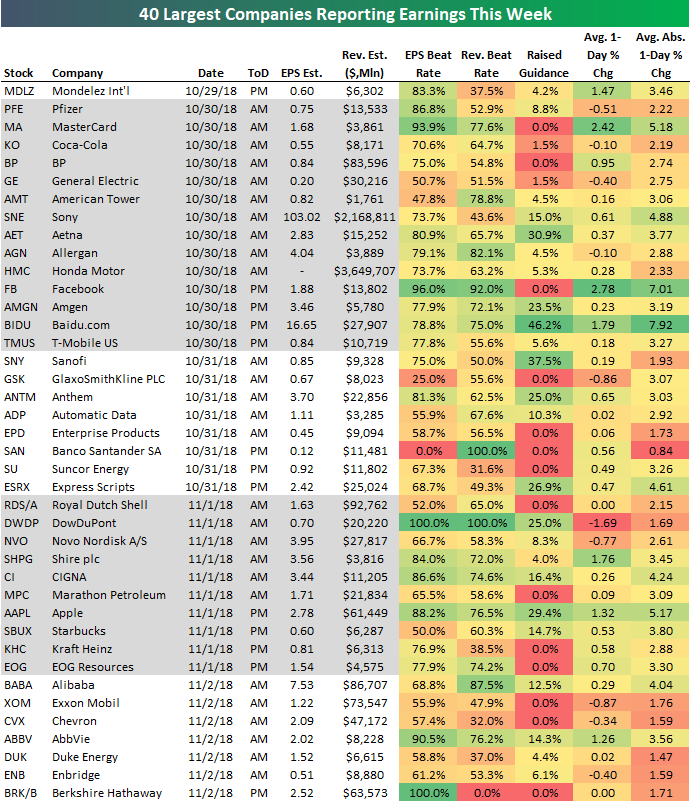

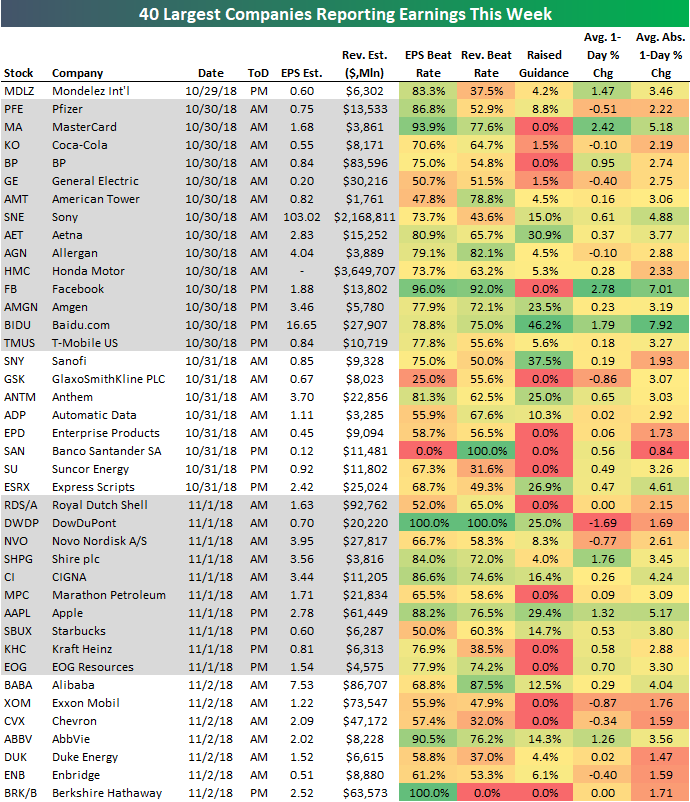

We’re smack dab in the middle of earnings season right now, and below is a list of the 40 largest companies set to report Q3 numbers this week. For each stock, we include a number of key data points that you won’t find in most earnings calendars. Data points like historical earnings and revenue beat rates, the percentage of the time that the company has raised guidance, and the stock’s average one-day price change in reaction to earnings are all included in the table after pulling them from our popular Earnings Screener tool.

After a slow Monday, we get a number of big reports on Tuesday from the likes of MasterCard (MA), Coca-Cola (KO), General Electric (GE), Facebook (FB), and Baidu (BIDU). Wednesday is relatively slow as well, but Thursday makes up for it with Apple’s (AAPL) release after the close. On Friday, we’ll hear from big oil companies Chevron (CVX) and Exxon Mobil (XOM) as well as the “Amazon of China” — Alibaba (BABA).

Of the stocks on the list, MasterCard (MA), Facebook (FB), and Apple (AAPL) have some of the strongest earnings and revenue beat rates, while Baidu (BIDU) has raised guidance the most. In terms of stock price reaction to earnings, Facebook (FB) and MasterCard (MA) show up again with average one-day gains of more than 2% when they have reported earnings throughout their history. Exxon (XOM), Chevron (CVX), General Electric (GE), and Pfizer (PFE) are four stocks that have historically averaged declines on their earnings reaction days.

Leave A Comment