Image Source: Pixabay

Image Source: Pixabay

Moody’s rating service lowered its outlook on the US credit rating to “negative” from “stable”. This is not a ratings downgrade; but rather a warning of things to come. This follows actual downgrades in the US credit ratings from Fitch and S&P Global Ratings.Yahoo Finance reports:

“The key driver of the outlook change to negative is Moody’s assessment that the downside risks to the US’s fiscal strength have increased and may no longer be fully offset by the sovereign’s unique credit strengths.

…. In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues, Moody’s expects that the US’ fiscal deficits will remain very large, significantly weakening debt affordability.

Continued political polarization within US Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability.”

Yahoo outlines the politics; each political party blaming the other, concluding:

“However the politics play out, analysts expect the debt to be an unavoidable issue for the foreseeable future. ‘Interest rates have shifted materially and structurally higher,’ (said) William Foster, a senior credit officer at Moody’s. …. ‘Our expectation is that these higher rates and deficits around 6% of GDP for the next several years, and possibly higher, means that debt affordability will continue to pressure the US.’

As for what happens next, Foster said lawmakers need to address the problem directly. …. ‘We need to have evidence that the government will reduce deficits either through lower spending, or other measures or raise revenues.’”

As always, Treasury Secretary Janet Yellen disagreed:“This is a decision I disagree with. ‘The American economy is fundamentally strong, and Treasury securities remain the world’s preeminent safe and liquid asset.’”Martin Armstrong is fed up:

“…. The US government is continually spending with no end in sight. The proxy wars have eliminated even a level-headed discussion of anything akin to a real budget.

…. I always question how this woman has a job. She insists Americans are happy with their economic situation, and called the US debt downgrade ‘arbitrary.’ Above she is promoting the propaganda about inflation being transitory.

Do not dare to mention the deficit when you continually support massive spending packages with hidden agendas. Yellen herself admitted that the Inflation Reduction Act was really a method to support climate change. ‘The Inflation Reduction Act is, at its core, about turning the climate crisis into an economic opportunity,’ Yellen admitted.”

Ignoring The Warnings!

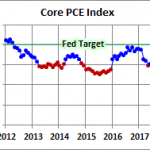

Political polarization allows the insanity to continue unabated. Gutless politicians pass (CR) continuing budget resolutions (upcoming elections take priority); federal spending is up 40% since 2019. The debt clock is ticking; Congress continues to ignore….Moody’s action is akin to a carbon monoxide detector blaring full blast. While you may not see, hear, or smell anything, it is a warning of impending danger – still allowing time to fix the cause and avoid a disaster. While politicos ignore the warnings, Americans should take heed.I contacted friend and expert, Chuck Butler, editor of The Daily Pfennig.DENNIS: Chuck, thanks for taking the time to help us understand what is going on.I thought political gridlock was a good thing. Now, I’m not so sure. Continuing down the current fiscal path is scary. You’ve mentioned we’re likely to either default and/or have unfathomable inflation, destroying wealth and our standard of living.Let’s discuss the process; and markers we might see along the way.Russia and China are unloading US debt, yet we continually add trillions to the deficit. Is there any limit?Could it happen that eventually, no one shows up at a treasury auction? You have talked about “Primary Dealers” having to buy US debt. What do they do with it?CHUCK: Dennis, thanks again for inviting me…Well, there will always be the usual suspects at the auction window… The allies of the U.S., but what happens if they too have debt problems and can’t participate in an auction of Treasuries?When all 24 of the Primary Dealers are in cahoots with the Fed/ Cabal/ Cartel, and the Treasury… They are there to buy any Treasuries that no one else bids on in an auction… Now, you may ask, “Where do primary dealers get money to buy Treasuries?The Primary Dealer borrows money from a money market fund via the repo market to make the purchase. The Treasury purchase is immediately pledged as collateral for the money market fund’s repo loan. Do you see the roundabout going on here?What happens when the Primary Dealers say “no mas”? That’s when the fit hits the shan, and we have no other choice but to print money to pay our own debt, which is called monetizing the debt… And we saw what all the money printing got us previously, didn’t we? Inflation soared…I told all my dear readers years ago, that inflating the debt away is the only option left to our leaders… They need inflation to help deal with their runaway debt… You don’t really think that inflation that hit us hard these last couple of years, was something that wasn’t planned? The Fed Heads knew exactly what they were doing, printing all that currency.Lenders will demand more interest to take on the risk of the declining dollar, further increasing the deficit and the need for even more borrowing. It’s like circling the drain at an ever-increasing pace.I don’t mean to sound like gloom and doom… The credit agencies are warning us. But those are the facts, ma’am!DENNIS: You recently asked The Daily Pfennig“‘It’s the sound of the Fed’s money printer warming up. $15 trillion in US debt matures and must be refinanced in the next four years. It’s $20 trillion over the next ten.’ – Dan Denning on Twitter”Zerohedge quotes billionaire hedge fund manager Stanley Druckenmiller:“When rates were practically zero, every Tom, Dick, Harry, and Mary in the United States refinanced their mortgage. Unfortunately, we had one entity that did not, and that was the US Treasury.…. I literally think…it was the biggest blunder in the history of the Treasury. I have no idea why she’s not been called out on this; she has no right to still be in that job after that.”Chuck, please tie these points together. Because of Yellen’s “blunder,” what happens with $15 trillion maturing in the next four years – on top of our continuing trillion-dollar deficits?CHUCK: We’re also seeing the same thing in the corporate world. Corporations that borrowed billions at very low rates are now having to refinance at much higher rates… When they can’t pay their debts, they go bankrupt.The Government is in the same predicament… The $15 trillion coming due in the next four years will be refinanced at much higher rates. The interest cost on our debt just reached $1 Trillion. Every 1% interest increase on that $15 trillion, equals $150 billion in interest cost. Using back-of-the-envelope math, our national interest cost will pass $1.5 trillion in less than five years.Where is Congress going to get the money to pay that interest? They want to hire 87,000 new IRS agents. Spending has jumped 40% since 2019, congress has a spending problem, not a revenue problem – and ignores the truth. It’s gonna get ugly!DENNIS: You mentioned that $174 billion in deposits left the banking system.The banks loved it when investors had no place to go but the stock market; money flew into the brokerage side of their business, and they made billions. Now, CDs and treasuries are more attractive.Where did the $174 billion go? Is this just money flowing back to where it started before the 2008 bailout?CHUCK: First of all, I think (and no media outlet is saying this) that the stimmie checks everyone received have been spent, not saved.Second, I feel the pundits/stock jockeys are telling their clients that the bear market in stocks has ended; the next move for interest rates will be down, expect a stock rally… Personally, I feel any current stock market rally is a bear market rally, and nothing more… The Fed/Cabal/Cartel isn’t going to be cutting rates any time soon. All the historical indicators we’ve used to tell when a recession is coming, are flashing red… This means… stocks have not done well in past recessions…I recommend extreme caution, don’t be fooled!DENNIS: One final question. Prior to Nixon taking us off the gold standard, most everything was bought with real (earned) money. Today’s economy is based on credit: promises to pay.You are telling us that a lot of those promises will not be kept. The politicians, banks, and media are ignoring the warning signs. When the smoke detector blares, they will ignore it until the flames are at their feet.What can our readers do?CHUCK: Well, I suggest that they invest in hard assets… Gold, Silver, shoot even Copper, Real Estate, and cash…Short-term CDs are earning interest ahead of the published inflation rate. Why not earn some interest on your cash, which is something new for us these days? A major correction is still very likely.Dennis Here. While the Fed and politicians ignore the warning signs, individual investors can’t afford to do so. I sure hope Chuck and I turn out to be wrong, but the stakes are too high not to proceed with caution. Wolf! Wolf! Wolf!On The Lighter SideI wonder how many die-hard football fans stayed up a week ago Monday night to watch the pathetic Bears beat Minnesota without scoring a touchdown. I’ve followed the Bears since the mid-1940s and find it very sad. P.T. Barnum supposedly said, “There’s a sucker born every minute.” Unfortunately for many sports fans, there is much truth to that statement.The NFL has a salary cap and revenue sharing. Each owner does not have a big financial incentive to win. The Bears have had one championship since the Super Bowl era began in 1966. Much like P. T. Barnum, they sell hope, hype and snake oil to keep their customers excited. How many times do you need to change coaches and general managers and continue to fail miserably, before you realize the problem is ownership?At one time I had season tickets, and a closet full of NFL merchandise. I stopped supporting them financially years ago. I’ll watch them for free but they will not get any more of my money.

Quote(s) of the Week…“People try to live within their income… so they can afford to pay taxes to a government that can’t live within its income.” — Robert Half“By continuing the process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” — John Maynard Keynes

And Finally…Friend Phil C. sends along some observations for our enjoyment.

And my favorite…

Until next time…More By This Author:The Final Act – How Will It End? What Can We Do?

What Happens When The World No Longer Wants, Or Needs US Dollars?

Push The Handle, Raise The Chain, There Goes The Dollar…

Leave A Comment