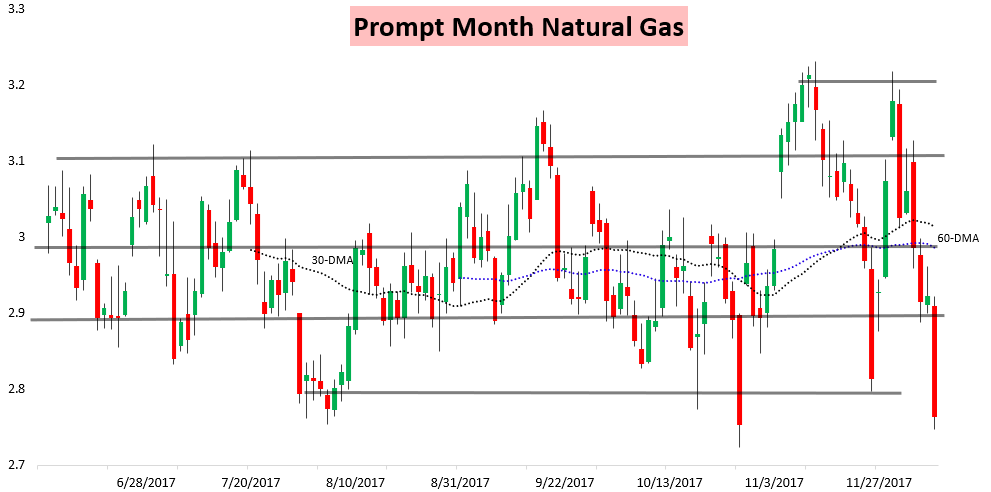

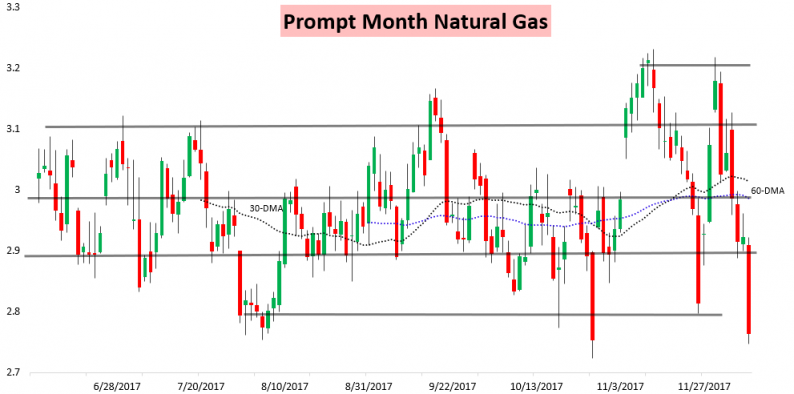

Another day, another large natural gas red candle. That seems to be the trend of late, with prices down over 13% from their settle last Wednesday.

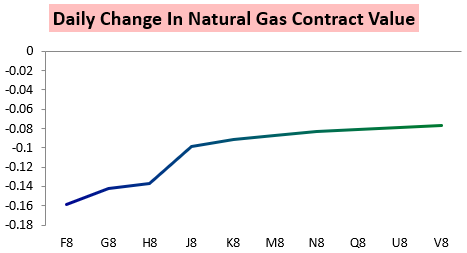

Yet while we have seen major declines a number of days, the catalysts for each have varied. Yesterday’s blog was about how selling appeared to be balance-driven. Today it was clear that selling was primarily weather-driven, with significant heating demand losses on European guidance overnight. Losses at the front of the natural gas strip were accordingly most extreme.

Shown another way, after holding relatively firm through recent selling, F8/G8 plummeted today.

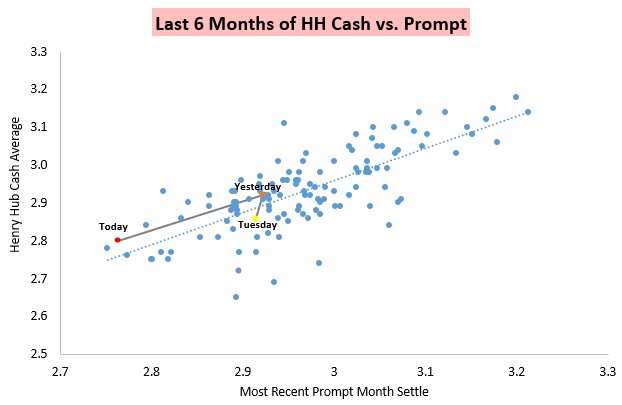

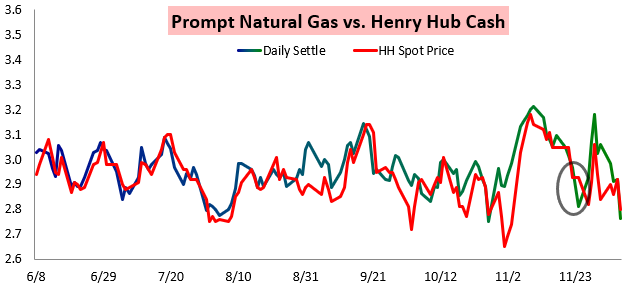

That would seem to indicate that weather is back in charge of price action, at least partially. Additionally, we can see how little traders are concerned about weather through the remainder of December by how physical gas is reacting; prompt month futures actually settled below the Henry Hub cash average for the day.

This is certainly not unprecedented, though it has been a little while since this occurred, with the last prompt expiry below cash coming on November on November 24th. Yet it tends to be more rare in December, where heating demand seasonally increases through the month.

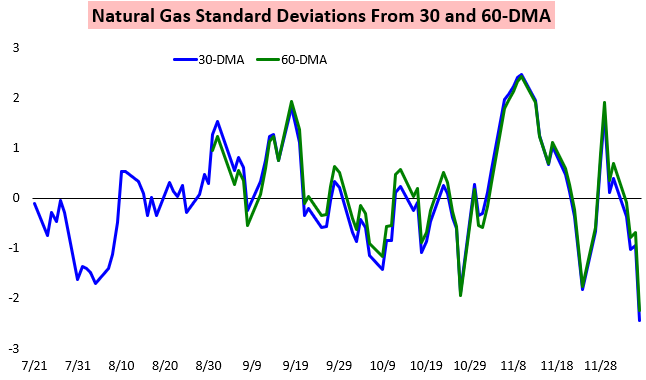

Additionally, prompt month natural gas prices are more oversold than they were on the 24th.

Leave A Comment