In a report on the history (and future) of inflation from Deutsche Bank’s Jim Reid, the credit strategist notes that while it may not feel like it, but we live in inflationary times relative to long-term history.

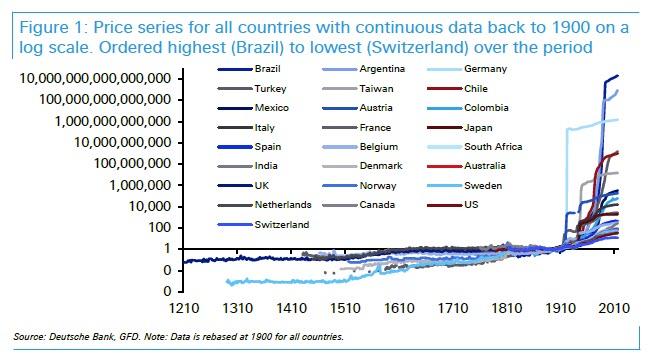

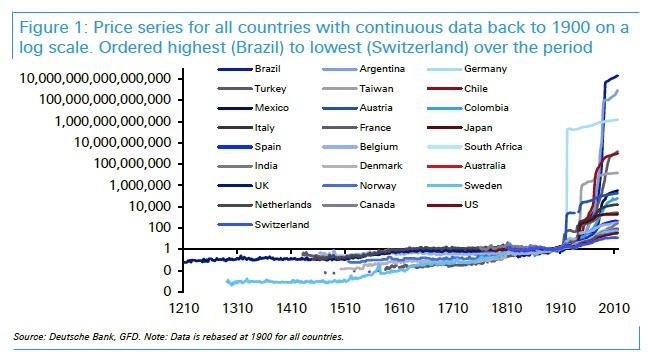

Before the start of the twentieth century prices generally crept higher only very slowly over time and were indeed often flat for very long periods. For example in the UK the overall price level was broadly unchanged between 1800 and 1938. However, inflation moved higher everywhere across the globe at numerous points in the twentieth century. UK prices since 1938 have increased by a multiple of 50 (+4885%) and of the 25 countries with continuous inflation data back to 1900, the UK is one of only 5 countries in the sample not to experience extreme inflation (defined as >25% YoY) in a given year. Of these 25 countries only Holland (3.0%), Canada (3.0%), the US (3.0%) and Switzerland (2.1%) have seen average annual inflation at 3% or below.

As shown in the chart below, while inflation was virtually non-existent until the 20th century, all of that changed once the Federal Reserve was created…

And while we will discuss in a follow up post Reid’s observations on just “what changed in the twentieth century”, below we list some “fascinatingf stats” about inflation as we thank the central bankers for unleashing this most powerful economic force on the face of the planet.

From Deutsche Bank:

Leave A Comment