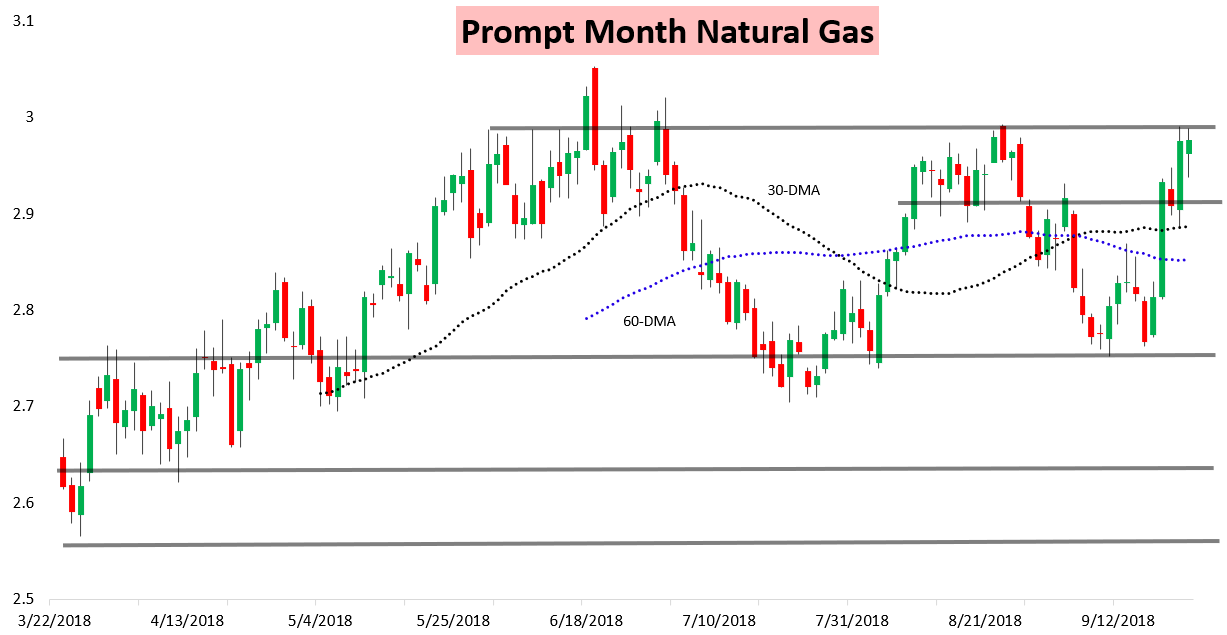

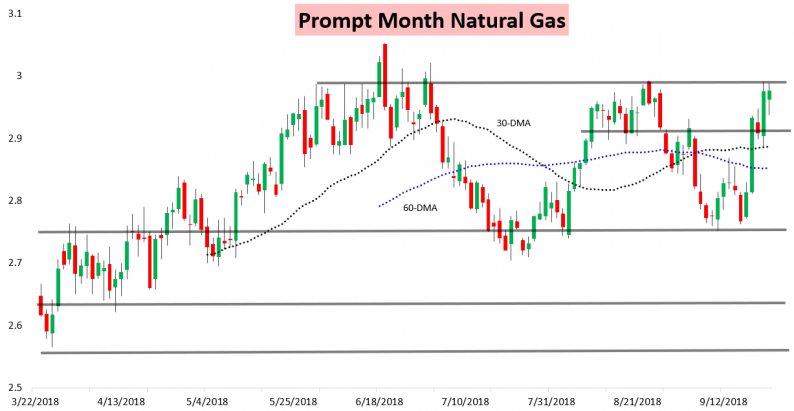

After what has been a very volatile week the natural gas market calmed down today, declining overnight but rallying on continued cash strength and a stronger winter strip this morning and settling near flat.

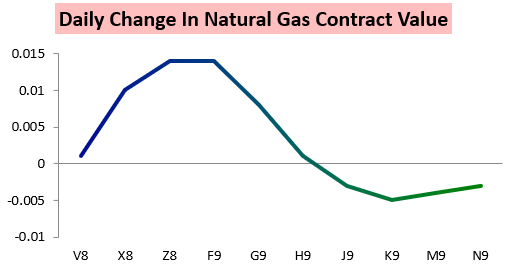

Again today the winter strip supported the prompt month October contract, with the December and January contracts logging the largest gains on the day.

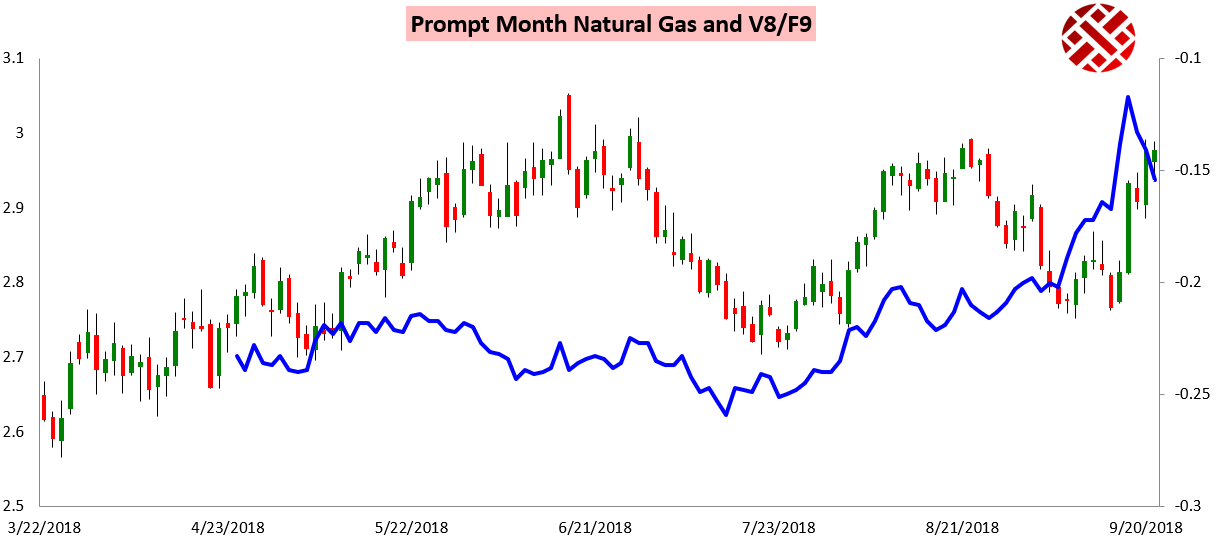

Thus the V/F October/January contract spread has continued to widen following the rapid narrowing of the last few weeks.

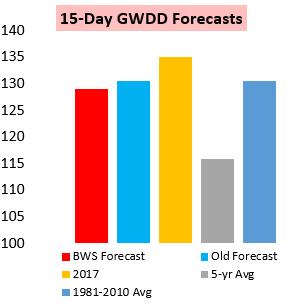

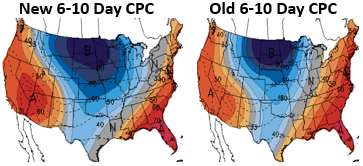

Prices did decline overnight on some slight revisions lower in weather-driven demand forecasts.

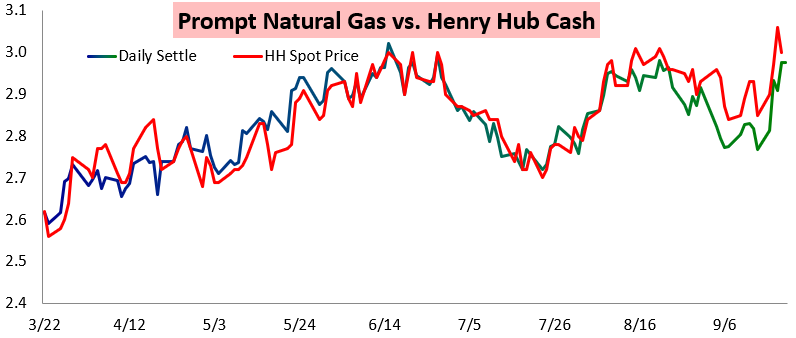

We outlined for clients in our Morning Update that, “…a test of $2.98-$3 into the weekend is not out of the question. Spreads do indicate at least some more support would come if cash is strong with V/F and V/X rapidly widening again.” Cash prices remained firm and we saw the October contract move right back into our resistance range, though as we expected resistance easily held even with continued cold risks in the 6-10 Day time period.

Into the weekend traders are closely watching colder weather over the next couple of weeks that could deliver the first heating demand of the season, as they attempt to determine whether we see enough GWDDs to keep injections limited and the storage deficit large. Low storage levels have helped keep Henry Hub cash prices strong relative to the prompt month contract, a trend that held this week.

Leave A Comment