I’ve been watching the herds to try to determine just when the interest rate topic among the best and brightest (as chosen by the media) would start to pivot from ‘rising rates!’ hysterics that have been locked and loaded in the public psyche since the US election to a sort of ‘rut roh, maybe we got played again… ‘ realization that Rome – and a Great America – are not built in a day.

What I am trying to say is that after the previous media headlines last summer (mainstream media: NIRP & BREXIT!!… everybody into risk ‘off’ bonds!) yields reacted a bit and rose as they should have, from a contrary setup, in order to catch the herds off sides.

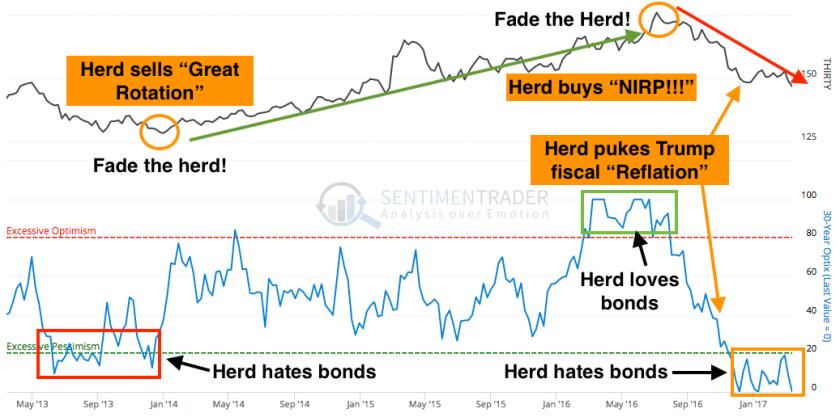

But then the hysteria over the Trump election led to the Druck’n Suck-In of the true believers (or “Sons of Druckenmiller”) and… here we are with everybody anti-bonds, pro-reflation and pro-interest rates. Maybe they would be right this time, but then again, given the herd’s history (from Sentimentrader w/ my markups)…

What got me on this is not that bonds are bouncing in line with NFTRH‘s favored short to intermediate view. The market has taken a hard lurch in our direction sure, but these are the markets and they live to make over confident or overly promotional commentators eat their words. What got me on this is that the robo financial media are still just churning out the pablum on an assumption (rising long-term rates) that is anything but assured. From MarketWatch…

Survey sees bear market for stocks if 10-year Treasury yield hits this level

The title baits you to click and find out just what level that global fund managers think would trigger a bear market in stocks. Well here it is…

Yields remain too low to hurt stocks for now, survey respondents said, with a minuscule proportion arguing that a 10-year Treasury yield at 2.5% would prove fatal to the bear. But 67% of respondents say a yield in the 3.5% to 4% range would put stocks in the danger zone.

Leave A Comment