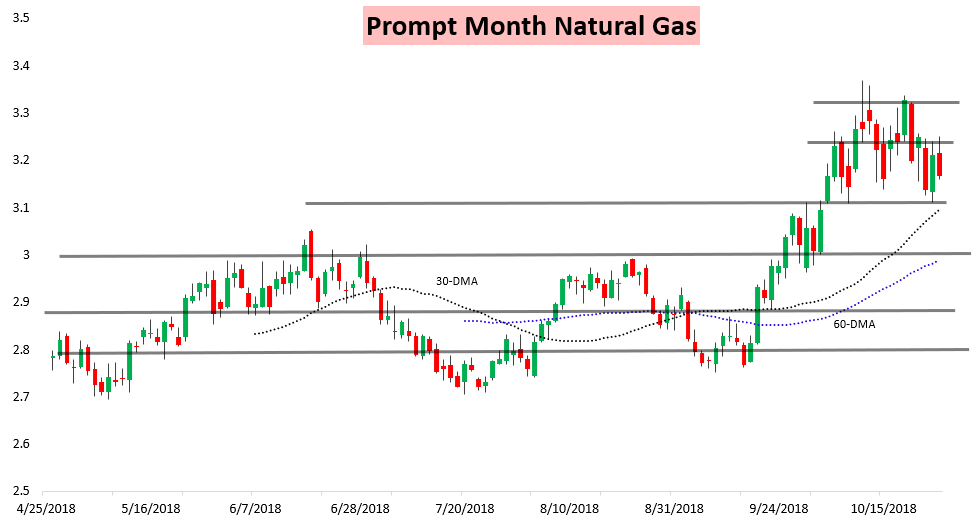

It was another day of significant volatility in the natural gas market, as slightly warmer overnight guidance pushed prices briefly lower before very strong physical prices spiked the front of the futures strip. Warmer risks on early afternoon guidance then sent prices lower, with the November contract settling over a percent lower on the day.

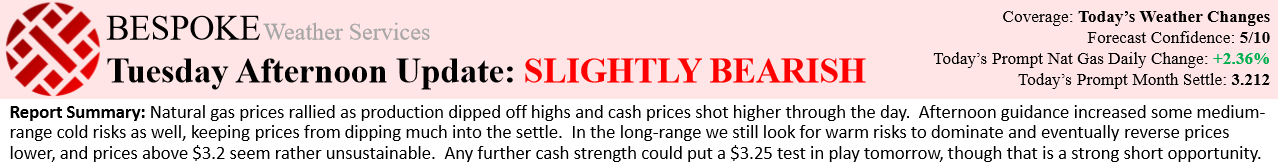

This was not a surprise to subscribers, as in our Afternoon Update yesterday we warned that strong cash prices today could pull the November contract into $3.25 but even so we held slightly bearish sentiment as the bounce should fail.

Sure enough, prices ripped higher on very strong cash prices today, and actually top-ticked at the $3.25 level before reversing lower into the settle. The result was a large differential between Henry Hub cash prices and prompt month futures with the November contract expiry approaching on Monday.

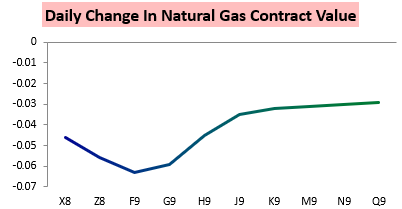

The impact of strong cash prices today can clearly be seen along the strip, with the prompt November contract propped up and losses largest for the January contract.

The result was that the X/F November/January contract spread approached recent narrows even with selling along the strip.

We warned clients in both our Morning Update and then our Note of the Day that today’s rally could not be attributed to weather, as overnight GWDD additions were minimal (as seen in our Morning Update).

Traders were likely also positioning ahead of an EIA print tomorrow that will hold some of the first real significant heating demand of the season.

Our intraday Note of the Day both warned clients that the rally this morning was cash-led and then also highlighted that it was likely to fail, while spelling out how balances could impact prices after the impact of cash faded. Our Afternoon Update then looked at the latest 12z afternoon model guidance, spread action, and weather-adjusted balance data to determine where natural gas risk appears skewed into and after the EIA print tomorrow.

Leave A Comment