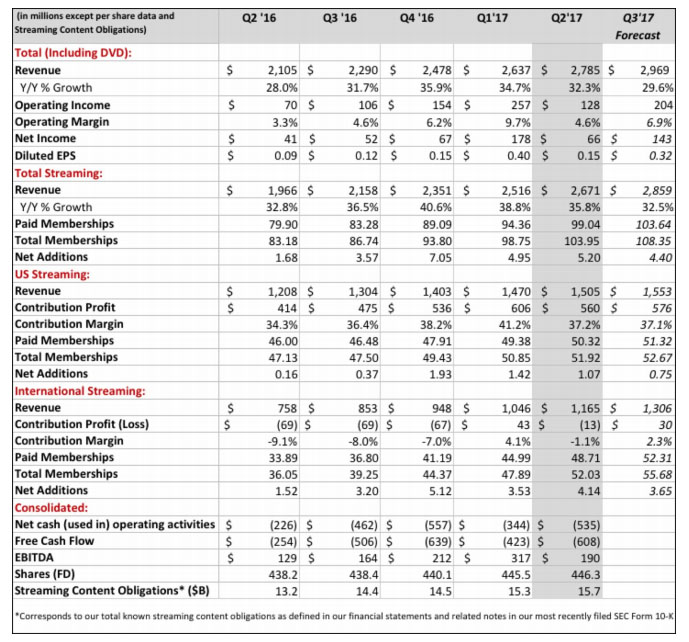

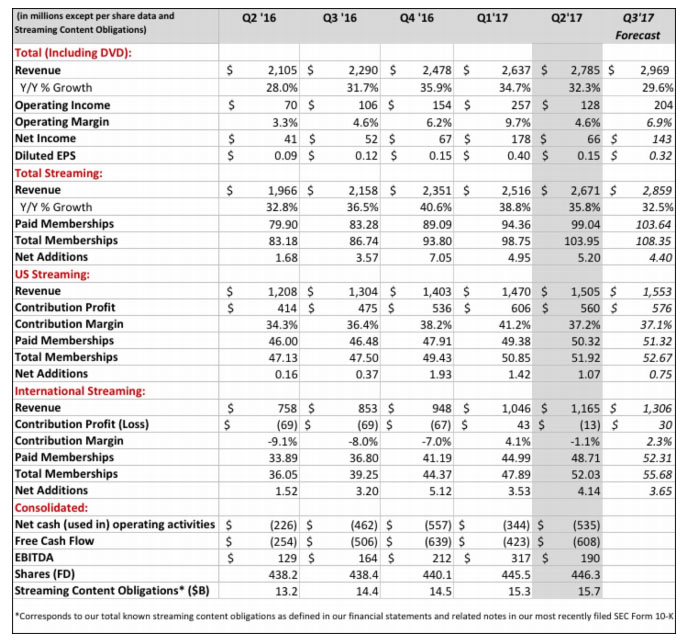

Netflix stock has surged after hours, soaring above its all time high price, and up 8% after reporting Q2 numbers which while beating slightly on revenues ($2.79Bn, Exp. $2.77Bn), and missing modestly on Earnings ($0.15, exp. $0.16), were far more remarkable for the subscriber numbers which smashed expectations as follows:

Just as impressive was Netflix’ outlook, which now expects Q3 net streaming adds of 4.4 over 400K more than the consensus estimate of 3.99 million. The company expects $2.97 billion in Q3 revenue, also above the consensus estimate of $2.88 billion, and net income of $143 million, above the est. $101.6 million.

Less impressive were the financials: here operating margin tumbled from 9.7% in Q1 to 4.6% in Q2 as a result of a $245 million sequential increase in cost of revenues.

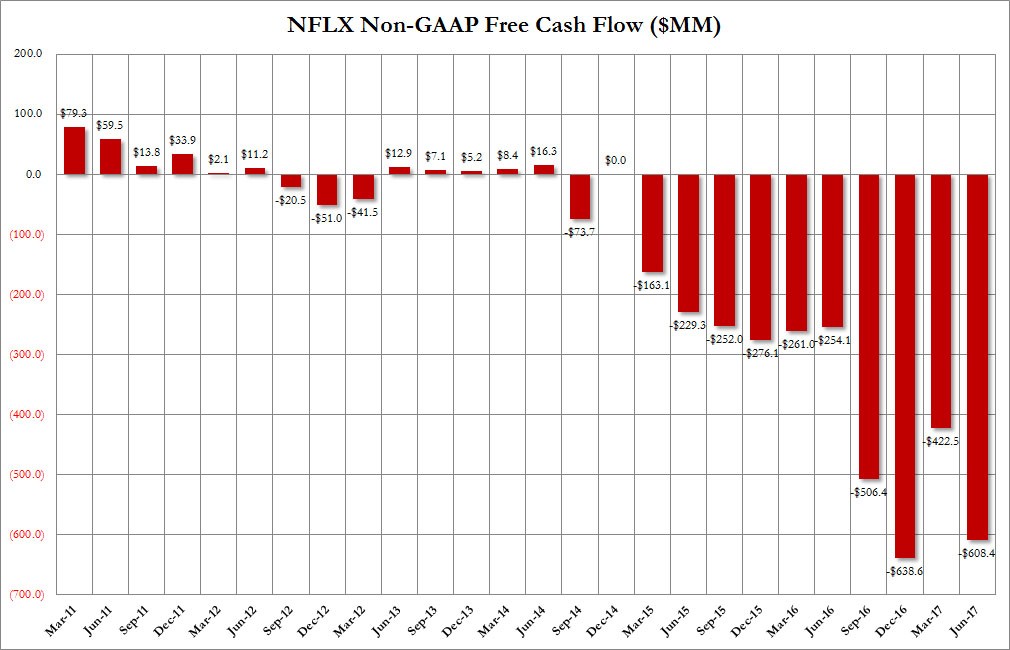

Furthermore, the company is back to its record cash burning ways, reporting that in Q2 it burned a record for the quarter $608 million, just why of its worst cash burn quarter in history when it burned $639 million in Q4 of 2016.

From Netflix’ letter:

In its quarterly letter, Netflix writes that In Q2 “we underestimated the popularity of our strong slate of content which led to higher-than-expected acquisition across all major territories. As a result, global net adds totaled a Q2-record 5.2 million (vs. forecast of 3.2m) and increased 5% sequentially, bucking historical seasonal patterns. For the first six months of 2017, net adds are up 21% year-on-year to 10.2m.

Our Q3 guidance assumes much of this momentum will continue but we are cognizant of the lessons of prior quarters when we over-forecasted and there was lumpiness in net adds, likely due to demand being pulled forward (into Q2 in this case).”

Leave A Comment