Quarter after quarter Netflix bulls tout how impressive the company’s subscriber growth numbers are. Despite underlying issues, which these investors care little about, as long as subscriber growth remains on the uptick, the stock follows suit. So what happens when that subscriber growth disappoints? NFLX shares face a stark reality in which the business operations aren’t justifying the current share price, far from it actually. We’ll detail some of the issues facing Netflix below.

Content Costs Are Misleading and Undermine Value of Revenue Growth

We first highlighted Netflix’s content cost problem in April 2014 and while the content cost growth rate has slowed lately, it still undermines revenue growth. While Netflix will tout 29% year over year revenue growth, it fails to mention its streaming content costs grew by 17% YoY as well to a total of $10.4 billion in 3Q15. Beware revenue growth that is closely followed or surpassed by expense growth.

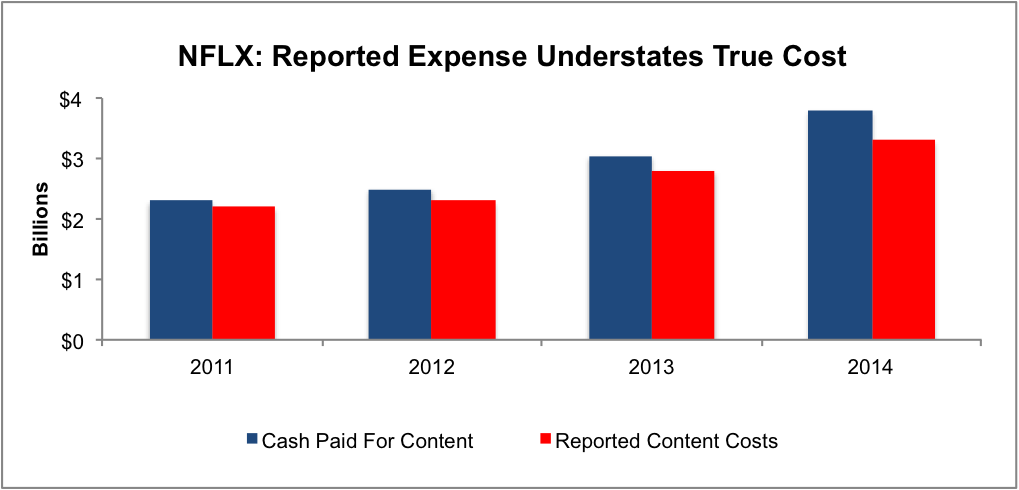

Furthermore, because of the way Netflix accounts for its streaming content, the reported expenses understate the cash costs of that content. From Figure 1, in just four years, the difference between reported content costs and actual cash payments for new content is nearly $1 billion. In 2014 alone, Netflix paid $500 million more to add to its library than it recognized in expenses.

Figure 1: Reported Costs Vs. Actual Cash Paid

Sources: New Constructs, LLC and company filings

Rising Content Costs Will Require Raising Capital

Netflix has been burning cash since 2011 when the company began aggressively expanding its content library. However, the 35 analysts who cover Netflix, as tracked by Factset, have an average overweight rating and price target of $121/share. Additionally, 18 analysts have increased their price target while only two have lowered them. How can so many analysts be bullish on a company that has burned through over $2 billion in cash since 2011? The answer is simple. Netflix has announced the need to raise capital to support its ventures. We’ve previously highlighted how analyst buy ratings are not always trustworthy and by maintaining a high rating on Netflix, an analyst can position their firm to aid in the capital issuance, which could mean big profits for the investment bank.

Leave A Comment