What’s more important? Making gains in the stock market or preventing losses?

Before answering that question, let’s list a few common fallacies about risk:

Instead of helping people, these fallacies trick investors into miscalculating risk.

Now, let’s examine the numbers to find out what’s more important: making gains or preventing losses.

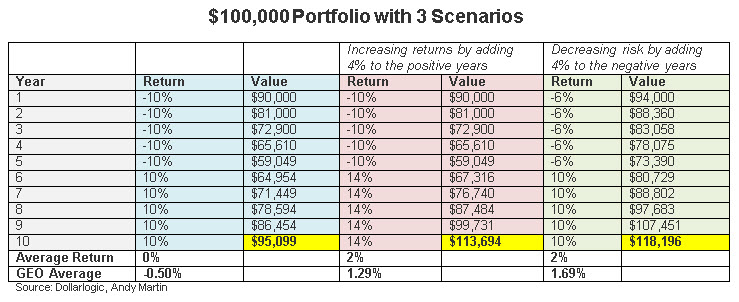

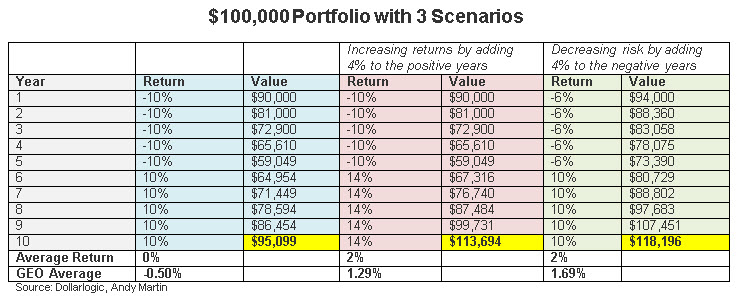

The table below is illustrated in a great book titled “Dollarlogic: A Six-Day Plan to Achieving Higher Investment Returns by Conquering Risk” written by my friend and colleague Andy Martin. The table illustrates a $100,000 portfolio with three different performance scenarios over a period of 10 years.

Scenario one (highlighted in blue), shows the first five years with consecutive yearly losses of 10% followed by five consecutive yearly gains of 10%. The investor began with $100,000 but ends the 10-year period with $95,099.

In scenario two (highlighted in red), the investor suffers five consecutive yearly losses of 10% but manages to recover by gaining 14% for five consecutive years. The investor began with $100,000 and ends the 10-year period with $113,964.

Now look at the green column. Compared to the previous examples, the investor in scenario three (highlighted in green) comes out on top with $118,196. Why? It’s because the investor minimized losses to only 6% during the bad years while the other portfolios lost 10%.

Although the average return for the portfolios inside the red and green columns are the same 2%, the geometric return for the portfolio that minimized market losses did better. Here’s something else: The portfolio that increased returns by 4% during the good years still got a lower total return of just 13.69% while the more conservative portfolio that reduced risk gained 18.20%.

Leave A Comment