Reader Arthurian writes in the wake of the 3% growth rate (SAAR) reported for 2017Q3:

Back in January Menzie Chinn said he thought growth in the 3.5-4% range was “unlikely”. I wonder if he is having second thoughts now.

I’m going to show two pictures deploying at most undergraduate statistics to show why I — like most numerically literate people — still think sustained 3.5% growth is unlikely.

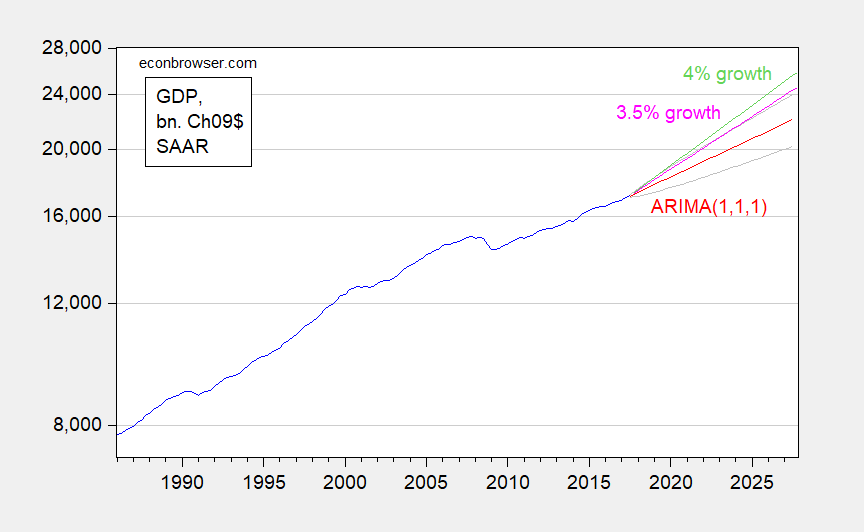

First, consider what a naive statistical model — an ARIMA(1,1,1) estimated over the 1986-2017Q3 period — says, as compared to a 3.5% or 4% growth rate.

Figure 1: Reported GDP (blue), ARIMA(1,1,1) dynamic forecast (red) and 64% prediction interval (gray lines), implied path for 3.5% sustained growth (pink) and for 4% (light green), all billions Ch.2009$ SAAR.

Source: BEA 2017Q3 advance release, author’s calculations.

Note that by estimating the regression starting in 1986 when the trend growth rate was relatively high, I am slanting the results toward projecting faster growth. Even then, the 3.5% growth rate is at the uppermost edge of the 64% prediction interval. 4% growth is even more laughable.

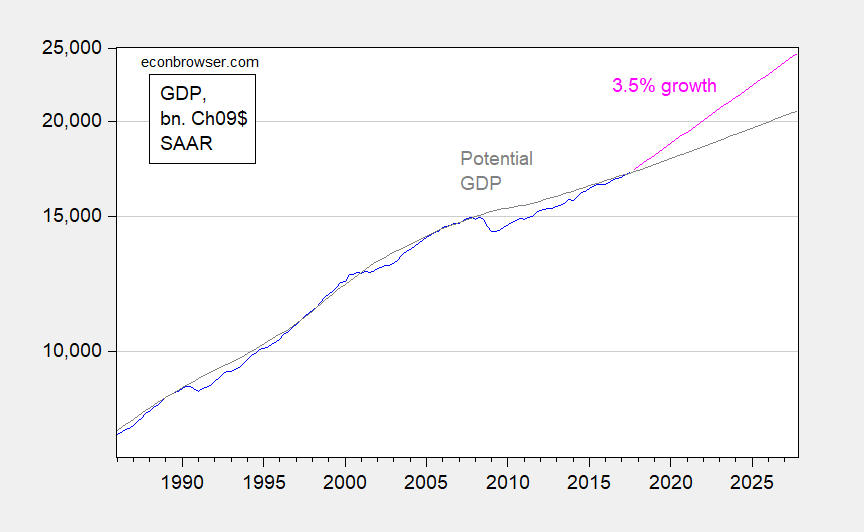

Second, now consider what sustained 3.5% growth implies for the output gap. For that calculation, one needs an estimate of potential GDP; for want of a better measure, I use CBO’s estimate. This is shown in Figure 2.

Figure 2: Reported GDP (blue), implied path for 3.5% sustained growth (pink) and potential GDP, all billions Ch.2009$ SAAR.

Source: BEA 2017Q3 advance release, CBO (June 2017), author’s calculations.

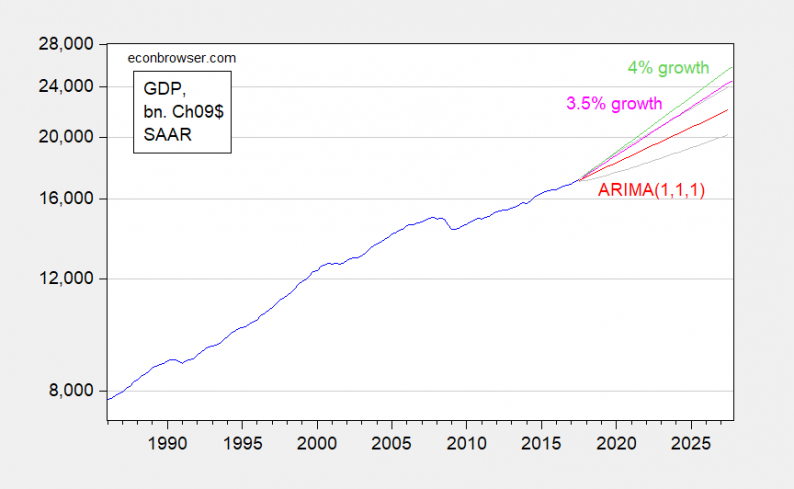

Assuming sustained 3.5% growth, the output gap by end-2019 would be 4.2%, 5.9% by end-2020. Of course, CBO could be terribly misguided about the trajectory of potential GDP. But in order to believe potential GDP can grow at 3.5%, I really do believe that it can only be done by adherence to January. Refer to Figure 3, reproduced from my January post, and look at what the orange bar — labor productivity — has to do in order to hit 3.5% potential growth.

Leave A Comment