Just one day after the SEC sued Elon Musk for securities fraud, in a move that shocked many who were skeptical the US regulator would do anything more than slap a few wrists – an action which it took only after it emerged that Musk had turned down a settlement offer from the SEC in the last minute – Musk, having seen TSLA stock tank the most in three years on Friday, changed his mind once again, and agreed to settle the case.

According to a settlement filing posted on the case docket on September 29, the SEC settlement is on almost identical terms to the deal he had rejected as recently as Thursday morning: it will require Musk to step down for three years as Chairman (up from two years in the first deal), pay a $20 million fine, comply with Tesla’s mandatory procedures for how to tweet going forward, however it means he will be able to continue as the company’s CEO and return as Chairman after three short years.

As part of the deal, Musk will also neither admit nor deny guilt, effectively confirming that all those who were skeptical of the SEC’s regulatory interests, were correct after all as the settlement now makes any potential criminal case far more complicated.

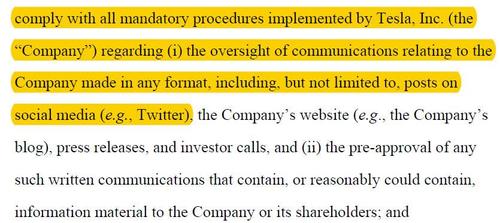

And, we’ll repeat it because it bears repeating, having cost ordinary investors billions of dollars with his manipulative, fraudulent tweet, all the SEC asks is for Musk to make sure he preclears all his future tweets that “contain information material to the Company.” One couldn’t make this up.

In short: securities fraud will get most ordinary people thrown in prison, but if you can afford $20 million and temporarily losing a token title in your resume, you get away scot-free.

Here are the key sections in the settlement filing that hit the SEC vs Musk docket late on Saturday afternoon:

Without admitting or denying the allegations of the complaint (except as provided herein in paragraph 13 and except as to personal jurisdiction as to this matter only and subject matter jurisdiction, which Defendant admits), Defendant hereby consents to the entry of the final Judgment in the form attached hereto (the “Final Judgment”) and incorporated by reference herein, which, among other things:

(a) permanently restrains and enjoins Defendant from violation of Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) [15 U.S.C. § 78j(b)] and Rule 10b-5 thereunder [17 C.F.R. § 240.10b-5];

(b) orders Defendant to pay a civil penalty in the amount of $20,000,000 under Section 21(d)(3) of the Exchange Act [15 U.S.C. § 78u(d)(3)]; and

(c) requires Defendant to comply with the undertaking set forth in this Consent and incorporated in the Final Judgment

Leave A Comment