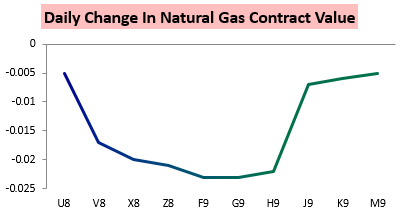

It was a busy Monday along the natural gas futures curve as traders weighed warmer trends over the weekend against a production increase. In the end, production appeared to slightly win out today, but with mixed results, as the September contract declined less than a cent and is now up on the day post-settle.

Meanwhile, losses for the winter contracts were far more significant, with balances playing more of a role there than weather.

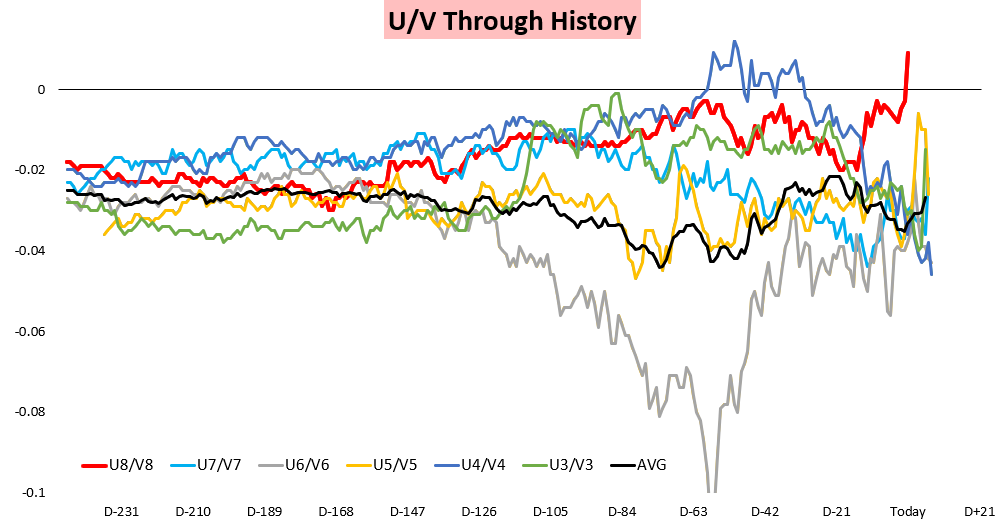

Strong cash prices and significant medium-term heat expectations spiked the U/V September/October contract spread positive and to levels not normally seen this close to September contract expiry.

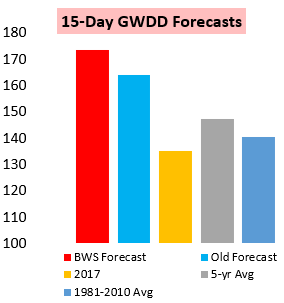

In our Morning Update, we told clients that, “we would watch for some more cash support as prices may try and defend $2.9 with significant medium-term heat expected.” This is exactly what happened, with the September contract moving off $2.903 higher through the morning as we saw weekend GWDD additions.

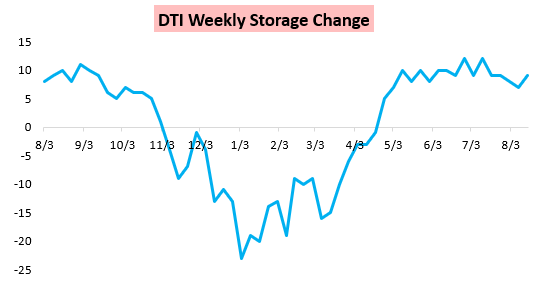

Meanwhile, the first storage data for the upcoming EIA print on Thursday was released, with Dominion Transmission reporting a 9 bcf injection last week as compared to a 7 bcf injection the week prior.

A larger storage injection from last week is likely to be announced on Thursday thanks to less cooling demand last week, but just how much larger remains up for debate.

This will be a key focus for us this week, as last week our EIA estimate was only 2 bcf off as we helped clients see price risk and position around the print. Traders will similarly be watching to see if last week’s loosening was a one-off event or more of a trend, something we have been analyzing daily with our weather-adjusted demand and balance data as well as our analysis of the latest production estimates. Combined with our weather analysis and forecasts we can thus provide a holistic view of the natural gas market and forward risks.

Leave A Comment