Things move so fast recently that I completely forgot to update you on my most recent purchases! In January, I bought shares of 4 different dividend growth companies. I already mentioned my purchases of MMM and EMA.TO (EMRAF). This means I have two more companies to tell you about!

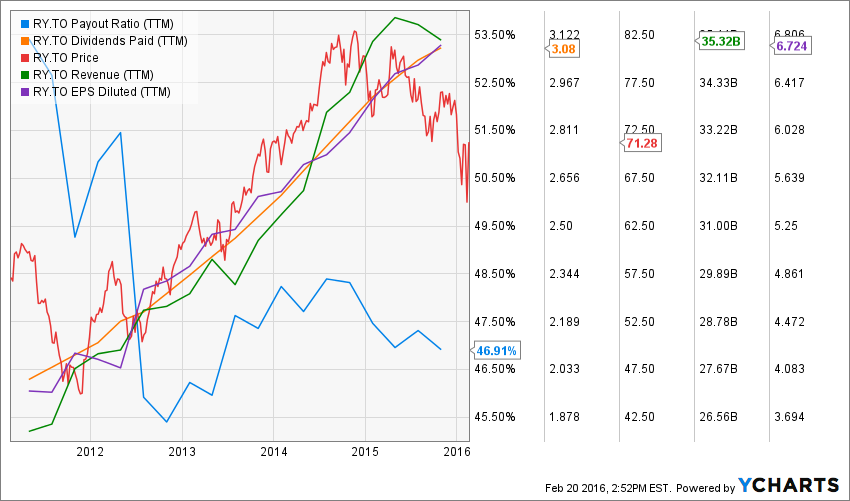

During the same month, I decided to add a Canadian bank to my children’s tuition fund (RESP) portfolio. Since I will not need this money for another 10 years, I thought it was a good time to add one of those dividend growth marvels that are Canadian banks. Last year, I reviewed the Big 5 and wrote that my favorite was Royal Bank (RY). I then decided to put my money where my mouth is and pull the trigger.

I purchased 29 shares of Royal Bank (RY.TO)

Investment Thesis

RBC has been on my Dividend Stocks Rock Buy List since July 2015. This is a very selective list of only 5 US and 5 Canadian dividend growth stocks. I consider RY as a very interesting play as its capital market and wealth management sectors provide strong and consistent revenue streams alongside their traditional banking. They do an awesome job generating strong profits from capital markets and their wealth management division generates revenues from over 15 million clients. They recently purchased City National, a private & commercial bank for wealthy clients based in Los Angeles.

While the Canadian debt ratio is still a concern, RY diversifies its revenue sources away from mortgages and commercial loans. However, keep in mind that capital markets brings higher volatility.

Most recently, Royal Bank continues to please their investors with solid results. While the market keeps worrying about the effect of low oil prices on RBC assets & loans, the largest Canadian bank in terms of market capitalisation is piling up good results with a record year for personal and commercial banking segment results.

The wealth management division also recorded solid growth despite the bearish Canadian stock market. Unfortunately, it was a tougher quarter for the capital markets segment that missed analysts’ estimates.

Leave A Comment