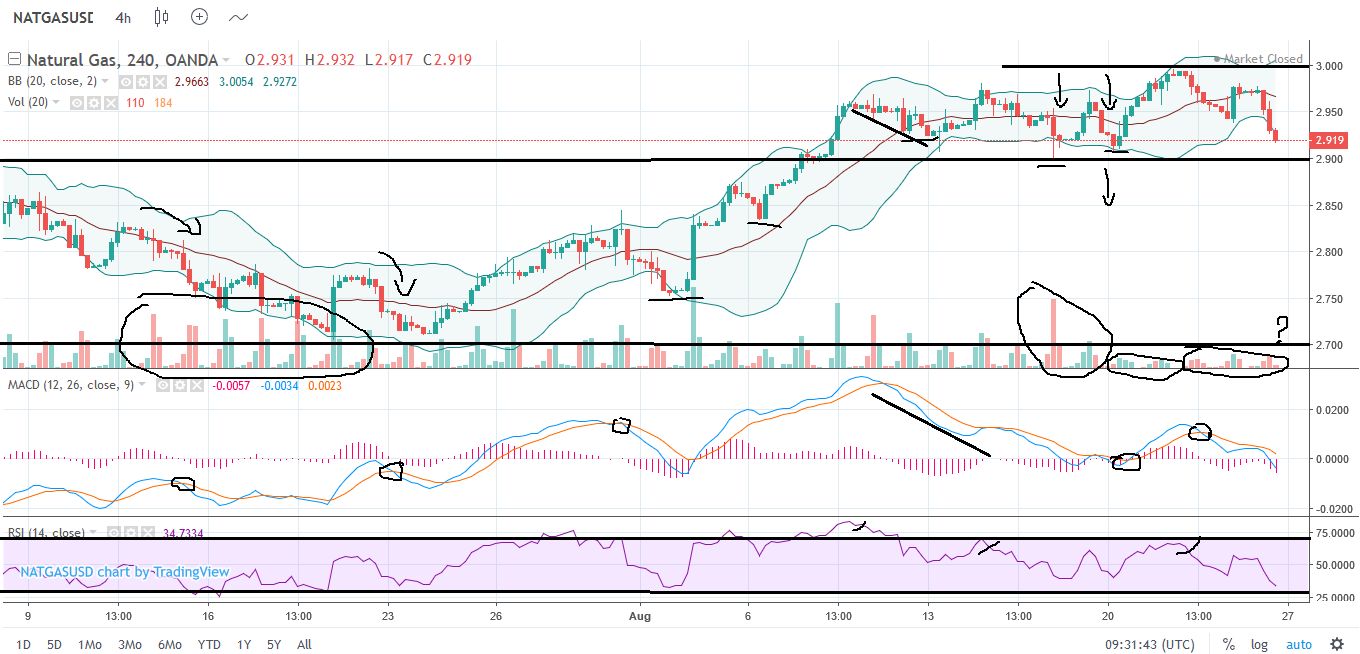

Natural Gas market faced a rather negative week closing 1.80% lower than the previous one at $2.91. Trading volumes decreased naturally, as the market is staying neutral, waiting for a longer term sentiment to be seen on fundamentals and expecting the figures that will truly represent its seasonality later in September.

Thursday’s storage report showed a 48 Bcf build which, in association with the milder weather expected for the Lower 48, pressed the price significantly. We are looking at a range-bound price that we like to sell when rallies occur for quite some time now. Ranges can vary on monthly and weekly charts. We can’t buy the market for the longer term, not before the $3.10.

Back in May, I was predicting that $3.20 is an area we will struggle to see before this year ends. Oversupply is the main issue the market is facing for the last few years and new trading agreements do not look to positively affect it either. No need to over analyzing the fundamentals though. Daily, for monthly trades, 4hour and hourly MACD and RSI for weekly ones or even day trading, offering good timing of entry on both directions.

Leave A Comment