Recently, I wrote some stuff about hedge funds and mutual funds.

If that’s the kind of thing you’re into (or if you want to read about hookers, groupies, Xanax, cocaine, and Maseratis) you should check out these two posts:

The overall message you’ll get if you peruse those is that fund managers of all stripes are kinda throwing in the towel on trying to beat benchmarks.

Well, that’s not 100% accurate and indeed, some people would try to say it’s not accurate at all.

But what they (funds) are doing is simply levering up and overweighting the names and sectors that are driving benchmark returns and then calling that “alpha.” And it is alpha – sort of. But that’s some pretty dumb alpha. (As you’ll read below, Goldman tries to spin this “strategy” as “alpha generation from bottom up stock picking.” I’m not convinced.)

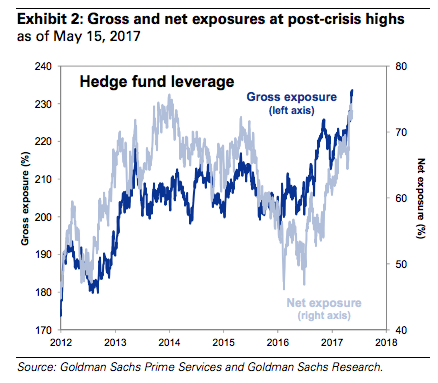

“Hedge funds lifted leverage to post-crisis highs as their most popular long positions outperformed in a rising equity market,” Goldman wrote a couple of weeks ago, adding that “net exposure (73%) is now roughly in line with its cycle highs reached in 2013, while gross leverage (234%) has soared to new post-crisis highs.”

On the mutual fund side, growth and value funds are outperforming for one simple reason. “Information Technology has outperformed the S&P 500 by 11 percentage points YTD (17% vs. 7%), 8 percentage points higher than any other sector [and] Info Tech is the most overweight sector among large-cap growth funds (+422 bp),” Goldman explained in their latest mutual fund monitor, before going on to note that “Large-cap value funds are also overweight Info Tech by 277 bp vs. the Russell 1000 Value index.”

Leave A Comment