Has the love affair with FAANG stocks ended? Just as Bank of America Merrill Lynch was pointing out that technology stocks started to become a crowded trade, along comes Morgan Stanley analysis that breaks down the beta factor performance models. In short, they see volatility ahead — which can disrupt existing momentum trades. When looking at the recent FAANG price breakdown, they consider the relative value analysis with the larger technology universe and are not as alarmed by the relative price move lower.

Morgan Stanley quants see volatility ahead — which typically isn’t positive for an existing price trend

Within the FAANG stocks – Facebook, Apple, Amazon, Netflix and Google – there has been idiosyncratic price divergences. From an algorithmic standpoint, the price modeling of Facebook appears in a longer-term mean reversion pattern, for instance. Both Facebook and Apple have been in market uptrends. But unlike Facebook, where upward price momentum is fading, Apple continues to exhibit signs of strength. This strength in price persistence from the May 13, 2016 low $90.52 has passed a statistically mature point on a mid-term basis, just observing the stock’s price history.

This is idiosyncratic price movement on display.

When Morgan Stanley’s Brian Hayes and his “QuantWise” team of equity analysts look at the FAANG stocks, they see various factors contributing to the performance – and point to a mean reversion.

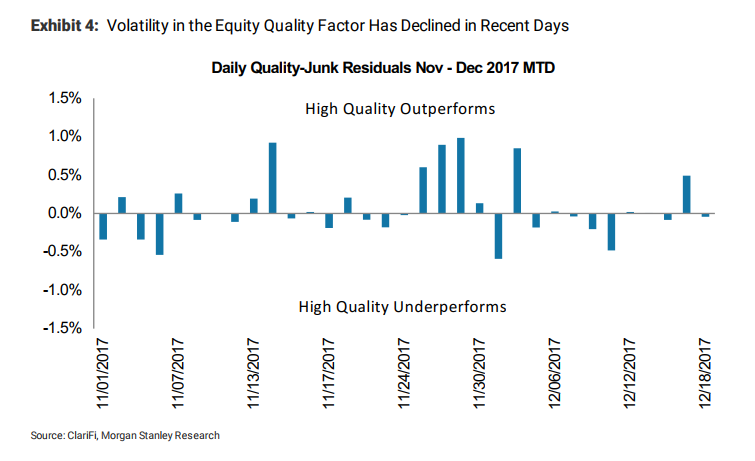

In particular, when considering the beta factors of volatility and momentum, Hayes and his team see an inverse relationship that is pointing to an expectation.

They run a dynamically weighting momentum exposure model that considers a 21-day time horizon. Using this as a measure, they forecast volatility to come, which points to the inverse relationship with momentum. “Momentum stocks are at risk of underperforming, based on this recent volatility of the factor,” the December 20 report predicted.

Leave A Comment