TM editors note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Written by SmallCapPower.com

Nemaska Lithium Inc. (NMKEF) has proprietary technology to produce low-cost, high-grade lithium carbonates and hydroxides which gives it a leading advantage over its peers and, given the surging demand for lithium, its stock should go to higher levels in the long term. Below is the investment thesis for making such an investment.

About Nemaska Lithium

Nemaska Lithium is engaged in the development of hard rock lithium mining properties in the Eeyou Istchee/James Bay territory in the province of Quebec, Canada and the processing of spodumene into lithium compounds…

Investment Thesis

Surging demand for lithium

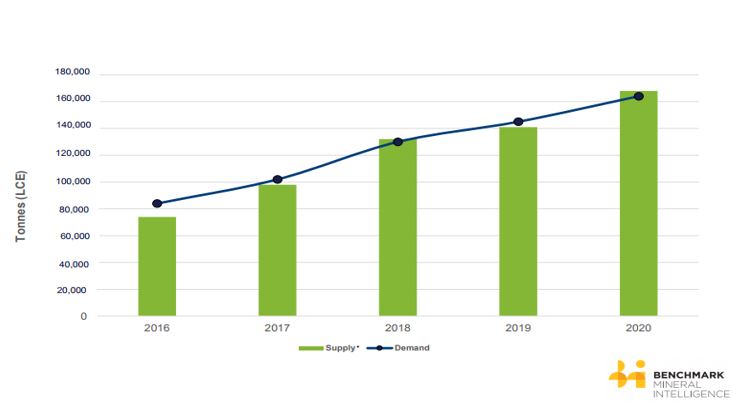

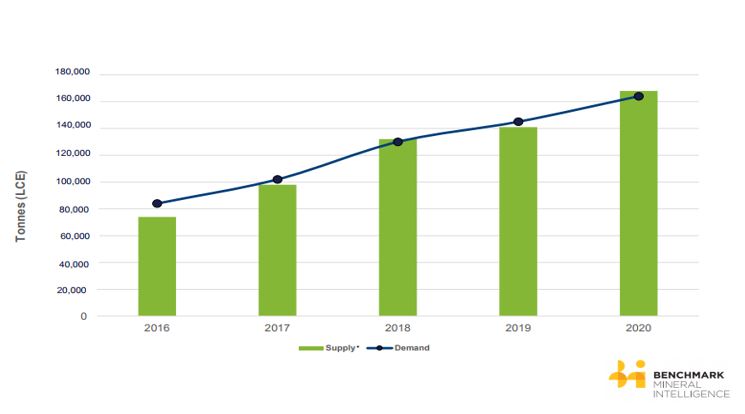

Demand for lithium in 2016 was at 84,000 tonnes LCE (lithium carbonate equivalent). Lithium demand from mega factories was 22,000 tonnes LCE. It’s estimated that at full capacity mega factories would require 132,000 tpa LCE. In 2020, Benchmark Mineral Intelligence forecasts lithium demand from the entire battery market will total 164,000 tonnes LCE. As the demand for lithium increases the prices are expected to go higher as well.

High-quality lithium hydroxide and carbonate

Nemaska Lithium intends to become a lithium hydroxide and lithium carbonate producer and supplier to the emerging lithium battery market that is largely driven by electric vehicles, cell phones, tablets and other consumer products as well as energy storage. The Company is developing significant spodumene lithium hard rock deposits, both in volume and grade, known as the Whabouchi mine. The spodumene concentrate extracted at that mine and produced at the commercial concentrator located on the mine site will be shipped to the Corporation’s hydro-metallurgical processing plant to be built in Shawinigan, Québec, where it will be transformed into high-purity lithium hydroxide and carbonate using the proprietary methods developed by Nemaska Lithium.

Leave A Comment