This morning’s release of the January New Home Sales from the Census Bureau came in at 593K, down 7.8% month-over-month from a revised 643K in December. Seasonally adjusted estimates back to October were also revised. The Investing.com forecast was for 655K.

Here is the opening from the report:

Sales of new single-family houses in January 2018 were at a seasonally adjusted annual rate of 593,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.8 percent (±19.0 percent)* below the revised December rate of 643,000 and is 1.0 percent (±16.4 percent)* below the January 2017 estimate of 599,000.

The median sales price of new houses sold in January 2018 was $323,000. The average sales price was $382,700. [Full Report]

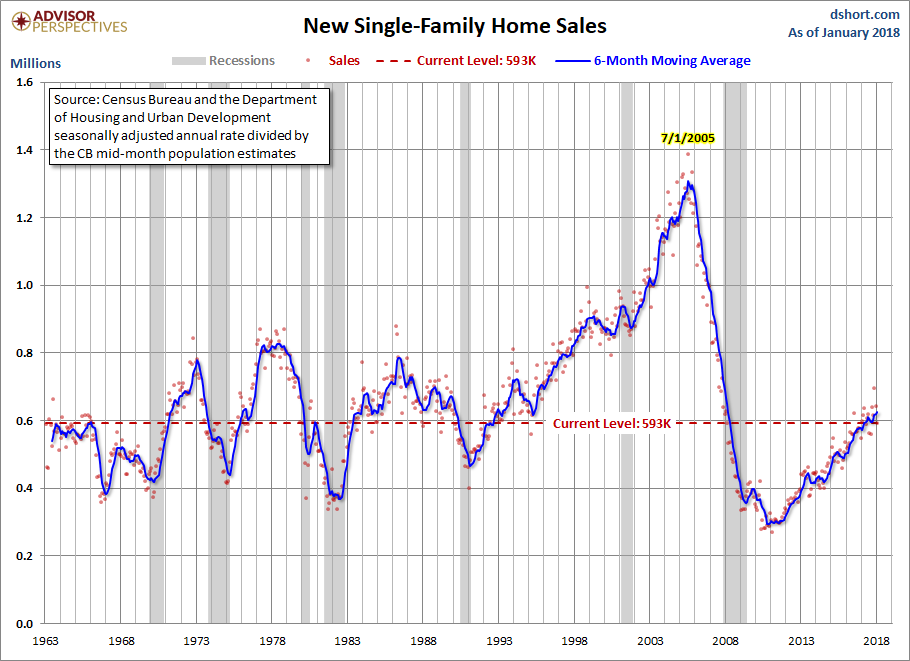

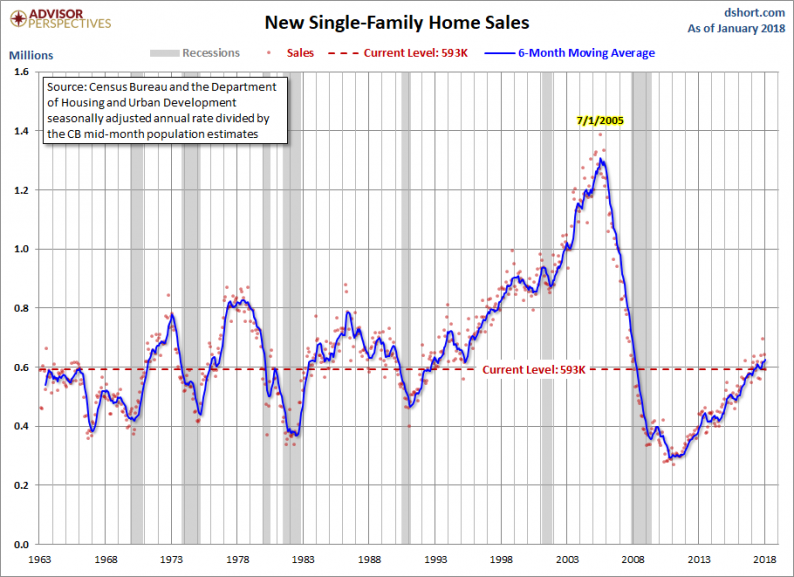

For a longer-term perspective, here is a snapshot of the data series, which is produced in conjunction with the Department of Housing and Urban Development. The data since January 1963 is available in the St. Louis Fed’s FRED repository here. We’ve included a six-month moving average to highlight the trend in this highly volatile series.

Over this time frame, we see the steady rise in new home sales following the 1990 recession and the acceleration in sales during the real estate bubble that peaked in 2005.

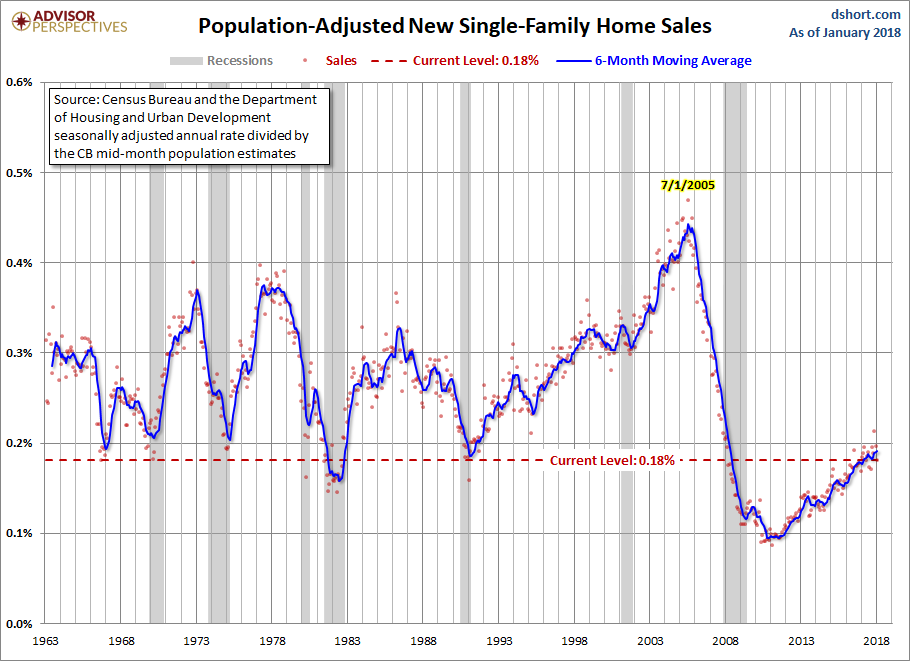

The Population-Adjusted Reality

Now let’s examine the data with a simple population adjustment. The Census Bureau’s mid-month population estimates show a 74.0% increase in the US population since 1963. Here is a chart of new home sales as a percent of the population.

New single-family home sales are 0.3% above the 1963 start of this data series. The population-adjusted version is 42.3% below the first 1963 sales and at a level similar to the lows we saw during the double-dip recession in the early 1980s, a time when 30-year mortgage rates peaked at 18.63%. Today’s 30-year rate is about 4.3%.

Leave A Comment