Let’s Buy Sweden and Put it on our Front Lawn

Or rather, let’s not. As Bloomberg reports, the officially admitted to amount of bad loans in China’s banking system has by now swelled to approx 4 trillion yuan, or $628 billion, which is roughly equivalent to Sweden’s total economic output per year.

Sweden is a small, but highly developed country which exhibits astonishing rates of monetary and credit inflation at present. It has slightly less than 10 million inhabitants, and its “GDP per capita” on a purchasing power parity basis amounts to approx. $44,000 compared to $12,600 in China. We are mentioning this to make clear that such comparisons have to be put into proper perspective.

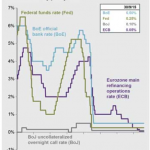

Annualized loan growth of China’s banking system. After the huge post GFC surge in bank lending (the government essentially ordered the large state-owned banks to expand credit willy-nilly) it has slowed to a still quite extraordinary 14.4% as of October.

In short, bad loans equal to the GDP of Sweden still represent a very low NPL ratio of just 5.5% – and this is including so-called “special mention” loans, which are dud loans that are held not to be complete write-offs just yet, primarily based on assorted extend & pretend schemes. In China this method of masking the extent of bad loans is called “evergreening” loans. Naturally, everything is done to hide the true extent of deterioration, but this is by no means unique to China.

For instance, the successfully “stress-tested” banking systems of Europe’s peripheral countries are weighed down by staggering amounts of dud loans as well, but extend & pretend is the order of the day everywhere these days. Based on official data and the relative sizes of their economies, the banking systems of countries like Spain and Greece are for the time being in a far worse position than China’s. In Sweden the credit bubble sun is still shining, but when (not if) its credit and real estate bubbles burst, it is highly likely to become the next Spain.

But what about China? Chinese data generally have to be taken with a big barrel-full of salt. A great many ancillary data that describe economic activity, such as electricity consumption, cargo traffic or steel prices belie official GDP growth rates. In fact, if all we knew were those ancillary data, we would never suspect GDP to be growing at all, let alone at a rate of 6.9%. Of course, one must never lose sight of the fact that GDP is a quite useless statistic to begin with. We have discussed this on several occasions (readers may want to check out “The GDP Illusion” and “The Mirage of Economic Growth” for details). In the words of Oscar Morgenstern: “[T]here is real trouble with the basic underlying notion of GNP. It is not an acceptable scientific concept for the purposes it is used”.

According to Bloomberg, another large corporate borrower has recently keeled over in China, with its debt abruptly joining the collection of dud loans in the banking system:

“Chinese banks’ troubled loans swelled to almost 4 trillion yuan ($628 billion) by the end of September, more than the gross domestic product of Sweden, according to figures released by the industry regulator. Banks’ profit growth slumped to 2 percent in the first nine months from 13 percent a year earlier, according to data released on Thursday night by the China Banking Regulatory Commission.

The numbers come as a debt crisis at China Shanshui Cement Group Ltd. prompts lenders including China Construction Bank Corp. and China Merchants Bank Co. to demand immediate repayments and as weakness in October credit growth shows the risk of a deeper economic slowdown. While the official data shows non-performing loans at 1.59 percent of outstanding credit, or 1.2 trillion yuan, that rises to 5.4 percent, or 3.99 trillion yuan, if “special mention” loans, where repayment is at risk, are also included. The amount of bad debt piling up in China is at the center of a debate about whether the country will continue as a locomotive of global growth or sink into decades of stagnation like Japan after its credit bubble burst.

It is a good bet that several more large borrowers will be going belly-up in the not-too-distant future. China has been home to twin real estate and infrastructure construction bubbles that are dwarfing anything seen before. Entire cities built for millions are ghost towns that are already crumbling before anyone has settled in them. It is malinvestment on a truly gargantuan scale, essentially Keynesian pyramid building to unbridled excess. All the economic activity associated with this waste of scarce capital was of course recorded as “growth” in the GDP accounts.

Leave A Comment