The Street has had a lot to worry about when it comes to auto-parts supplier American Axel (AXL), most notably a big drop-off in business with mega-customer GM and a lot of debt. But the stock’s valuation doesn’t seem close to reflecting the extent to which the company has and continues to progress beyond its challenges.

Why this Stock is Being Considered

It’s important before you start to read about or evaluate a stock, to know why it came under consideration be comfortable soundness of those reasons. American Axle (AXL), got into my radar as a result of the small-cap value screen I created on Portfolio123 that looks among the constituents of a Russell 2000-like universe that looks for stocks with relatively low valuation metrics but only from a universe that has been prequalified to exclude the lowest quality stocks and stocks viewed unfavorably by the Street. Details of the approach are described in an 8/15/18 blog post.

Retrieved from the Dumpster

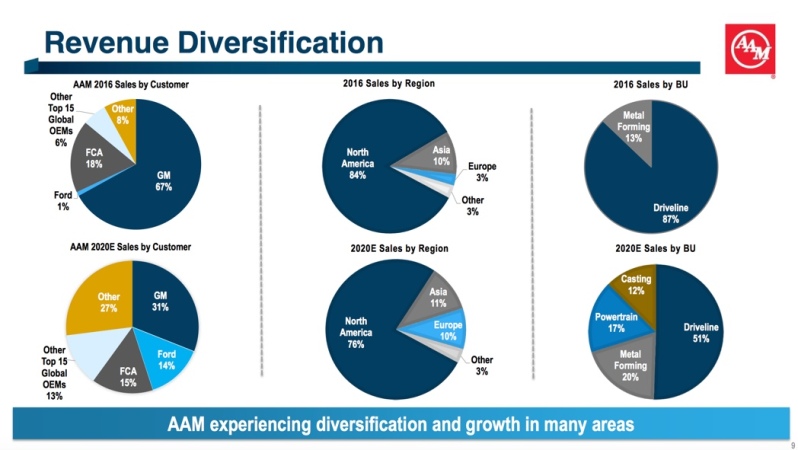

Back in 2016, shares of this vehicle-parts supplier (drivelines, powertrains, metal formed products and casting of components) plunged quickly from a high of nearly $23 to around $13 and then edged toward a bottom just below $12. The catalyst was an announcement by General Motors (GM) that it would bring a lot of the work done by Axle in-house; not all of it but enough to pose something of a crisis considering that the company had relied upon GM for 67% of its sales.

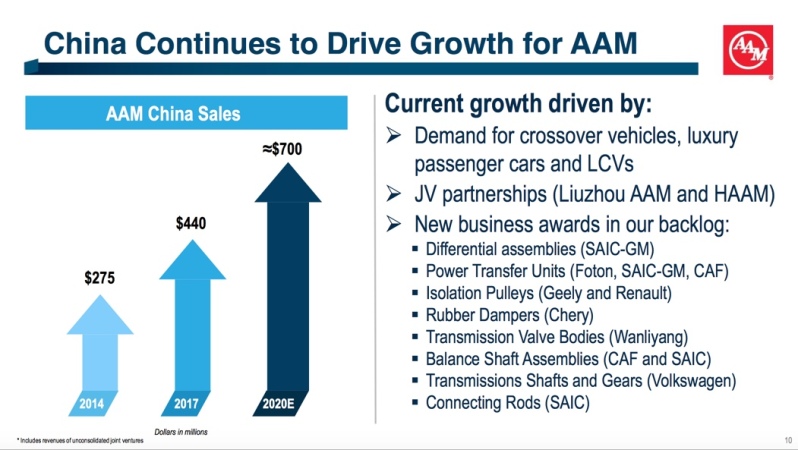

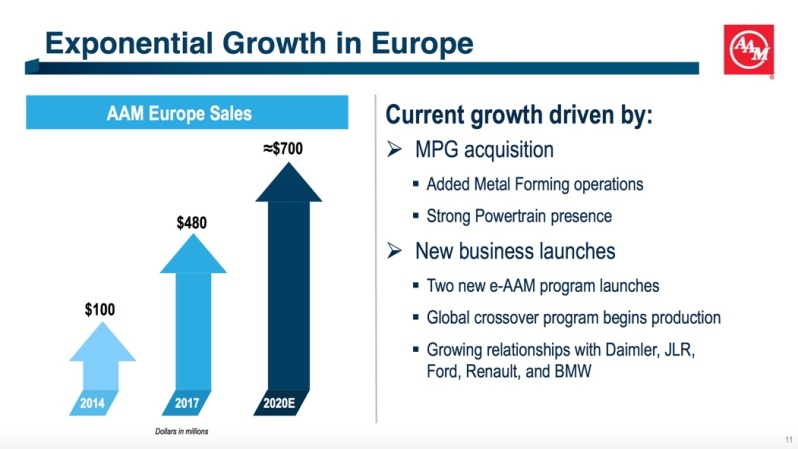

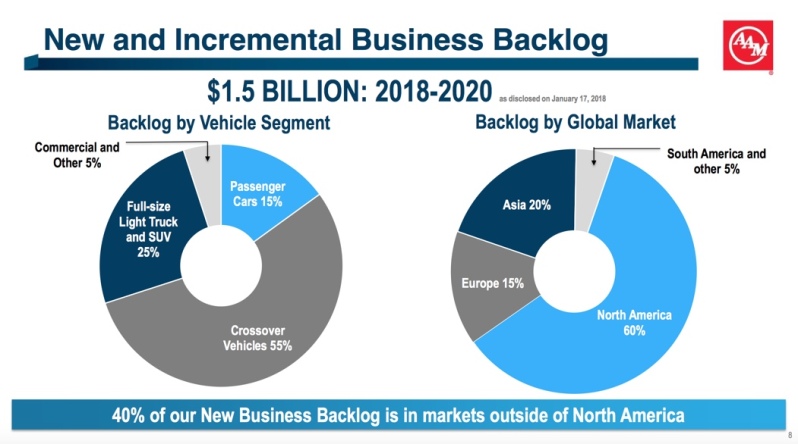

Since then, Axel has been working to diversify its customer base and has accomplished quite a bit due to successful efforts to do more business in Europe and China.

(From American Axle’s 8/18/18 J.P. Morgan Automotive Conference Presentation.)

This isn’t just a matter of hopes and wishes. Approximately two-years beyond the GM-induced trauma, Axle is already showing tangible progress.

(From American Axle’s 8/18/18 J.P. Morgan Automotive Conference Presentation.)

Leave A Comment