Today’s updates on sentiment in the US services sector and the Federal Reserve’s Labor Market Conditions Index (LMCI) offer more evidence for arguing that economic growth is slowing in the third quarter. There’s still a solid pace of output in services, but LMCI confirms the weakening trend that’s conspicuous in Friday’s disappointing release on payrolls for September.

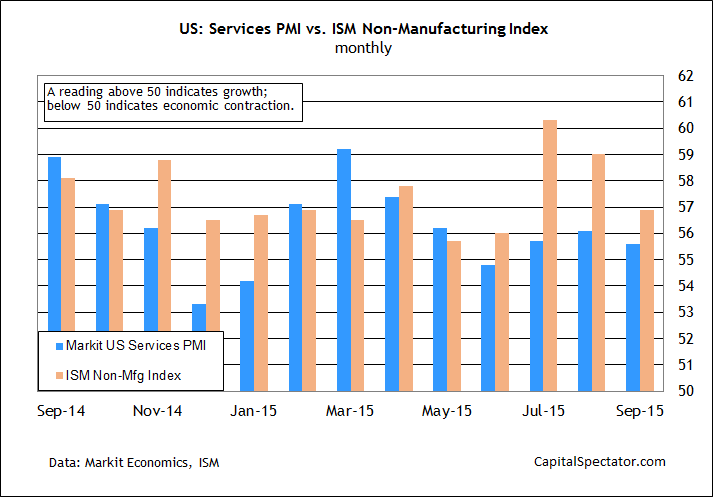

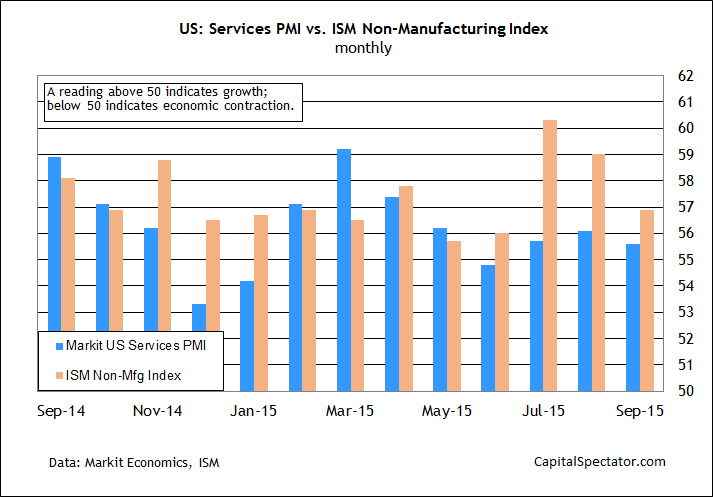

Let’s start with the services sector. New data published this morning by the Institute for Supply Management (ISM) and Markit tell a similar story of deceleration for this slice of the US economy in September. “US economic growth slowed in the third quarter according the PMI surveys, down to around 2.2%,” said Markit’s chief economist, Chris Williamson. “But this largely represents a payback after growth rebounded in the second quarter, suggesting that the economy is settling down to a moderate rate of growth in line with its long term average.”

Today’s update of the ISM Non-Manufacturing Index aligns with this view. The headline data fell to 56.9 in September, a three-month low. But that’s still well above the neutral 50 mark and so it’s clear that this corner of the economy—the dominant slice of macro activity in the US—continues to expand at a healthy if modestly diminished clip. The concern is that the services sector will continue to slow in sympathy with softer numbers from manufacturing and employment.

Meanwhile, LMCI’s decline last month to zero marks the lowest reading in five months. This broad-brush review of the labor market has turned weaker lately, but it’s not yet at the tipping point that clearly signals a new recession. Analyzing LMCI’s historical record, in context with NBER’s business cycle dates, via a probit model tells us that the odds are extremely low that September was the start of a new US downturn.

Leave A Comment