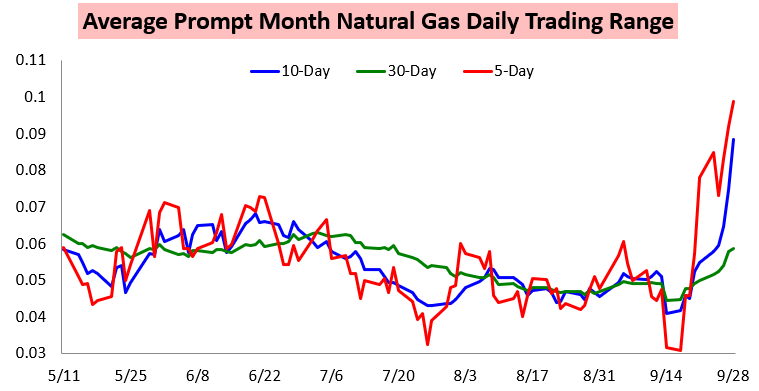

Natural gas prices saw a week that featured a significant increase in volatility, as again Friday we saw the daily average trading range for the prompt month increase.

The week started with strong cash prices dragging up the front of the strip before weak balances reversed the October contract into expiry. A bullish EIA print then spiked the newly-prompt November contract before bearish weather expectations and continued looser balances pulled the front of the strip down into the end of the week.

On the week the front of the strip logged small gains still, though the March contract logged a loss. Friday, meanwhile, losses were largest at the front of the strip.

Warmer forecasts appeared to play a role in selling at the front of the strip Friday, as we outlined overnight GWDD losses that we explained should prove bearish.

In our Morning Update we outlined that “….$2.98-$3 support is in play into the weekend…” as “…weather-driven demand is less impressive today and with looser burns and production still near highs it is hard to see cash running all that much more.” Sure enough, cash prices were weaker Friday, and the natural gas strip sold off as a result with the November contract bouncing off $2.98.

As volatility increased in flat price, spreads exhibited more activity this week as well. The February/March G/H spread bounced around significantly the last few days, falling off quite a bit Friday.

This comes as the market weighs recent balance dynamics against forward weather expectations and the backward-looking but bullish EIA report from yesterday.

Next week’s EIA print is looking solidly looser, with a question of just how much looser it is likely to be.

Leave A Comment