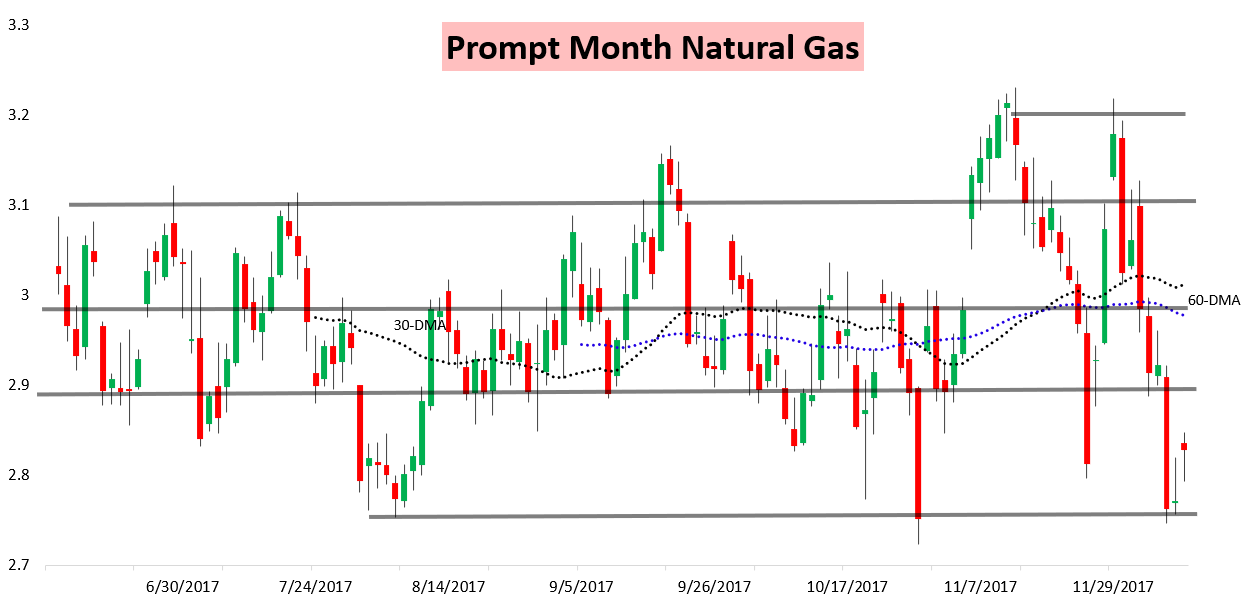

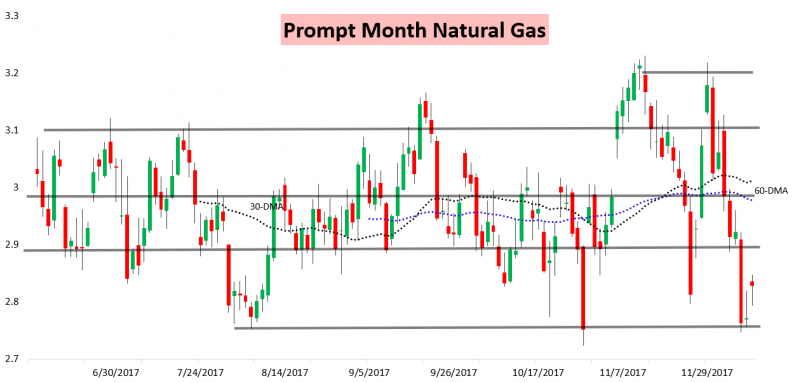

Natural gas prices gapped up a couple percent last evening and held there through much of the day today, settling up just over 2% on the day. Yet prices were not able to continue higher from the gap, raising concerns for bulls that expected more of a recovery.

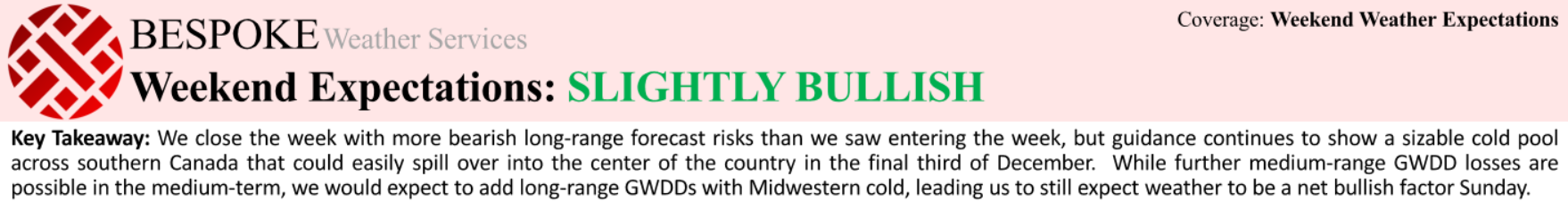

The gap up was not a surprise to subscribers, as on Friday we alerted that there were more bullish than bearish long-range weather risks headed into the weekend, and that we expected model guidance to finally pick up more of them by Sunday evening. We then saw long-range cold risks as one of the key driving factors that supported prices today.

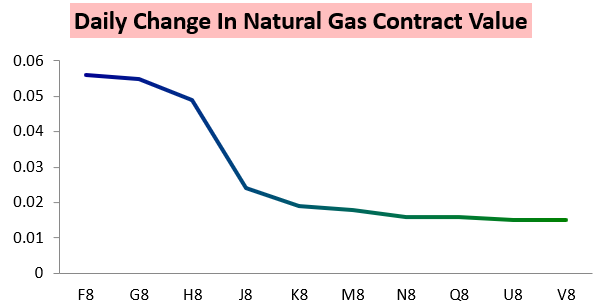

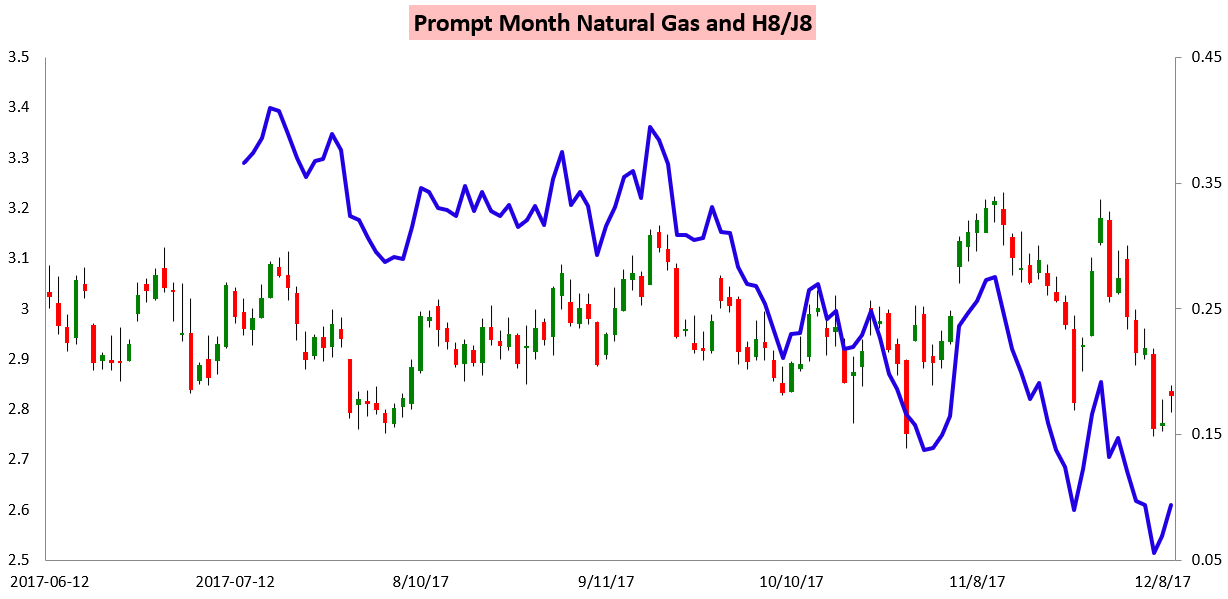

The weather’s influence can best be seen by the relatively large move out we saw today in the March/April H/J spread as traders became a bit more concerned about limited stockpile levels heading through the winter with late-month cold.

Seen another way, the spread recovered a significant amount of its recent losses despite a relatively small prompt month price move.

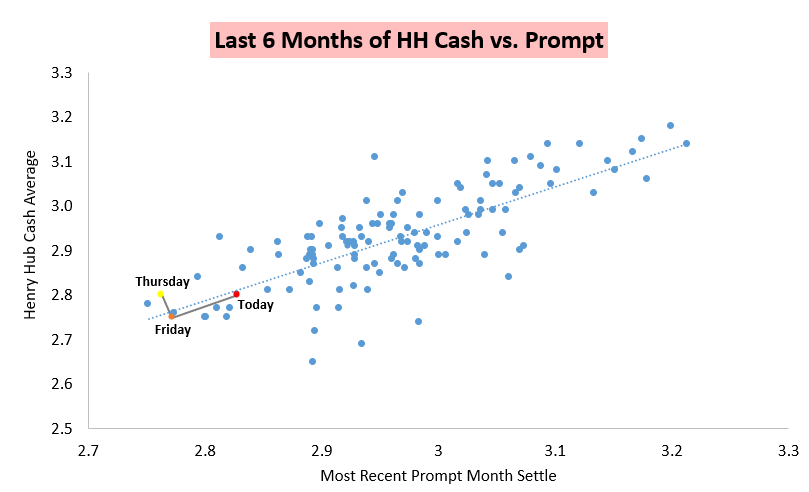

Meanwhile, the gain in the January contract about matched the gain in Henry Hub cash today, as short-term cold lingers as well.

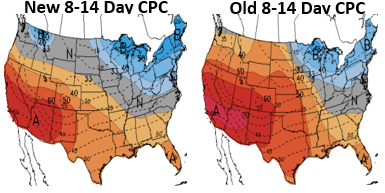

For futures traders, though, all eyes remain on long-range forecasts, as we see significant warmth in the medium-range before we cool off in the long-range. This is best seen in recent trends in Climate Prediction Center forecasts as they pick up on long-range cold risks.

The intensity and duration of any incoming long-range cold should determine if and how much prices are able to recover after their recent heavy selling in the last couple of weeks.

Leave A Comment