Since late 2008, central banks around the world have used unprecedented QE to try and stoke the global economy.

Then in June 2014, the ECB took it a step further. They went negative.

Zero short-term interest rates apparently weren’t enough. The ECB realized that if they couldn’t get banks to loan or consumers to spend, why not really light a fire under their ass and tell them: “if you’re not going to spend, you have to pay to keep your money in the bank!”

The Swiss thought this was a great idea and did the same in December 2014. Later on, the Danish and the Swedes joined the party. And last week, the Bank of Japan decided zero wasn’t enough, either – they went negative, too!

Japan can’t seem to get a grip on the fact that, as a country, they’ve been slowly walking off the plank since 1989 back when everyone (except us) thought they were going to take over the world. They actually started experimenting with QE back in 1997, right after the last of its baby boom peaked in spending as we forecast would happen. And in early 2013, they really stepped on the gas, ultimately tripling their QE!

And what does Japan have to show for all that?

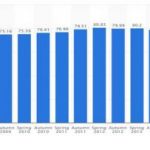

In the 20 years between 1996 and 2015, Japan’s GDP has grown by a lousy 0.17% as the country’s been on-and-off in recession.

Inflation has been comatose as well at near-zero, only bouncing temporarily at first with the surge in QE in 2013 forward.

Japan has the highest debt ratios of any major country. Their 10-year bond yields recently sank to 0.045%, which adjusted for inflation is well into negative. And now they’ve officially adopted negative short-term interest rates of -0.10%.

Look, I get it. Japan’s desperate. Officials aren’t going to stand by and watch as their country continues to sink into oblivion. But how much longer can this delusional policy of bubble denial last?

Japan couldn’t get its GDP off the ground even after tripling its QE. This just proves that it takes more and more of a financial drug to create less and less of a high. These slightly negative interest rates will likely achieve very little.

Leave A Comment