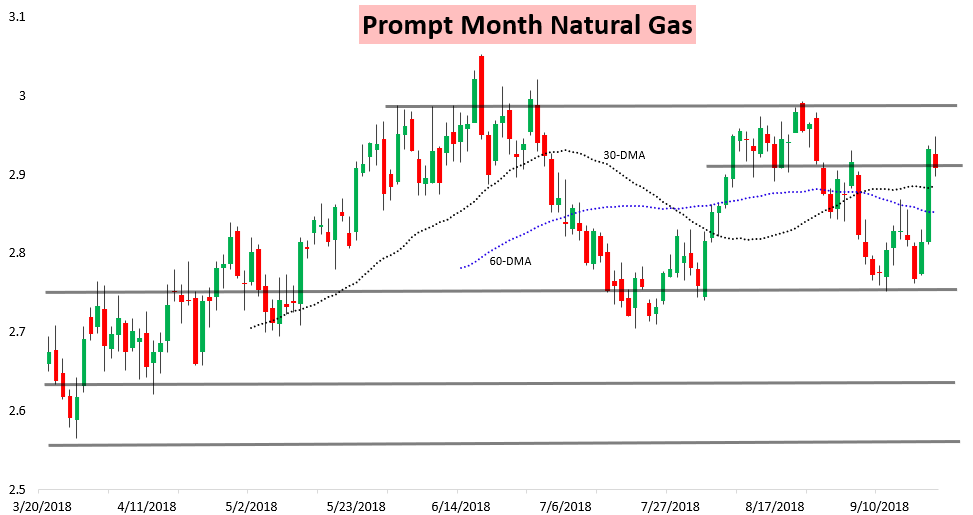

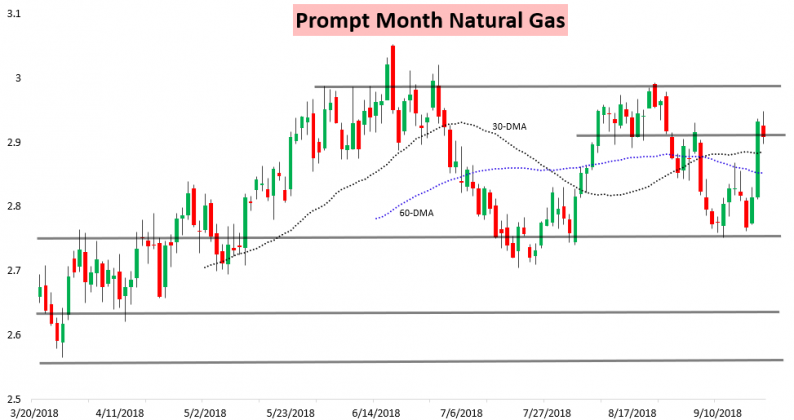

After spiking over 4% yesterday, the October natural contract pulled back slightly today, settling down a bit less than a percent.

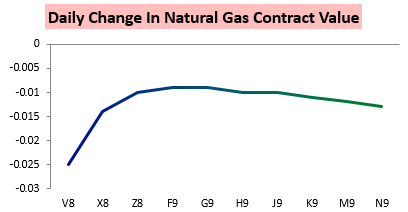

On the day the October contract saw by far the largest loss with the rest of the strip more stable.

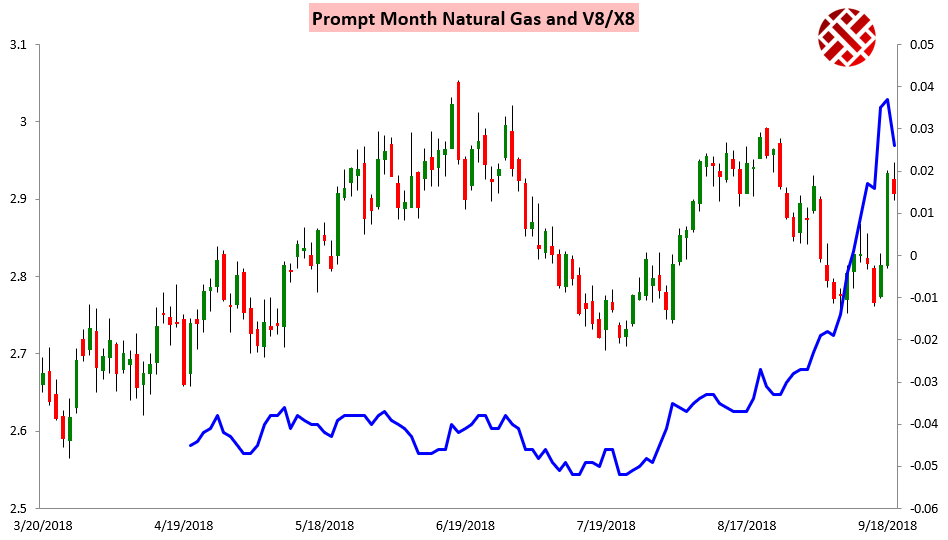

The result was a decent move back in the V/X October/November spread that has been on a tear as of late.

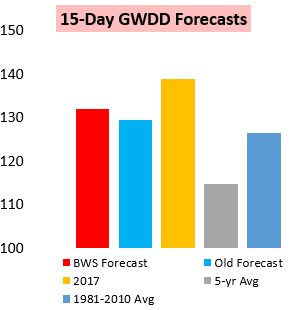

In our Morning Update we warned that, “…a bit more short-term upside with lingering cash strength wins out.” However, we highlighted that such a rally was unlikely to be sustained, which verified well on the day. Little of this appeared weather-driven, however, with relatively small overnight GWDD changes.

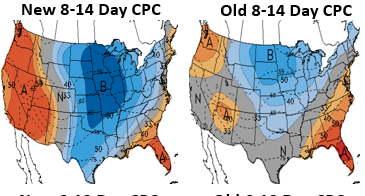

Climate Prediction Center forecasts continued to pick up on the Week 2 cold risks we had been highlighting for clients the last 36 hours as well.

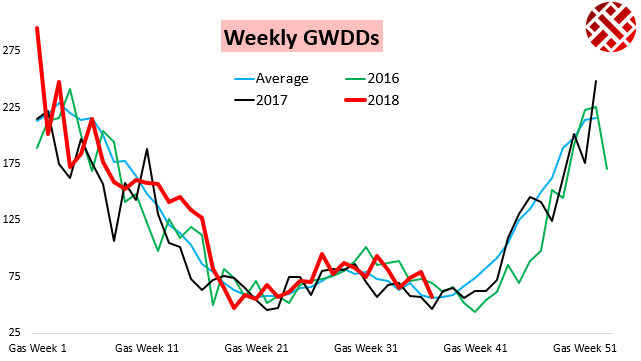

Meanwhile, traders are preparing for tomorrow’s EIA print, where we are looking for a larger injection than the previous week thanks to far less weather-driven natural gas demand this past week. Gas Weighted Degree Days fell off significantly week-over-week and are the lowest for a week since the past spring.

Leave A Comment