Fewer than 100 of the more than 10,000 publicly-traded companies have increased annual dividends for at least 26 consecutive years. National Retail Properties (NNN) is one of them.

Perhaps more impressively, National Retail’s average annual total return for the past 25 years has been 14.8%, significantly outpacing the market to provide meaningful value for shareholders.

The company is conservatively managed and generates a stream of highly predictable operating income, making it an appropriate income investment for our Conservative Retirees dividend portfolio.

Business Overview

National Retail was formed in 1984 and is a real estate investment trust (REIT) with more than 2,200 properties over 47 states. The company’s retail properties are leased to more than 400 tenants across 38 industry classifications such as convenience stores and restaurants, providing nice diversification.

Furthermore, National Retail only originates single-tenant triple-net leases, which shift property operating expenses such as maintenance, taxes, and utilities to the tenant. In other words, the rental revenue received by National Retail has substantially fewer expenses and more stable net cash flow than other REITs with a smaller mix of triple-net leases.

Business Analysis

We believe National Retail has a strong moat and plenty of opportunities for long-term profitable growth. The company’s strengths really begin with management’s focus on generating consistent annual funds from operations (FFO) per share growth, increasing the dividend annually, and assuming below average balance sheet and portfolio risk.

These objectives have resulted in a conservatively managed, well-diversified business that is not susceptible to any single industry, customer, or geography, which results in very reliable cash flows.

Convenience stores are the company’s largest exposure at about 17% of annual rent, followed by full-service restaurants (11%), limited service restaurants (7.2%), auto service (7%), family entertainment centers (5.6%), and theaters (5.2%).

National Retail’s largest tenant is Sunoco, which generated 5.9% of NNN’s total rent last fiscal year. The company’s top 25 tenants account for 60% of rent, which is a healthy level of diversification. Many of them are in very stable lines of business, too. This prevents National Retail from being overly exposed to the fate of any one customer, reducing its risk profile.

Its top tenants are also in good financial shape with a weighted average rent coverage ratio of 3.6x. By spreading its properties across nearly 40 different industries and hundreds of tenants, National Retail diversifies away a significant amount of fundamental risk.

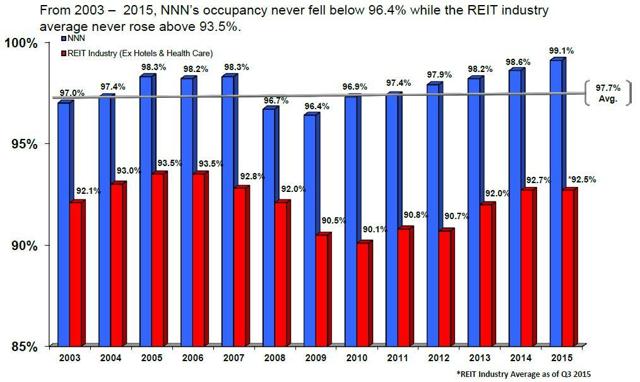

Furthermore, National Retail owns well-placed retail locations. The company finished 2015 with an occupancy rate of 99.1%, and its occupancy rate has never dipped below 96.4% over the last 13 years. As seen below, National Retail enjoys significantly higher occupancy rates than the broader REIT industry, which results in lower earnings volatility.

Source: National Retail Properties Investor Presentation

Importantly, National Retail has not had to discount its leases or make substantial improvements to its properties to get tenants to stay. The chart below shows the company’s lease renewals by year. From 2007-2015, National Retail renewed 86% of its leases, and 58% of renewals were at rates about the prior rent (14% were at the prior rent, and 28% were below the prior rent).

Importantly, National Retail only invested $338k in capital expenditures on these properties while renewing nearly $40 million in rent over this time period, highlighting the benefits of its triple-net leases (the company doesn’t have to “buy” higher rent with capital investments because tenants are on the hook for maintenance).

Leave A Comment