– U.S. Consumer Confidence Survey to Narrow From Highest Reading Since 2001.

– 12-Month Inflation Expectations Have Softened for Last Two Consecutive Months.

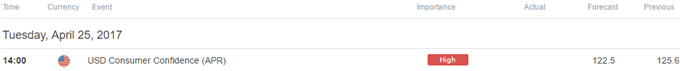

Trading the News: U.S. Consumer Confidence

A downtick in the Conference Board’s U.S. Consumer Confidence survey may drag on the greenback as it casts a weakened outlook for growth and inflation, but the figure may do little to alter the monetary policy outlook as the Federal Reserve appears to be on course to implement additional rate-hikes over the coming months.

Why Is This Event Important:

The Federal Open Market Committee (FOMC) may continue to prepare U.S. households and businesses for higher borrowing-costs as the central bank closes in on its dual mandate, and Chair Janet Yellen and Co. may relay a more hawkish tone at the May 3 interest rate decision as ‘nearly all participants judged that the U.S. economy was operating at or near maximum employment.’ However, the FOMC may attempt to buy more time as ‘market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance,’ and the committee may try to tame market speculation as Fed Fund Futures price a greater than 60% probability for a June rate-hike.

Expectations: Bearish Argument/Scenario

Release

Expected

Actual

Average Hourly Earnings (YoY) (MAR)

2.7%

2.7%

Non-Farm Payrolls (MAR)

180K

98K

Personal Income (FEB)

0.4%

0.4%

Easing job growth paired with subdued wages may weigh on household sentiment, and a marked downtick in the Conference Board’s survey may generate near-term headwinds for the U.S. dollar as it drags on interest-rate expectations.

Risk: Bullish Argument/Scenario

Leave A Comment