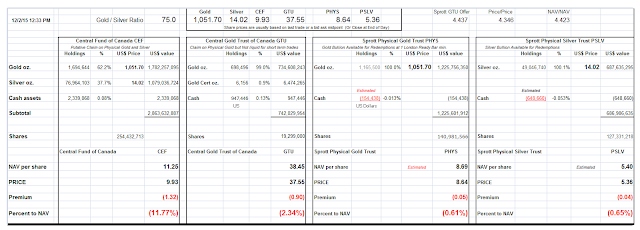

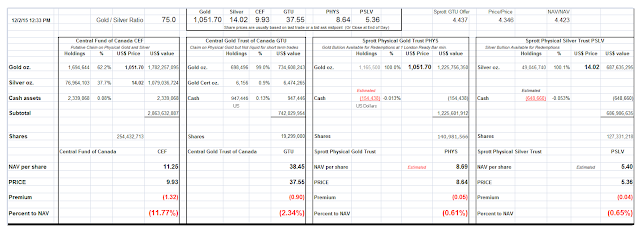

There was another gold redemption from the Sprott Physical Gold Trust of 16,467 troy ounces.

However one may wish to account for this, it is noteworthy that there have been no similar redemptions from the silver trust.

This is consistent with the overall experience of Western funds and trust which have been seeing the outflows of gold bullion for the past couple of years, but not of silver.

As you may recall, I have formed the hypothesis that the trading at the Comex in ‘synthetic gold,’ or highly leveraged paper gold claims, is creating a situation in which risk of a failure to deliver at current prices in the broader, global gold markets will be more likely to occur than in a well-managed and regulated market.

Or more bluntly, the price rigging of gold at The Bucket Shop is setting up the gold market for a severe dislocation when the artificial pricing scheme collapses.

I doubt it will be acknowledged as a ‘fraud’ since it involves systemically ‘important’ financial organizations and the acquiescence of bureaucrats caught up in a credibility trap.

The negative estimated cash balances on both Sprott funds continued to increase. One might assume that the Sprott funds have decided that now is not a good time to sell metal to raise funds.

Prior posting from the 27th of November 2015

Leave A Comment