The October natural gas contract exploded higher over 4% today as cash prices spiked on tight power burns and impressive short-term heat.

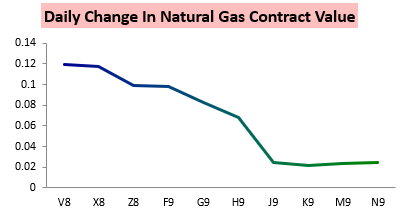

The October contract again logged the largest increase on the day, but it was closely followed by the November contract.

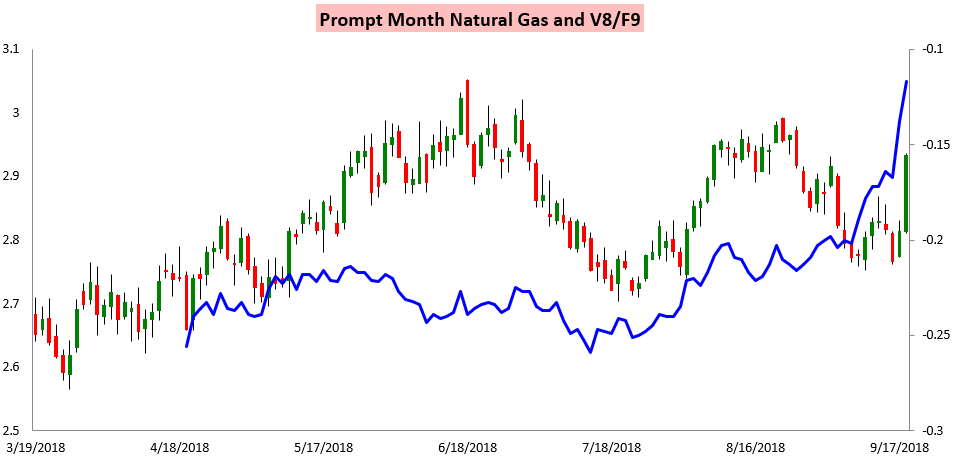

Meanwhile, the move higher in the October/January V/F contract spread continued unabated today.

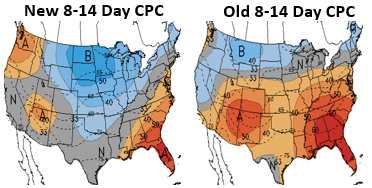

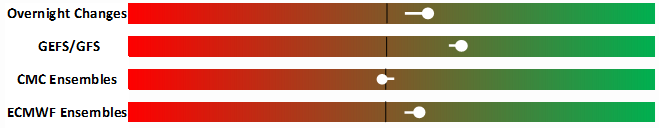

This came as models increased heating demand expectations in the long-range, something which we warned clients in our Morning Text Message Alert at 6:47 AM Eastern saying in part, “[s]mall net demand loss but cold risks may spook market…” Those cold risks became apparent on Climate Prediction Center forecasts this afternoon.

Our Morning Update then warned that we initially were, “…looking for some type of cash rally towards the $2.85 level,” with that rally certainly occurring but only continuing from there.

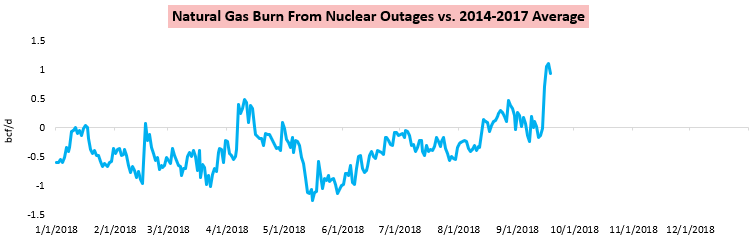

As we mentioned yesterday, and have been covering closely for clients, a number of nuclear plants remain offline which has increased gas burn relative to the 5-year average. This was a focus of our live chat for subscribers, included in our Trader level subscription.

We also published our weekly Seasonal Trader Report with 5-month GWDD forecasts and updated storage modeling. In it we also looked at movement of various contracts along the natural gas strip and discussed how risk appeared skewed heading into the winter along various time frames.

Leave A Comment