The latest issue of the NFIB Small Business Economic Trends came out this morning. The headline number for August came in at 105.3, up 0.1 from the previous month. The index is at the 97th percentile in this series. Today’s number came in above the Investing.com forecast of 105.0.

Here is an excerpt from the opening summary of the news release.

The NFIB Index rose 0.1 points to 105.3. Five of the components increased, while five declined. The lofty reading keeps intact a string of historically high performances extending back to last November.

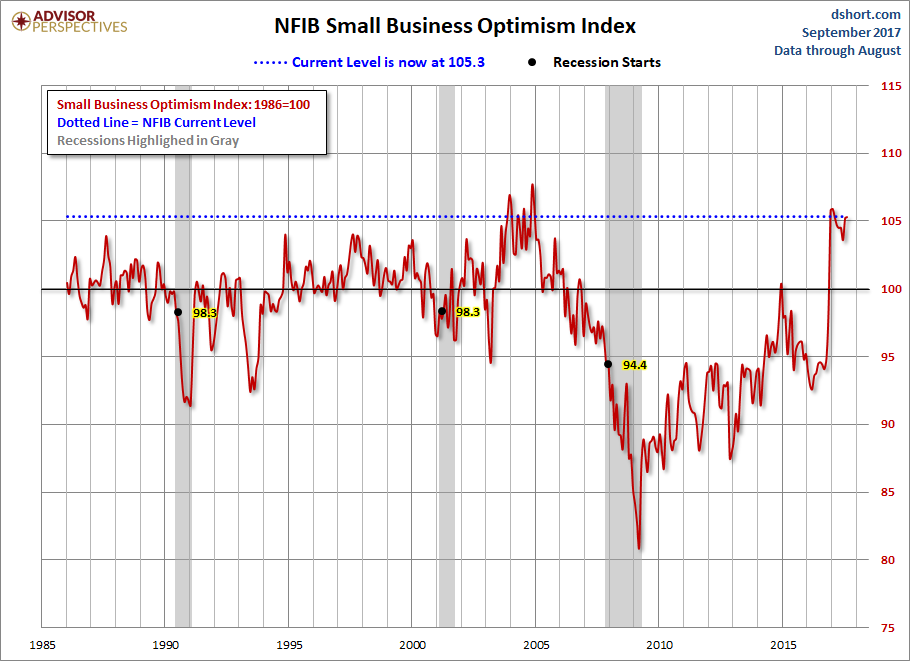

The first chart below highlights the 1986 baseline level of 100 and includes some labels to help us visualize that dramatic change in small-business sentiment that accompanied the Great Financial Crisis. Compare, for example, the relative resilience of the index during the 2000-2003 collapse of the Tech Bubble with the far weaker readings following the Great Recession that ended in June 2009.

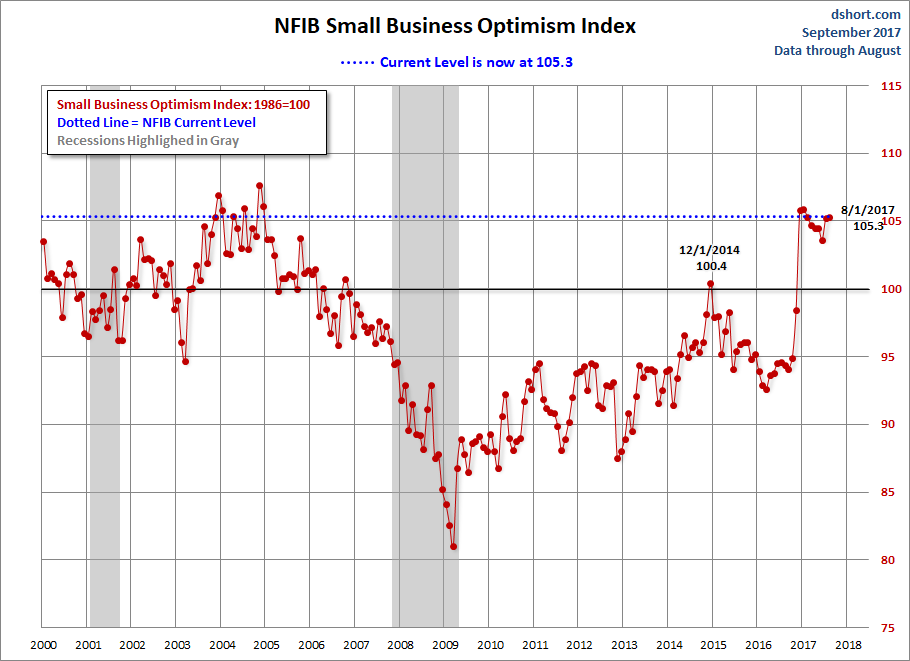

Here is a closer look at the indicator since the turn of the century. We are now just below the post-recession interim high.

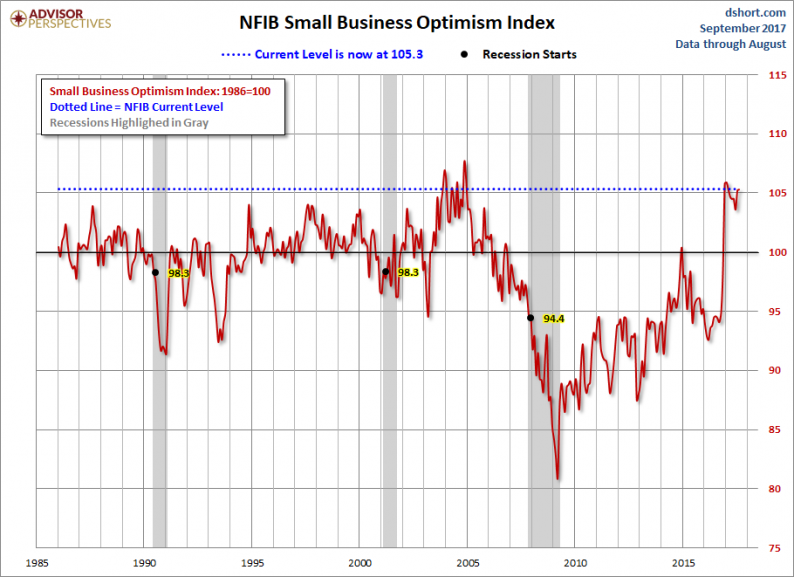

The average monthly change in this indicator is 1.3 points. To smooth out the noise of volatility, here is a 3-month moving average of the Optimism Index along with the monthly values, shown as dots.

Here are some excerpts from the report.

Labor Markets

Small business owners reported a seasonally adjusted average employment change per firm of 0.18 workers per firm over the past three months, virtually unchanged from July.

Inflation

How effective has the Fed’s monetary policy been in lifting inflation to it two percent target rate?

The net percent of owners raising average selling prices increased 1 point, rising to a net 9 percent. This is the highest reading since 2014, good news for the Federal Reserve which is trying to generate more inflation.

Credit Markets

Has the Fed’s zero interest rate policy and quantitative easing had a positive impact on Small Businesses?

Leave A Comment