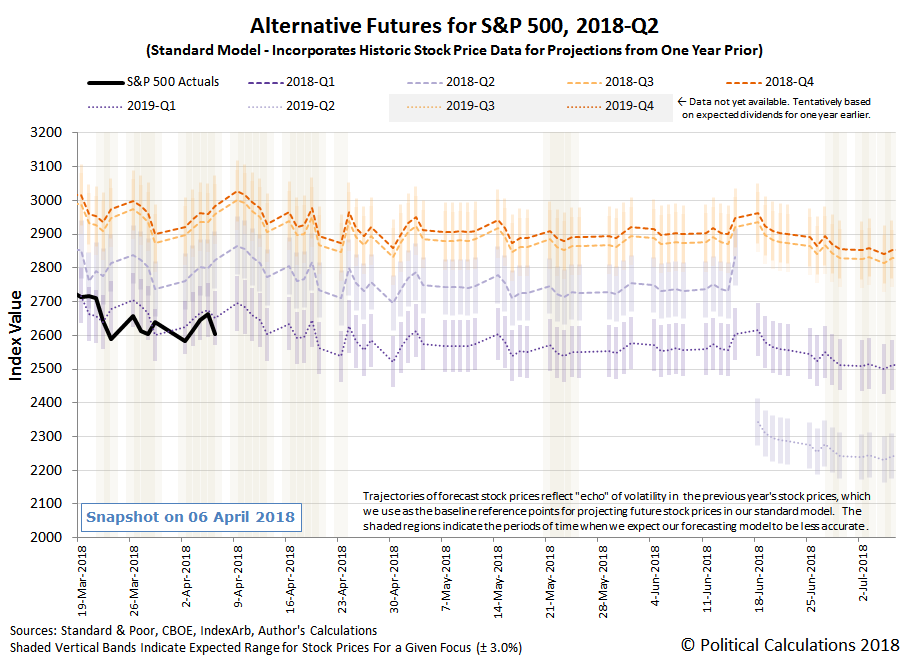

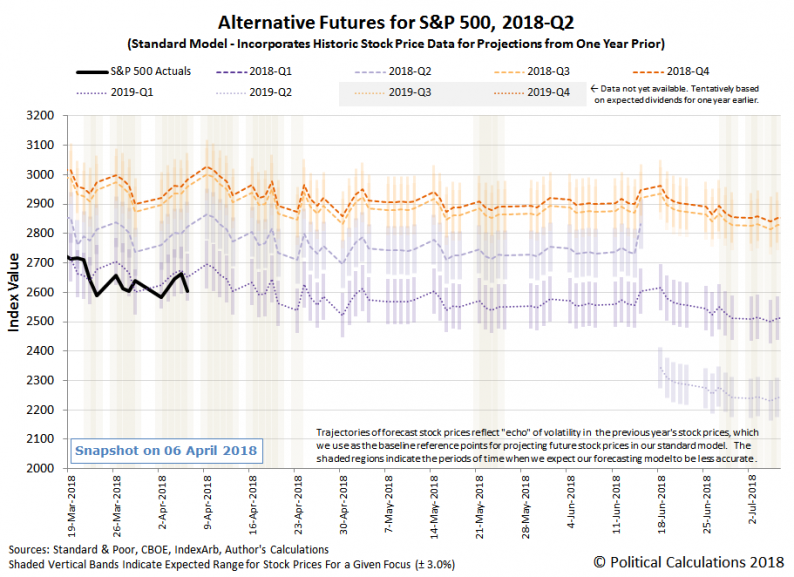

Volatility was once again the name of the game in the US stock market during the first week of April 2018. Starting from Friday, 30 March 2018’s closing value of 2,640.87, the S&P 500 (Index: INX) bounced off an intraday low of 2,553.80 on Monday, 2 April 2018 before going on to rise as high as an intraday high of 2,672.08 on Thursday, 5 April 2018 – a swing of 4.4% from low of the week to high of the week – before dropping 85.8 points on Friday, 6 April 2018 to hit an intraday low of 2,586.27 before rebounding a bit to close the week at 2,604.47.

Which is to say that there was quite a lot of noise in the U.S. stock market during the week that was, but not so much as to deviate from generally following our dividend futures-based model’s projected trajectory associated with investors being largely focused on the distant future quarter of 2019-Q1 in setting today’s stock prices.

Picking up from our analysis of our model’s performance last week, we confirm that our model’s projections are slightly overshooting the actual trajectory of the daily closing price of the S&P 500 as expected, but not by so much that we need to develop a red-zone forecast – we’re going to let our standard model’s forecast ride, with the understanding that it is likely to overshoot the actual trajectory of stock prices through 23 April 2018, and that the continuing elevated level of volatility in stock prices may exceed the “typical” level of volatility that we’ve built into our model’s forecasts.

Here are the headlines that caught our attention as being noteworthy for their market-moving potential, where the noise being generated by the developing trade war between the U.S. and China would appear to be a leading contributor to the elevated level of volatility in the U.S. stock market.

Monday, 2 April 2018

- Amazon shares fall 6 percent as Trump renews attack

- Tesla shares fall on worries about Model 3 production rate

- Intel shares see biggest drop in 2 years after report Apple will ditch Mac chips

Leave A Comment