The Dividend Aristocrats Index is comprised of 50 stocks that have increased their dividend payments for 25+ consecutive year.

The Dividend Aristocrats Index is very exclusive. To be a member a stock must have the aforementioned dividend history and be a member of the S&P 500.

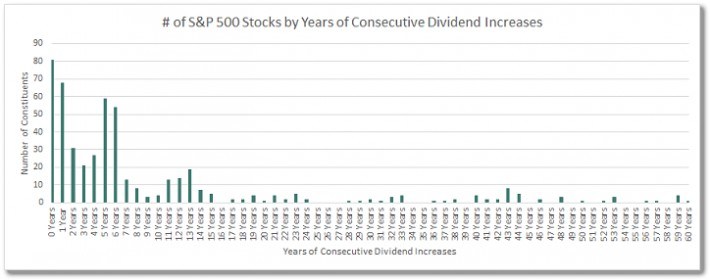

Only ~10% of S&P 500 stocks are Dividend Aristocrats. The image below shows the number of years of dividend payments for S&P 500 stocks.

Sources: Yahoo! Finance, David Fish’s CCC List, Dividend.com, and various investor relations pages

Note: 0 is no dividend payments, 1 is 1 year of dividend payments, and 2 is 1 year of increases, 3 is 2 years of increases, and so on.

Being a Dividend Aristocrat matters. The Dividend Aristocrats Index has outperformed the S&P 500 e over the last decade.

Source: S&P Dividend Aristocrats

Based on my research one business will be added to the Dividend Aristocrats List in 2016. Three more will be added in 2017 (assuming they continue to increase dividends).

This article examines the 4 stocks that will become Dividend Aristocrats in the next 2 years

General Dynamics

General Dynamics (GD) is an aerospace and defense company founded in 1952. The company has grown to reach a $42 billion market cap.

General Dynamics is the 4th largest aerospace and defense business in the United States based on its market cap. The company’s 3 larger competitors are shown below:

General Dynamics has increased its dividend payments for 24 consecutive years.

The company’s 25th consecutive dividend increase will occur in April of 2016 (if the company does increase its dividend has planned – which is extremely likely).

The 2016 dividend increase will make General Dynamics eligible to be a Dividend Aristocrat.

General Dynamics operates in 4 segments:

The company’s aerospace segment is its largest based on operating income in fiscal 2015.

One large customer accounts for over 60% of General Dynamics sales – the United States government. Having one customer responsible for the majority of your business is usually a risky strategy. In General Dynamics case the risk is subdued because that customer is not going anywhere. The United States government is the largest entity in the world.

General Dynamics has grown its earnings-per-share at 8.9% a year over the last decade. The company has accomplished this growth by:

I expect General Dynamics to continue growing its earnings-per-share at around 9% a year going forward. This growth combined with the company’s current 2% dividend yield gives investors an expected total return of around 11% per year going forward.

Leave A Comment