In the previous article, The U.S. Is Still The Global Natural Gas King, I highlighted the rise of the United States as the world’s leading natural gas superpower.

Workers look at the LNG Sakura liquefied natural gas tanker berthed at Tokyo Gas Co.’s Negishi LNG terminal in Yokohama, Japan, on Monday, May 21, 2018. This was Japan’s first LNG shipment from Dominion Energy’s Cove Point facility. LNG exports in recent years have increased significantly, one of many new demand drivers in the natural gas markets. Photographer: Tomohiro Ohsumi/Bloomberg

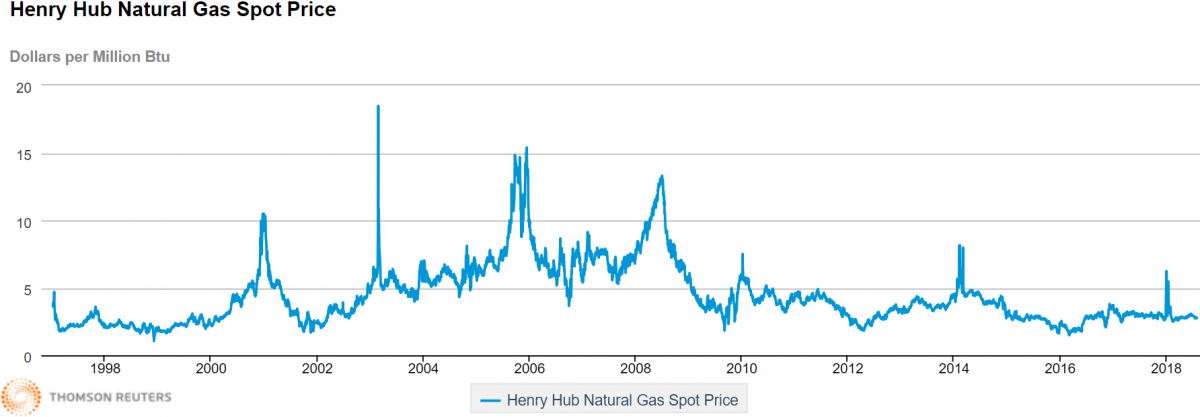

But it is easy to forget the view of the U.S. natural gas markets circa 2005. At that time, U.S. natural gas production had begun to decline. Natural gas spot prices regularly spiked above $10 per million British thermal units (MMBtu), and sometimes as high as $15/MMBtu.

Henry Hub natural gas spot price.

The late Matt Simmons predicted in 2003 that with “certainty,” by 2005 the US would embark on a long-term natural gas crisis for which the only solution was “to pray.” T. Boone Pickens and a number of high-profile energy insiders concurred.

ConocoPhillips and ExxonMobil made large acquisitions of natural gas companies, betting on a future with much higher natural gas prices. Liquefied natural gas (LNG) import terminals were built to help address the expected supply shortfall.

Of course, that didn’t happen. Natural gas production rose sharply as a result of advances in hydraulic fracturing and horizontal drilling, and that kept prices under control. Natural gas spot prices fell below $10/MMBtu in 2008, and since 2010 have rarely been above $5/MMBtu.

There have been two exceptions since then. During the winter of 2014, low natural gas inventories caused spot prices to briefly spike above $8/MMBtu. This happened again during the first week of this year, when low inventories caused prices to briefly spike above $6/MMBtu. I circled this time period in the graphic below:

Leave A Comment