Investors will ignore a lot of red flags if they think they’ve found a diamond in the rough.

This company has an alarming number of red flags. Its shrinking cash flows can’t cover its debt burden, its accounting is confusing and possibly unreliable, its industry faces technological disruption, and its valuation assumes implausibly high profit growth. These issues make Hertz Global Holdings (HTZ: $20/share) a dangerous stock.

Long-Term Track Record of Profit Decline

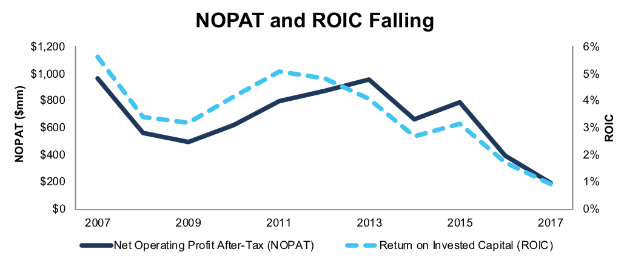

Since 2007, after-tax profit (NOPAT) has fallen from $960 million to $196 million in 2017, and return on invested capital (ROIC) has fallen from 6% to 1%. Declining margins have been the primary culprit, with NOPAT margins falling from 11% to 2%.

Figure 1: HTZ’s NOPAT and ROIC since 2007

Sources: New Constructs, LLC and company filings

Investors in Hertz are hoping for a turnaround, but so far there’s been no sign that profits are stabilizing, much less returning to growth. Meanwhile, the company’s debt burden continues to mount, with net debt hitting $16.1 billion (84% of enterprise value) in 2017. The company’s NOPAT has not been enough to cover its interest expense in each of the past two years.

Non-GAAP Accounting Misleads Investors & Raise Red Flags with Auditor

Hertz is a difficult stock for the average investor to evaluate because its GAAP net income number is functionally useless. The company’s large debt load, frequent write-downs, unusual tax activity, and various other one-time items cause reported earnings to swing back and forth from positive to negative with no relation to the underlying economics of the business.

In 2017, Hertz’s GAAP net income turned positive as a result of a $679 million gain from the remeasurement of its deferred tax liabilities after tax reform. In reality, as Figure 1 shows, Hertz’s profitability continued its long-term decline.

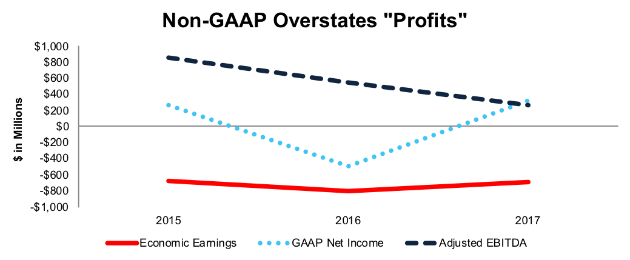

Since GAAP numbers are even more misleading than normal for Hertz, investors pay more attention to non-GAAP metrics, especially adjusted EBITDA. Unfortunately, as shown in Figure 2, adjusted EBITDA significantly overstates the economic earnings of the business over the past three years (we don’t have comparable adjusted EBITDA numbers before 2015 due to accounting restatements and the spin-off of Hertz’s equipment rental business).

Figure 2: HTZ’s Non-GAAP Metrics Paint False Picture of Performance

Sources: New Constructs, LLC and company filings

Investors should be extra wary of Hertz’s reported profits (both GAAP and non-GAAP) due to the company’s history of accounting problems. In 2015, Hertz was forced to restate its earnings going back to 2011. One would imagine that such a significant problem would lead the company to emphasize accurate accounting going forward, but the company still has material weaknesses in its internal controls over reporting according to auditor PricewaterhouseCoopers. The inability (or lack of desire) to fix such a glaring problem poses a risk of further restatements and raises questions about management’s ability to execute a turnaround.

Compensation Plan Rewards Execs for Non-GAAP Growth and Other Flawed Metrics

Hertz’s executive compensation misaligns executives’ interests with shareholders’ interests. The misalignment helps drive the profit decline shown in Figure 1 and the disconnect between non-GAAP EBITDA and economic earnings.

80% of executives’ long-term performance share units are awarded for meeting adjusted EBITDA and adjusted EBITDA margin targets. The remaining 20% is tied to improvements in net promoter score, a measure of customer satisfaction.

Leave A Comment