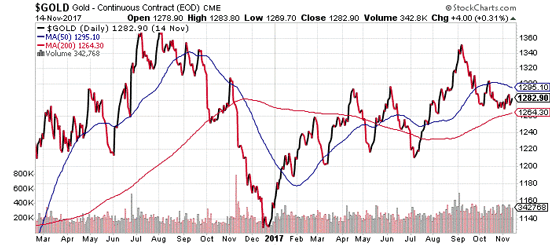

If you look at gold’s performance over the last few months, or even quarters, it would be hard to feel much excitement.

Stocks are near all-time highs, oil is roaring back, and Bitcoin has blasted off.

Meanwhile, gold sentiment is negative.

Getting almost anyone excited about gold seems like a monumental task; it appears to be stuck in a trading range that’s going nowhere fast.

Unless you’re looking at what I’m looking at right here…

From Around the World, the View Couldn’t Be Better

Traders and investors obsessing and, inevitably, fretting, over gold’s performance at yearly or quarterly timescales, like in the chart below, simply aren’t looking in the right place.

And it’s costing them a lot of upside.

The truth is, gold’s been doing well. Very well, in fact.

Here’s how I know.

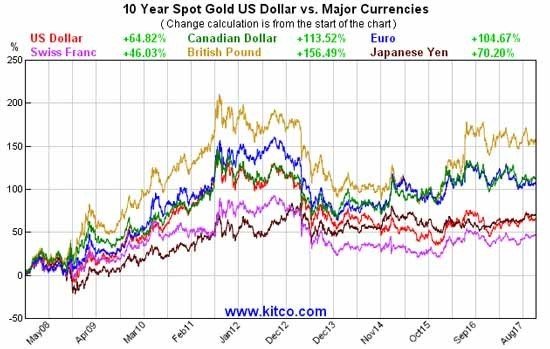

You see, it’s normal to look at the gold price in U.S. dollars.

Nothing wrong with that at all – heck, a good chunk of the world does this – even to a fault. It does makes some sense, because nearly every other commodity is also priced in U.S. dollars.

But the reality is, unless you already have dollars, when you buy gold, you’re going to buy it in your home currency.

And gold has a lot of appeal – arguably a lot more – in places like Europe, Asia, Africa, and the Middle East.

So the much better way to judge gold’s health is to look at its performance in relation to a much bigger basket of currencies.

“How best to do that?” you may ask…

Here are a couple of charts that do exactly that over the past 10 years…

One aspect worth noting is that in some currencies – like the Russian ruble, South African rand, and, to a lesser extent, the British pound sterling – gold is not far off its bull-market highs.

And in the two strongest currencies, the Swiss franc and the U.S. dollar, gold is still up 44% and 63%, respectively.

Leave A Comment