Multiples – Apple & Amazon Fall, But Stocks Rally

The S&P 500 rallied 0.56% on Monday. Berkshire Hathaway’s Class B shares rallied 4.7%. That’s because the company bought almost $1 billion of its shares back in August.

In the first 9 months of the year, the firm purchased $24.4 billion worth of shares. That’s over double what the company bought through June. Warren Buffett is widely considered the best investor ever. His buybacks improve investor confidence.

However, investors still aren’t confident in Apple and Amazon. They fell 2.2% and 2.84%, bringing the Nasdaq down 0.38%. Investors are worried about Apple’s iPhone unit growth.

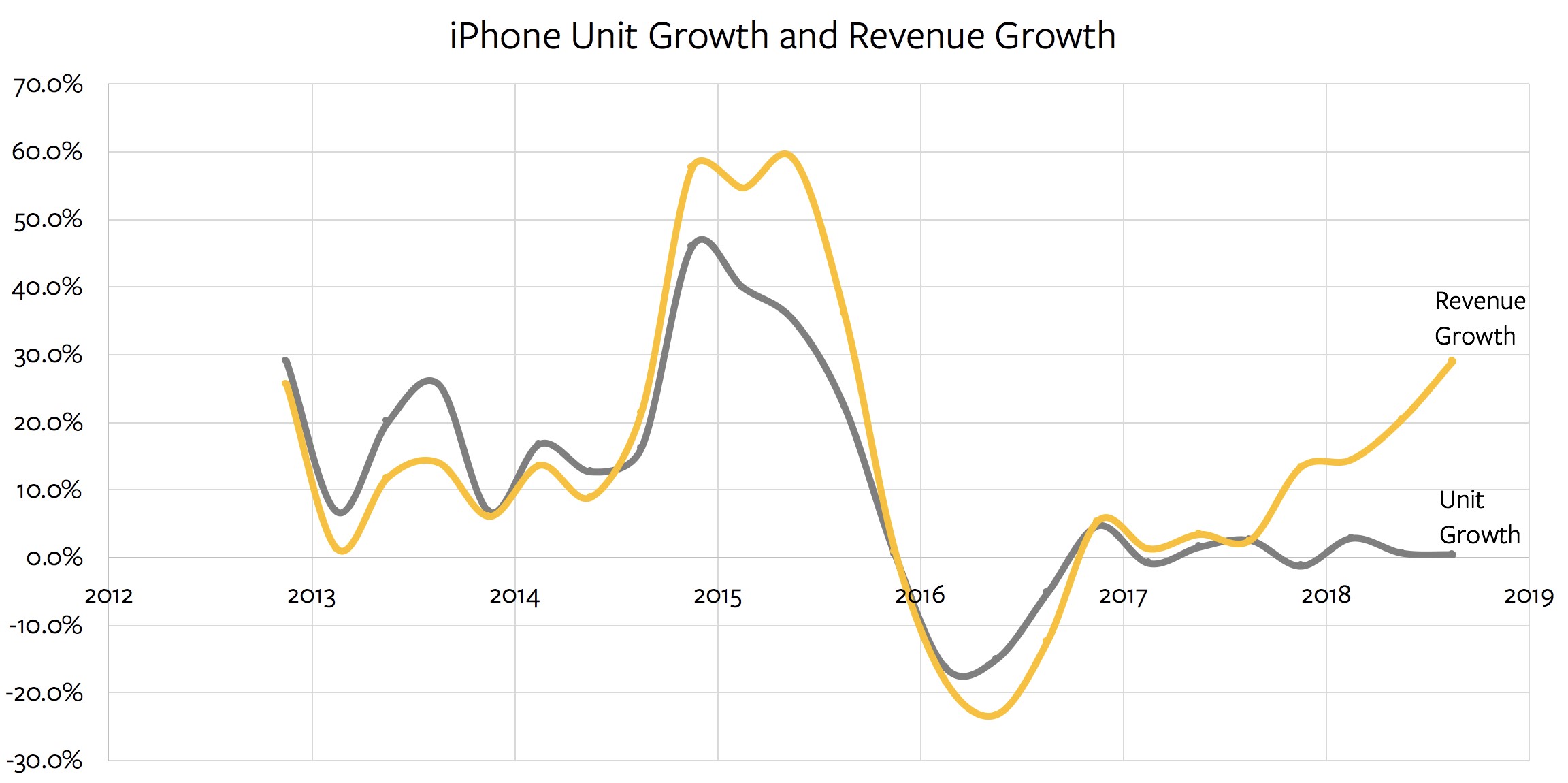

As you can see in the chart below, revenue growth has accelerated while unit growth is barely positive. There’s no way Apple will be able to increase prices on its iPhones at its current rate.

It’s very unusual for a consumer product to successfully raise prices. Just because Apple defied the odds with this cycle of iPhone products, doesn’t mean it can continue to do so.

Multiples – Stocks Are Cheap & There Is Fear

Russell 2000 was down 3 basis points and VIX was up 2.31%. CNN fear and greed index increased from 8 to 9 which is still extreme fear.

It has been in the single digits in this correction for longer than the winter correction. Current forward PE multiple on the S&P 500 is 15.6 That’s below the 5 year average of 16.4, but above the 10 year average of 14.5.

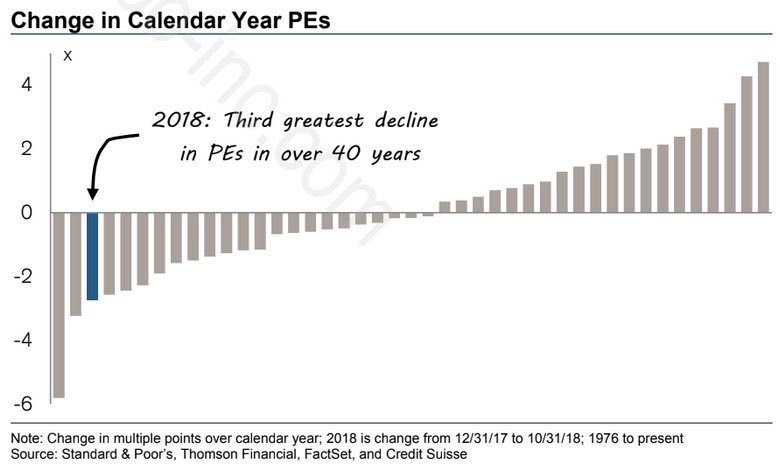

As you can see from the chart below, the PE multiple in 2018 has fallen the 3rd most ever as of October 31. Stocks have had a middling performance. Earnings have grown over 20%.

The 3 worst sectors were communication services, technology, and consumer discretionary. They fell 0.32%, 0.18%, and 0.18%, respectively. They were driven down by the big internet names.

Even Facebook fell 1.11% after rallying last week on great earnings. The 2 best sectors were real estate and energy which increased 1.69% and 1.61%.

Leave A Comment