Sprott Offer For Central Fund of Canada Press Release dated March 8

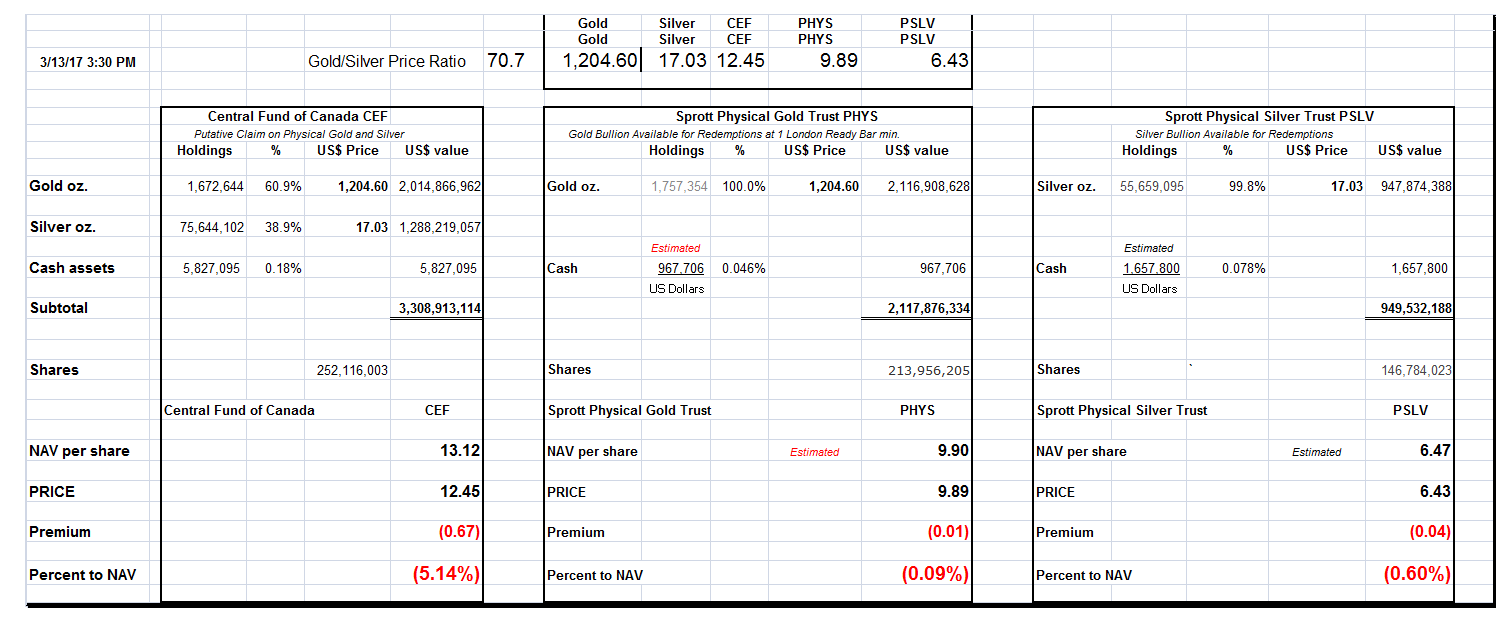

Sprott Asset Management LP (“Sprott”), a wholly owned subsidiary of Sprott Inc. (TSX:SII), today announced that it has filed an application (the “Application”) with the Court of Queen’s Bench of Alberta (the “Court”) to formally commence proceedings which, if successful, would result in the Class A shareholders of Central Fund of Canada Limited (“CFCL”) (NYSEMKT:CEF) (TSX:CEF.A), effectively, exchanging their Class A shares for trust units of a newly-formed Sprott Physical Gold and Silver Trust (the “New Sprott Trust”) on a net asset value (“NAV”) for NAV basis pursuant to a plan of arrangement (the “Arrangement”). The aggregate value of the proposed Arrangement is approximately US$3.1 billion and stands to unlock $304 million in shareholder value as a result of CFCL’s persistent discount to NAV.

The New Sprott Trust would be managed by Sprott and be substantially similar to the existing Sprott Physical Gold Trust (NYSE Arca:PHYS)(TSX:PHY.U) and Sprott Physical Silver Trust (NYSE Arca:PSLV)(TSX:PHS.U) and would include Sprott’s best-in-class physical bullion redemption feature.

Leave A Comment