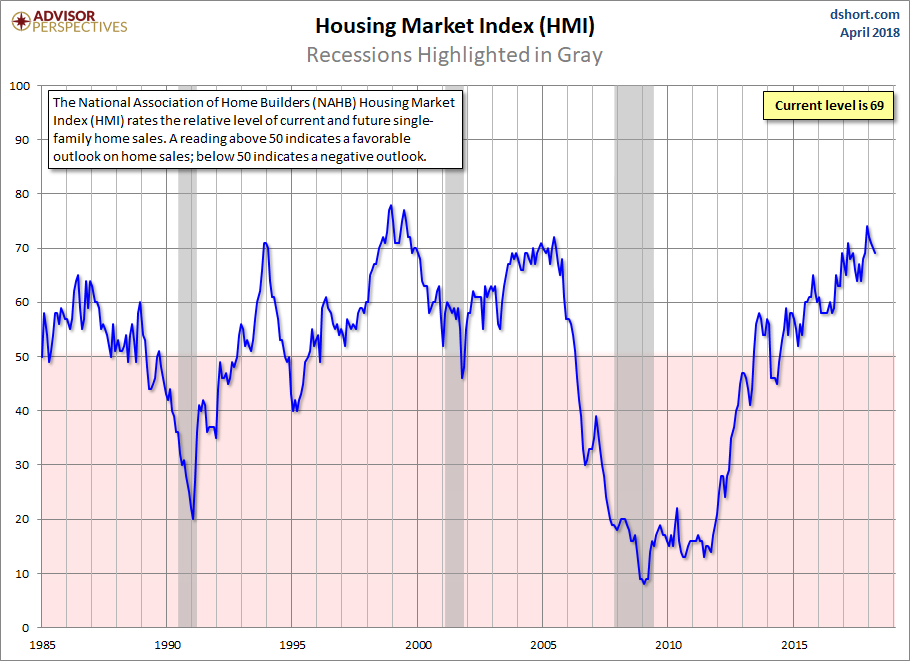

The National Association of Home Builders (NAHB) Housing Market Index (HMI) is a gauge of builder opinion on the relative level of current and future single-family home sales. It is a diffusion index, which means that a reading above 50 indicates a favorable outlook on home sales; below 50 indicates a negative outlook.

The latest reading of 69, down 1 from last month’s number, came in below the Investing.com forecast of 71.

Here is the opening of this morning’s monthly update:

Builder confidence in the market for newly built single-family homes edged down one point to 69 in April on the NAHB/Wells Fargo Housing Market Index (HMI) but remains on firm ground.

“Strong demand for housing is keeping builders optimistic about future market conditions,” said NAHB Chairman Randy Noel. “However, builders are facing supply-side constraints, such as a lack of buildable lots and increasing construction material costs. Tariffs placed on Canadian lumber and other imported products are pushing up prices and hurting housing affordability.” [link to report]

Here is the historical series, which dates from 1985.

The HMI correlates fairly closely with broad measures of consumer confidence. Here is a pair of overlays with the Michigan Consumer Sentiment Index (through the previous month) and the Conference Board’s Consumer Confidence Index.

Leave A Comment