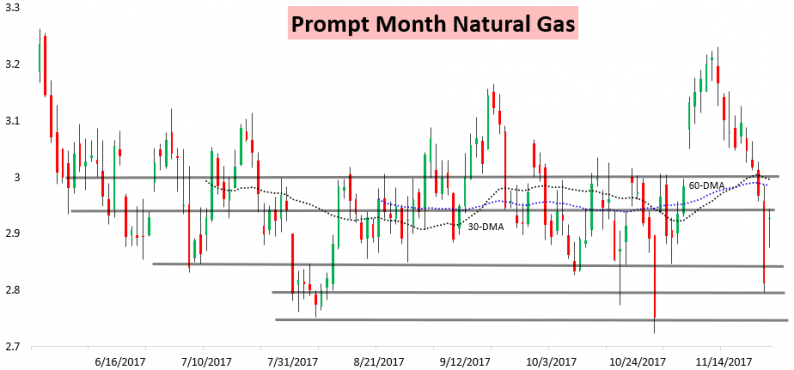

After a Thanksgiving and Black Friday bloodbath, natural gas prices recovered today by gapping up significantly and holding on to that gap through the trading session today. Though prompt month prices were unable to rally above a resistance level around $2.95 we had been watching, this was still a welcome move for beleaguered bulls.

The move today came in the face of continued cash weakness, as warm weather over the next week to week and a half will keep heating demand below average and ensure that we withdraw less natural gas from storage than we otherwise would with average weather.

The front of the natural gas strip thus was clearly supported by weather expectations, with both Z/F and H/J moving out a bit on the day.

We added a significant number of GWDDs to our 11-15 Day forecasts over the weekend, something that we warned clients in Friday’s Pre-Close Update was a real possibility and would likely support natural gas prices.

In that same report we similarly warned that the natural gas market was seemingly pricing in a “max bearish scenario through the middle of December,” meaning that any additional cold would help “stabilize and support this market for next week” as we have seen.

The recent natural gas move also fits with our Note of the Day from last Wednesday, November 22nd, which warned that there was short-term downside for natural gas prices as warmer trends in medium-term forecasts continued, but that a near-term bottom would likely be set for natural gas prices last week and that by this week forecasts should be trending colder. We included the text-only portion of this Note below.

One piece of data that caught our eye today (and we pointed out to subscribers) was the relatively small move in H/J relative to the size of the price recovery at the front of the strip.

In our Afternoon Update we outline what we see this meaning in the context of current weather forecasts, and explain where we see both weather forecasts and natural gas prices trending through the coming week.

Leave A Comment