The Empire State Manufacturing Survey improved insignificantly and remains deeply in contraction.

As this index is very noisy, it is hard to understand what these massive moves up or down mean – however this regional manufacturing survey is normally one of the more pessimistic.

Econintersect reminds you that this is a survey (a quantification of opinion). Please see caveats at the end of this post. However, sometimes it is better not to look to deeply into the details of a noisy survey as just the overview is all you need to know.

From the report:

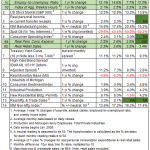

The November 2015 Empire State Manufacturing Survey indicates that business activity declined for a fourth consecutive month for New York manufacturers. The headline general business conditions index was little changed at -10.7. New orders and shipments also declined, although at a slower pace than last month. Price indexes suggested that input prices increased slightly, while selling prices were slightly lower. Labor market conditions continued to deteriorate, with survey indicators pointing to a decline in both employment levels and hours worked. Indexes for the six-month outlook were little changed from last month, and suggested that optimism about future conditions remained tepid, even though employment is expected to increase.

z empire1.PNG

The above graphic shows that when the index is in negative territory that it is not a signal of a recession – of 8 times in negative territory (since the Great Recession) – no recession occurred. Conversely, a positive number is likely to be indicating economic expansion. Historically, when it does make a correct negative prediction it can be timely – this index was only two months late in going negative after what was eventually determined to be the start of the 2007 recession.

Leave A Comment