When we reported yesterday that Netflix is looking to prefund two more quarters of cash burn – which hit $860BN in Q3 – by issuing another $2 billion in junk bonds, just six months after the company issued an upsized $1.9 billion in 5.875% bonds in April, we expected that the bond market may demand a pound a flesh and Netflix would be forced to pay as much as a 7% coupon on the new issue.

It wasn’t quite that bad, but investors certainly did not roll out the red carpet either.

According to Bloomberg, the world’s largest paid online TV service had to offer yields “at the high end” of its price expectations – the first time it has had to do so in its history. Specifically, Netflix (NFLX) priced $800 million of bonds at a yield of 6.375% and 1.1 billion euros ($1.26 billion) of notes for 4.625% on Tuesday.

While not dramatically higher than initial price talk, the company had come to market with an offer of around 6.25% for the US and 4.5% for the European notes. The deal was marketed briefly, hitting the market on Monday before today’s pricing with some investors expressing concerns about buying longer-dated debt as rates rise, according to Bloomberg.

While for resolute yield chasers the bond deal would have been a great deal no matter the yield, for investors growing concerned about higher interest rates and a turn in the credit cycle over the next years, the deal’s long-term maturity was a reason for concern, if certainly not a dealbreaker. Additionally, the new debt is structured as a 10.5-year non-call for life, which while good news to investors seeking to lock in duration at today’s terms for over a decade also means the company can’t buy it back.

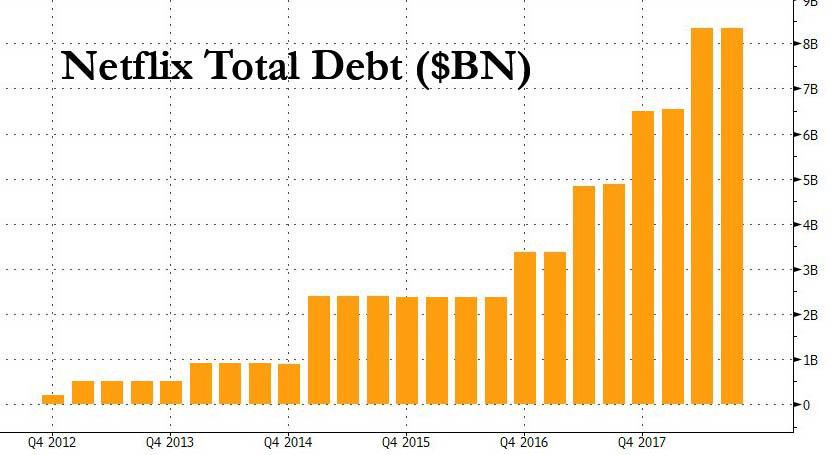

Some investors – those crazy enough to be worried about fundamentals – reportedly passed due to the company’s growing debt load which pro forma for this deal will rise above $10 billion..

… and its record high cash burn.

Leave A Comment