There wasn’t much to say about today. Small gains kept things ticking over, but there were no key breaks of resistance. Tomorrow is another day.

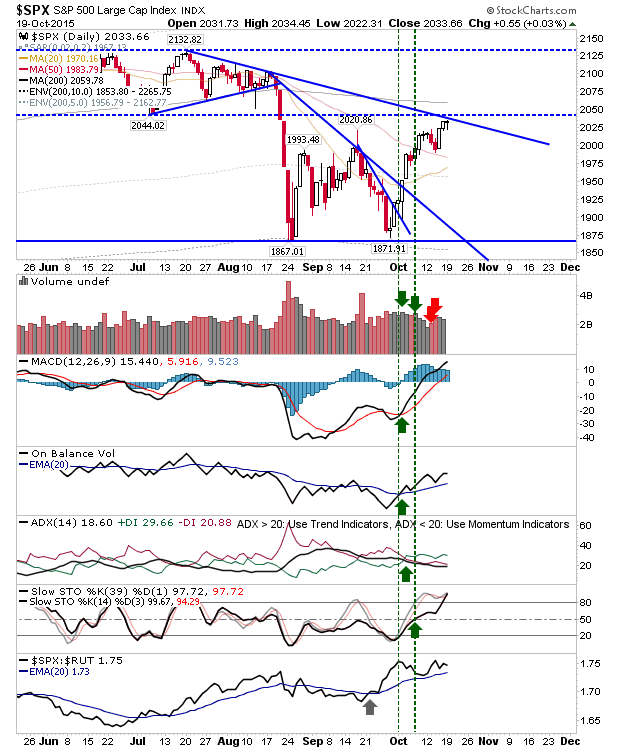

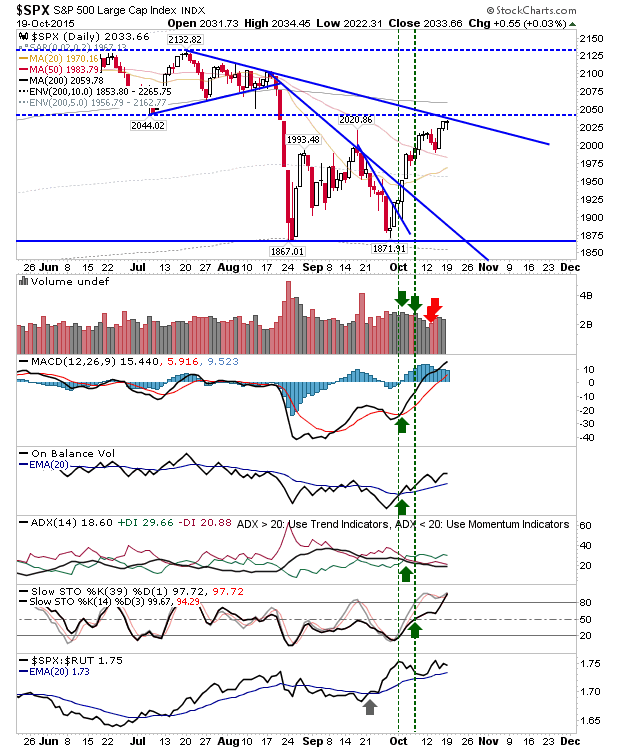

Shorts may again try to short the S&P with today’s close near highs, and the convergence of resistance.

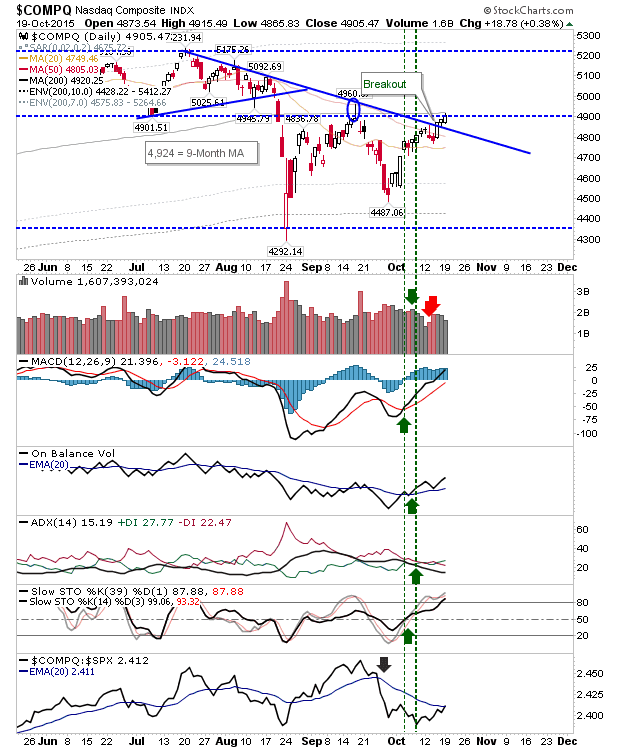

The Nasdaq is also pegged by resistance, finishing just above 4,900. Volume was down on Friday, holding with a quiet day in the market.

The Russell 2000 also managed a small gain, but this didn’t change the index’s under-performance relative to other indices.

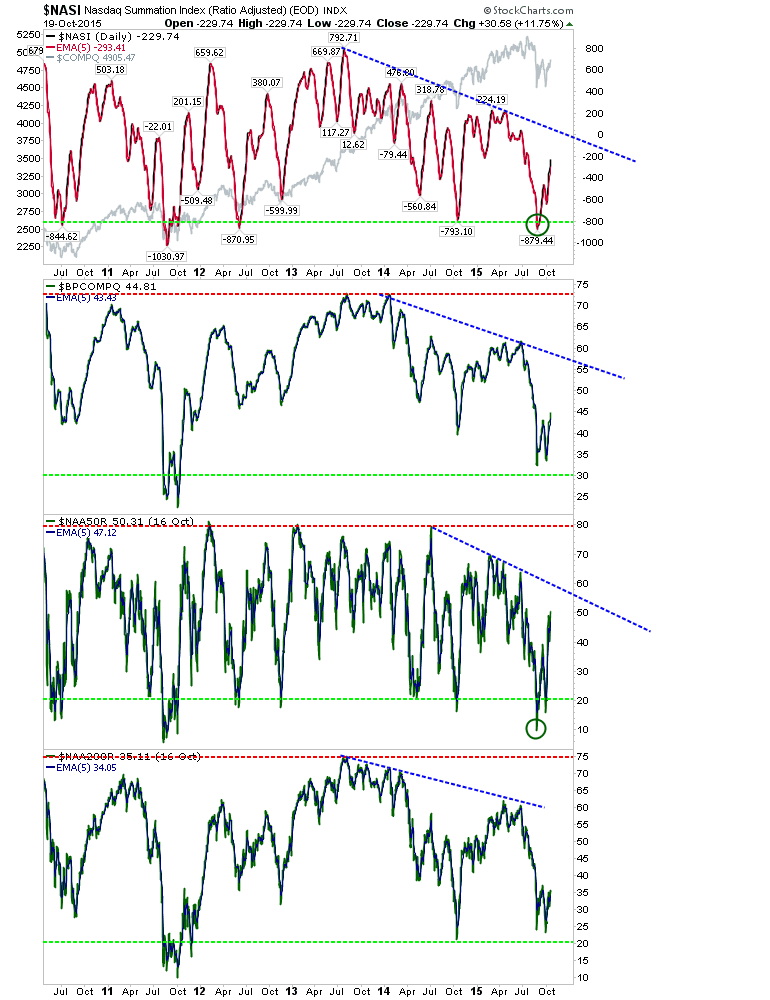

Market breadth is in neutral territory. Bullish percents and the Percentage of Nasdaq Stocks above the 200-day MA didn’t make it to oversold territory in the July decline, but the Nasdaq Summation Index and Percentage of Stocks above the 50-day MA did suggest a bottom of substance was put in place. A push to declining resistance is still on the cards, which would mean the current rally in the Nasdaq is not yet done.

Shorts are going to need some early reward if they are going to take anything here. Longs aren’t under much pressure to sell, which may ultimately just attract more money from the sidelines.

Leave A Comment