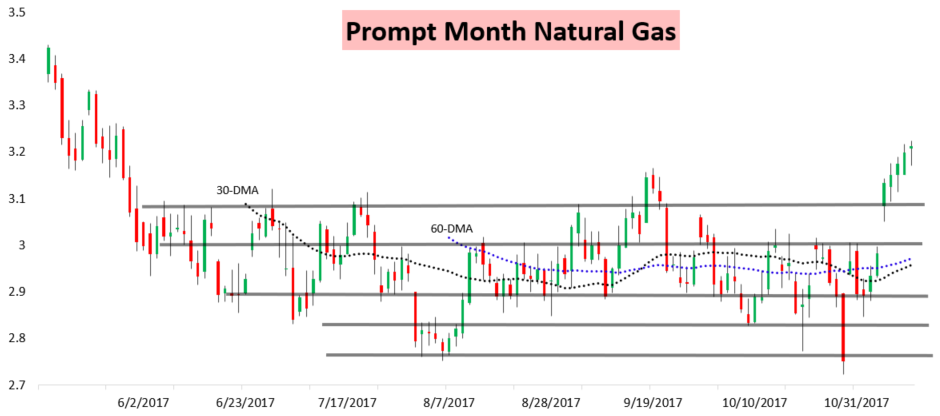

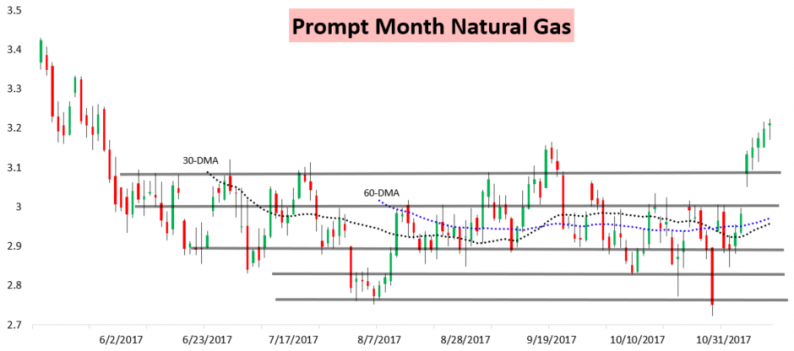

Prompt month natural gas prices have now logged gains 7 days in a row, yet each of the last 4 days we have not seen a gain over a percent. Prices have continued this steady grind higher as we have continued adding GWDDs to our 15-day forecast, so the weather has continually been providing support.

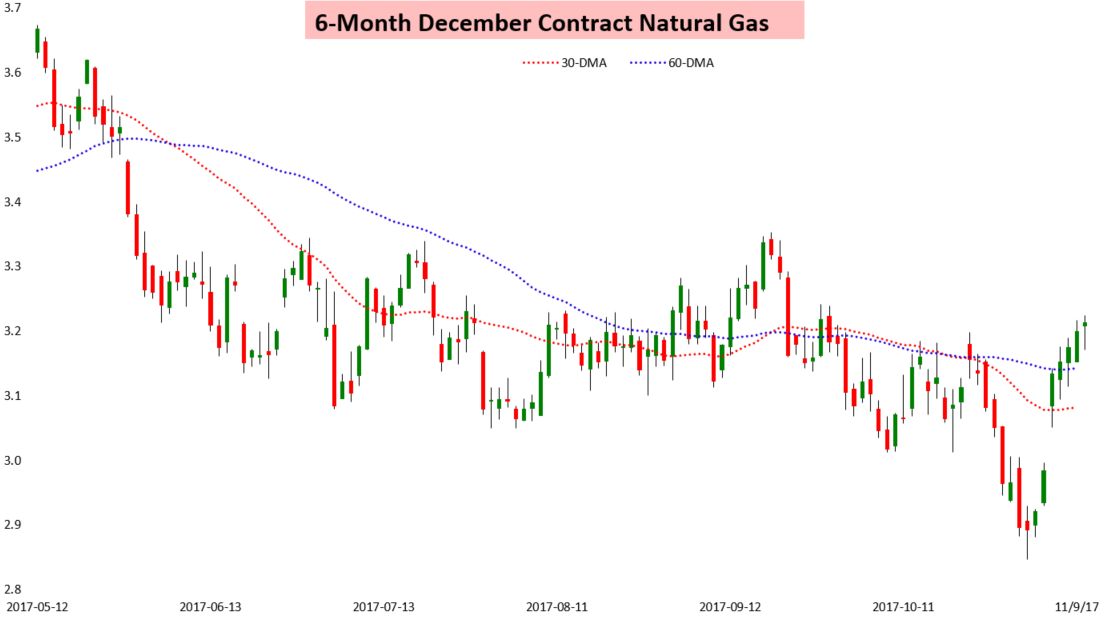

Though on the prompt month chart prices may look overbought deviating so far from the 30 and 60-DMA, we note that for the December contract itself this rally does not appear nearly as impressive, with prices holding healthily above the 60-DMA.

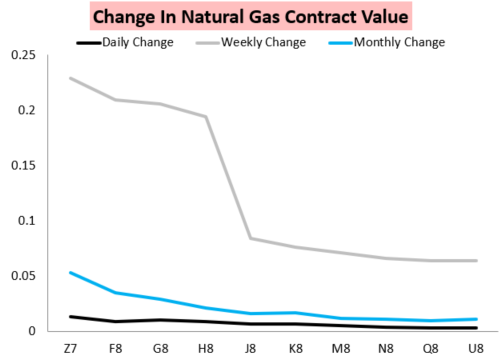

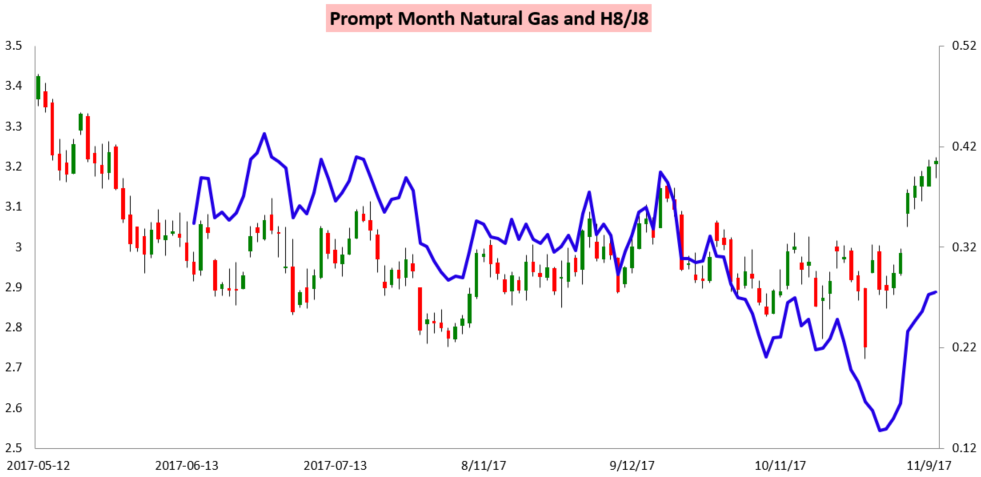

We saw weather clearly support prices again today with the gains again strongest at the front of the natural gas strip. Over the week we noted a massive increase in H/J as well as increased heating demand expectations from the colder weather we expect through November has been priced in.

The result is that H/J settled at its highest level since the start of October.

Perhaps more impressively, however, this November cold has driven Z/F back to its highest levels since early September. This clearly indicates the role that colder weather forecasts had in supporting prices through the week.

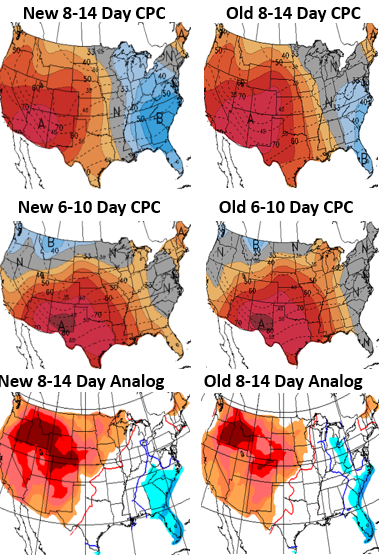

To continue this rally, then, it would appear that cold would need to remain sustained through much of November, or perhaps intensify a bit more in forecasts to provide an upward catalyst. In today’s Pre-Close Update we outlined how Climate Prediction Center forecasts were finally catching up on colder risks in the long-range we were watching all week, as their 8-14 Day forecasts now show colder risks in the East. Still, there are a number of bearish risks as well, primarily across the South.

Despite these bearish risks, we correctly predicted to clients in the middle of the week that it would be hard for natural gas prices to significantly break above the $3.2 resistance level without increasing weather-driven demand expectations even further.

Leave A Comment