There are a few pieces to this. First, mortgage credit continues to improve, albeit painfully slowly. This is the reason I’ve been saying for some time now higher rates are needed. Higher rates will increase the availability of credit to other borrowers vs who is getting it now (the lowest credit risk). Demand won’t be dampened and in fact once the general public starts to think rates are actually going to start going higher, I think you’ll see a surge in demand (to lock in lower purchase rates).

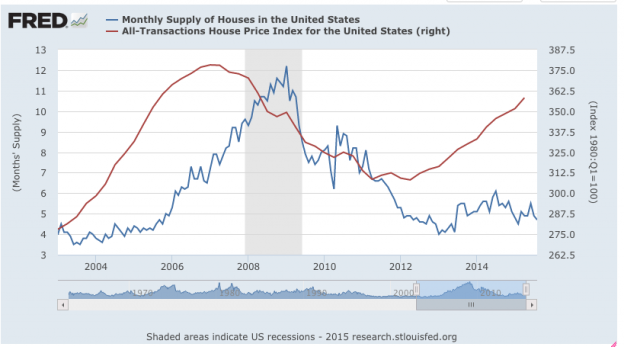

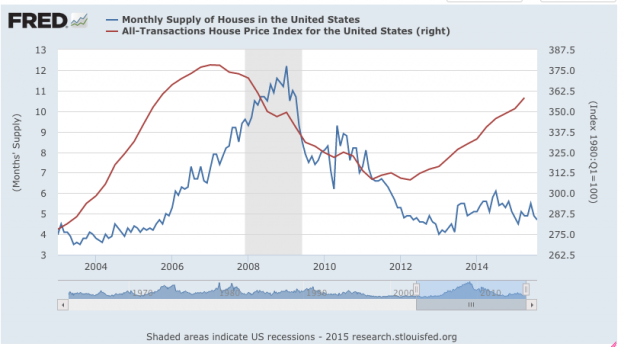

Second, and most importantly. We are nowhere near a bubble. Just because prices rise, it does not mean a bubble. Bubbles are multi-variable events. For housing they need to include essentially “free money”. By “free” I don’t mean low rates. By free I mean banks are handing out mortgages to anyone. Both the recent housing bust and the housing downturn in the early 90’s featured this. The recent housing bubble included free money (liar loans, interest only etc), rising prices and rising inventories (both happened from 2004-’08). When inventory almost triples while sales fall and prices still rise significantly, that is a sign something very wrong is happening.

We are not even close to those days as we have none of those conditions. The only reason prices are rising the way they are is because supply is so very low and has been low for nearly 4 years now. Until housing nationally gets back to ~6mos inventory, prices will keep going up, simple.

Now, builders cranking up production so inventory reaches the 6mos level won’t crash prices. What it will do is slow down the rate of price appreciation which would be just fine as stable prices would bring more sellers into the market (vs holding out for top dollar).

Bottom line is housing is in a very stable condition poised for years of growth ahead.

Leave A Comment