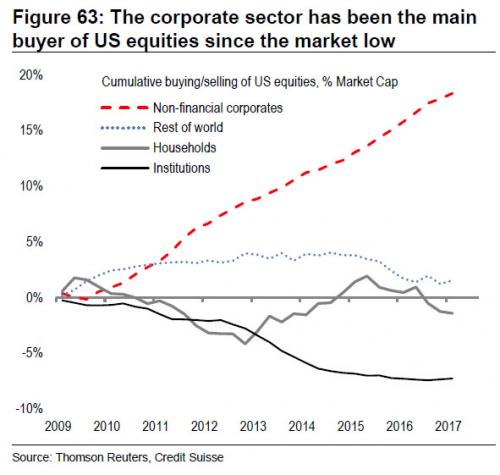

While we can’t count on Corporations to spend the cash they bring back in, we can expect the massive stock buyback trend to continue. As you can see from Credit Suisse’s chart, the only real buyer of US equities for the past 10 years has been the Corporations themselves – who have engaged in MASSIVE buy-back programs that have lowered the share count of US equities by 20% which has therefore inflated the earnings per share by 20% by simply reducing the number of shares those earnings are divided by.

This makes our Top 1% CEOs look good and also makes them much, much richer (see: “Stock buybacks enrich the bosses even when business sags“) and so far, so good, as the market has gone up despite most companies making roughly the same amount of Dollars they did back in 2008 – they are just changing the math to make things look pretty.

But, much like the Oil Cartel (OPEC) benefits from cutting supply and making oil more scarce and Crypto Currency purveyors keep their supplies limited to jack up the prices – the Corporate Cartel (MFers) reduces the supply of stock AND they themselves begin buying their stock – as if it’s valuable at any price. The higher the market goes, the more they buy – what can possibly go wrong?

Like any meth addict, they are now hopelessly hooked on buybacks and simply can’t stop. It’s a finite World and they have infinite amounts of money and they can’t grow market share so they will reduce the number of shares in their companies to make it look like there’s great demand for their stock and, most importantly, to make it look like they are accomplishing something.

Just this morning, Lowe’s (LOW) announced a $5Bn stock buyback program ON TOP OF their previous $2.1Bn program. The entire market cap of LOW is $89Bn so we’re talking close to 10% of the company being bought back in just a couple of years. That has helped Lowe’s stock to go up from $20 per share in 2012 to $107 per share this morning despite earnings only going from $1.8Bn to $3.5Bn. Yes, it’s an impressive 100% gain in earnings (20% per year average) but the stock is up 400%, outpacing earnings growth by 3x!

Leave A Comment