Buffett and Blankfein are wrong. That’s the message from Matthew Hornbach and the rates strategists at Morgan Stanley who proclaim in their latest report that “the bell has tolled for the best of the bear market in longer-duration bonds…We like the long end.”

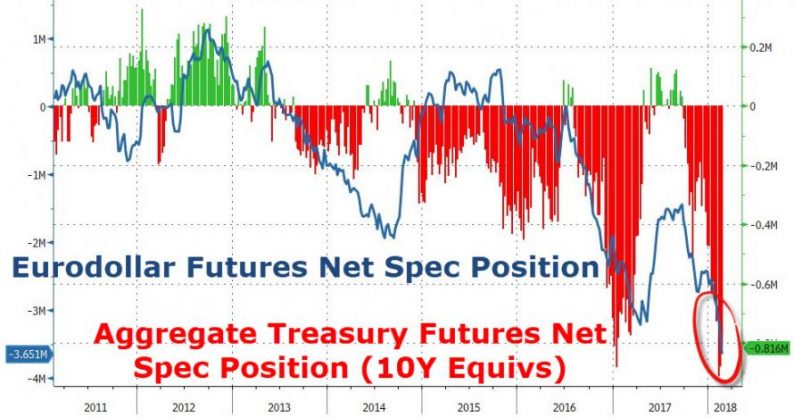

Amid record speculative short positions across the Treasury complex…

Morgan Stanley begins:

History has shown that consensus estimates for Treasury yields are usually wrong. Everyone understands that accurate point forecasts rarely occur. Either the consensus is wrong in terms of direction or, when it has the direction correct, the consensus is wrong in terms of timing. The wisdom of crowds has yet to grace itself on bond yield forecasters.

And furthermore, Hornbach and his team note that every time the bond market moves dramatically and unexpectedly higher in yield, the consensus forecast plays catch-up as the desperate “told you so” crowd of equity market commission-takers and asset-gatherers jumps on the trend to push ‘rotation’.

The chart below shows the 3-quarter-ahead consensus forecast for 10y Treasury yields over the past decade alongside 10y yields themselves.

The exhibit also shows that, even after yields stabilize, the consensus forecast continues to increase – likely reflecting bearish sentiment and recency bias in the wake of a large sell-off.

Morgan Stanley concludes: “We don’t feel compelled to join that crowd yet.”

In Hornbach and his team’s view, it is too soon for FOMC participants to begin raising longer run dots with the view that the longer run neutral rate is rising. But it’s not too soon for participants to increase the pace of projected rate hikes to a degree that would still qualify as “gradual”. This keeps us in the yield curve flattening camp. We continue to see value at the long end of the Treasury curve relative to the projected equilibrium interest rate, as displayed in Exhibit 5 and Exhibit 6.

Leave A Comment