The S&P 500 is right under all-time highs. An upside breakout in the next few weeks/months is very likely.

Based on where the Medium-Long Term Model is right now and the rate at which data is progressing, this bull market probably has 1 year left. Over the past week we have seen a few more signs that the stock market will probably make an important top somewhere in mid-2019.

As always, the U.S. economy’s fundamentals determine the U.S. stock market’s medium-long term outlook. Technicals determine the stock market’s short-medium term outlook. Here’s why:

Let’s go from the long-term to the medium term, to the short term.

Long Term

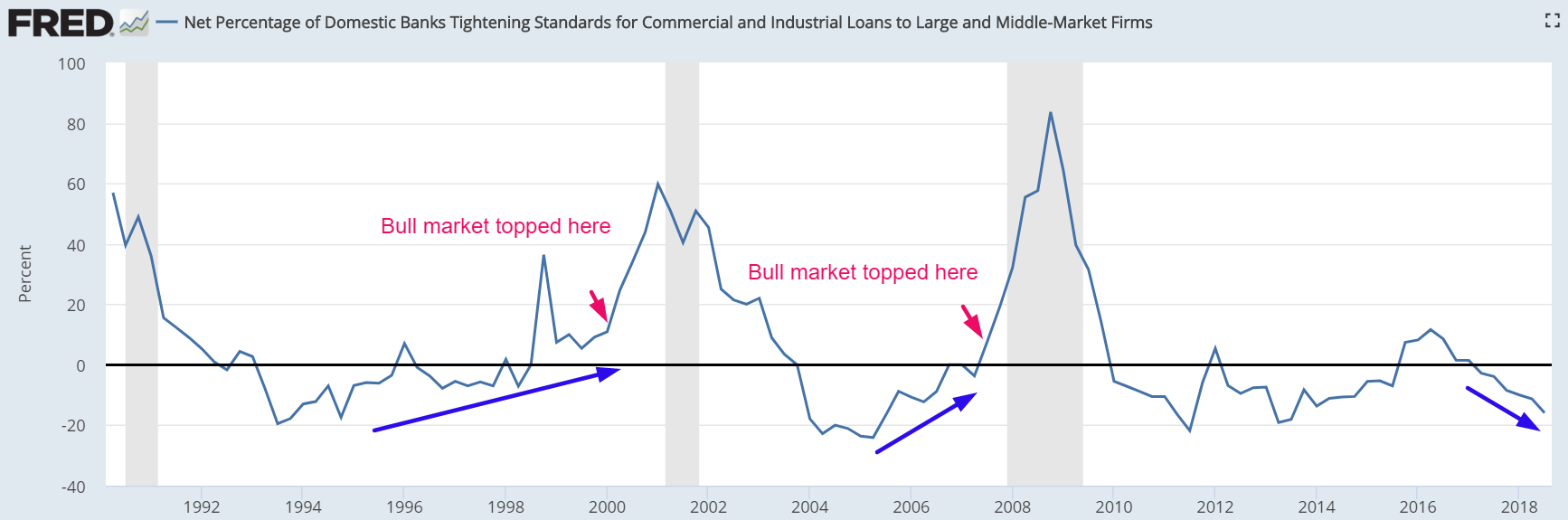

Banks’ lending standards continue to ease (trend downwards). Lending standards tend to get tighter in the last rally of a bull market.

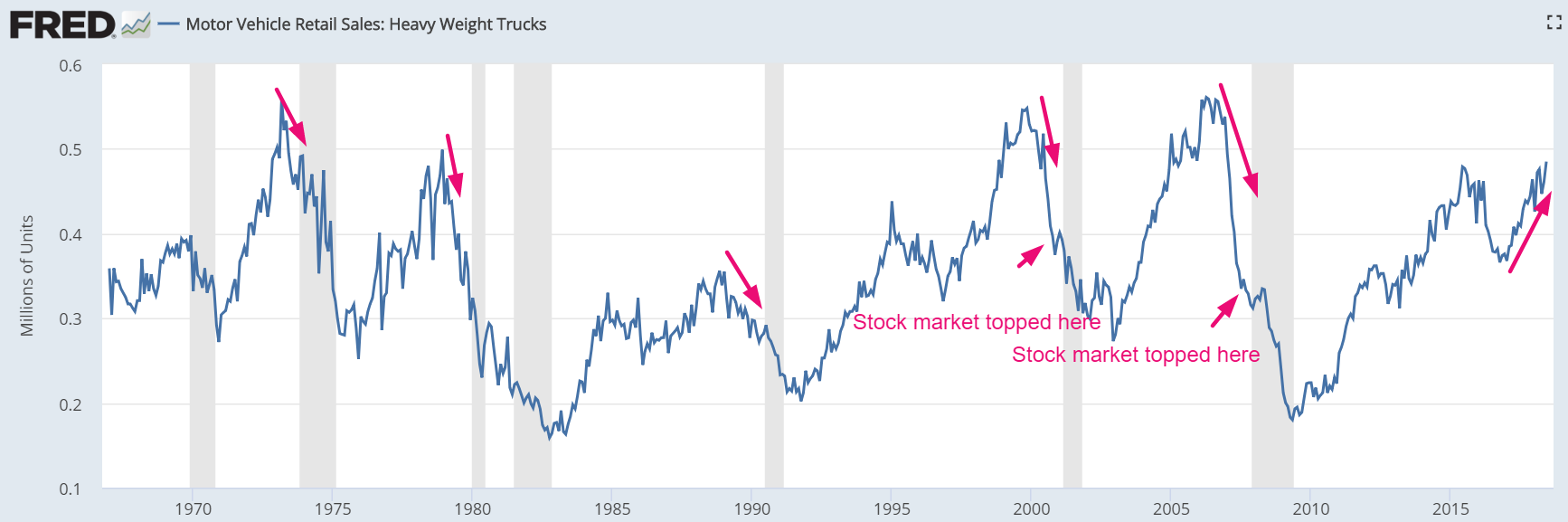

Heavy Truck Sales are still trending higher. This is a long-term bullish sign for the stock market. Heavy Truck Sales tend to trend downwards before economic recessions and equity bear markets begin.

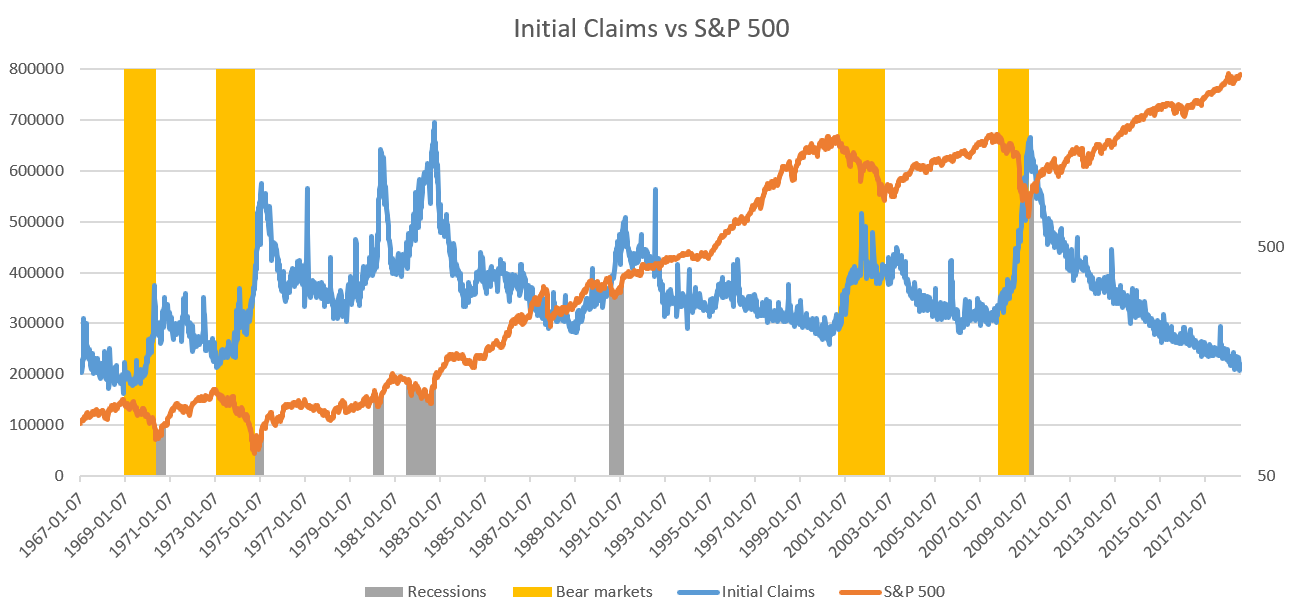

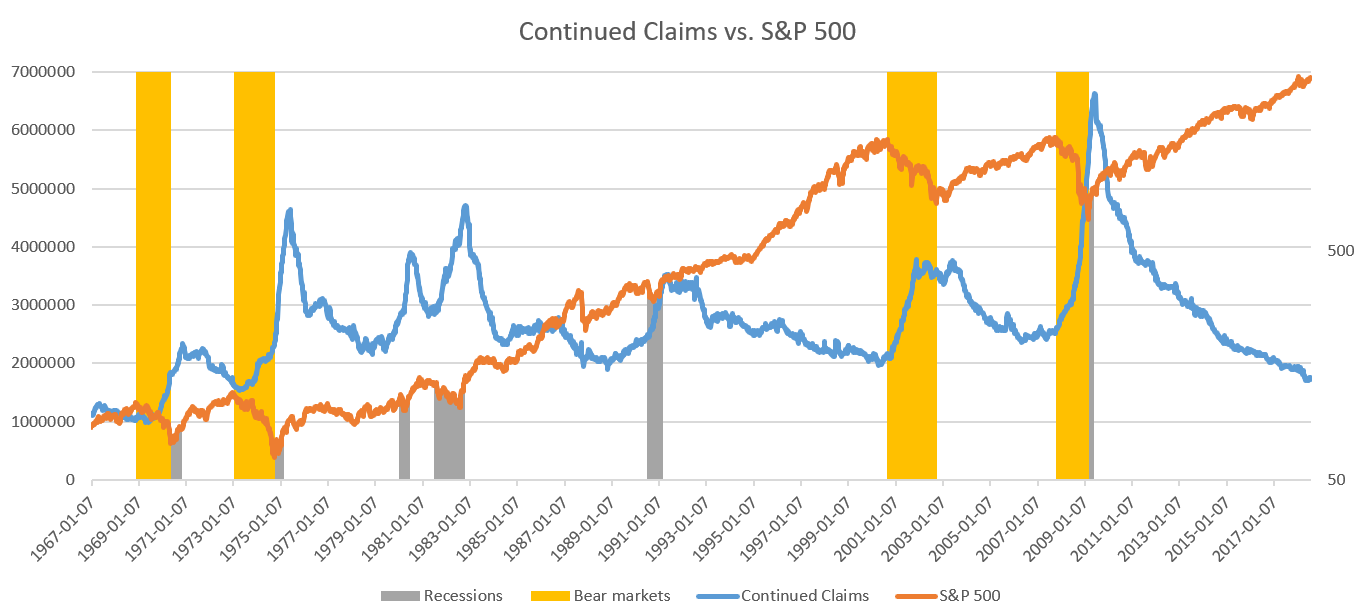

Initial Claims and Continued Claims are still trending lower. This is a long-term bullish sign for the stock market. Initial Claims and Continued Claims tend to trend higher before bear markets begin.

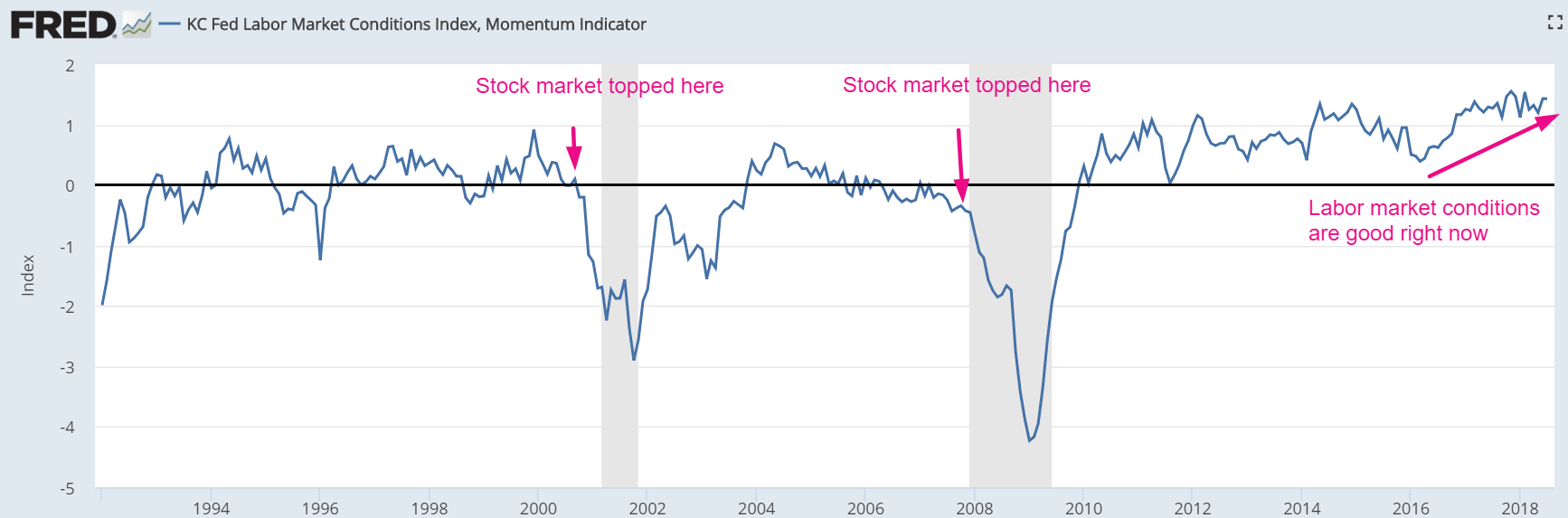

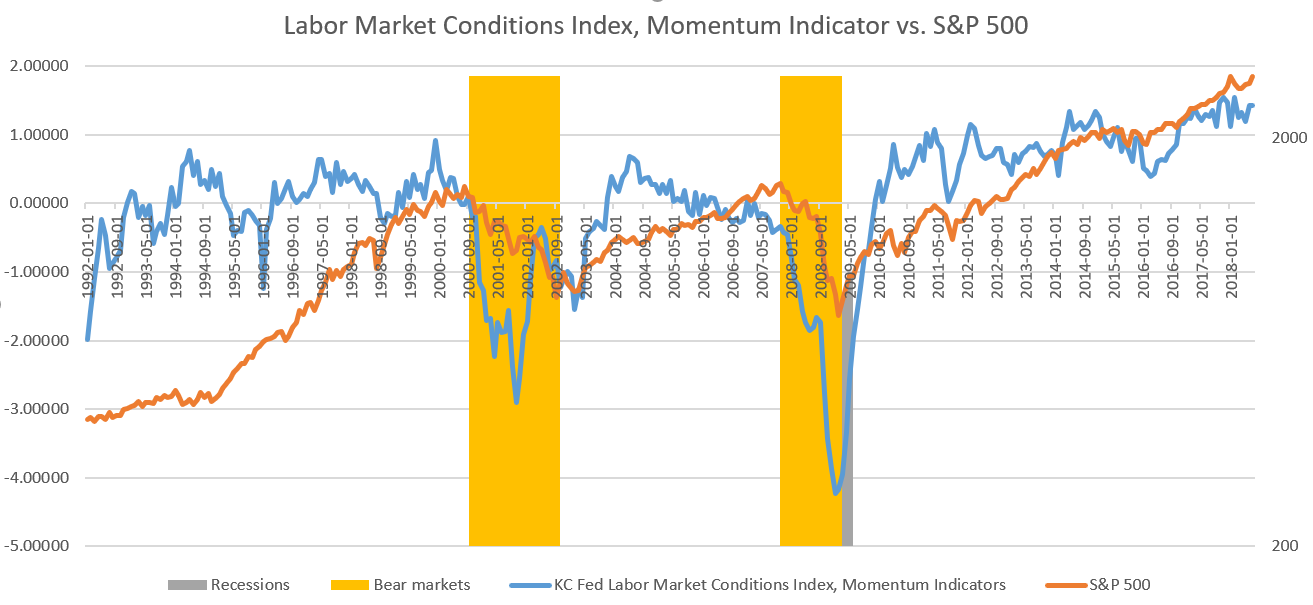

Labor Market Conditions are still healthy. This is bull market behavior. Bear markets start when Labor Market Conditions are much weaker.

However, this bull market doesn’t have many years left. We are definitely in the late stages of this bull market. Corporate Unit Profits tend to peak in the middle of a bull market and economic expansion. This is bull market behavior.

Leave A Comment