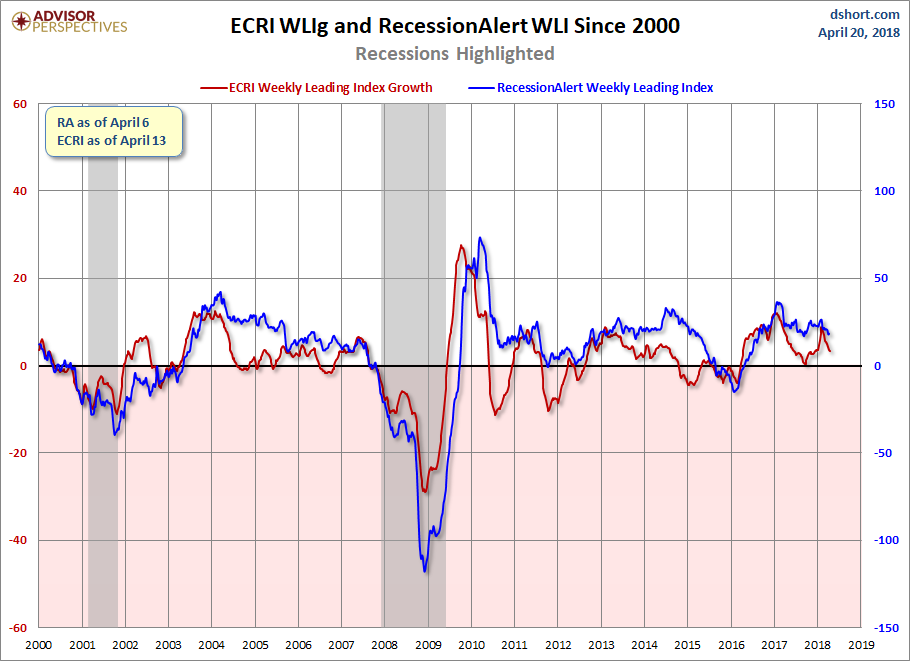

ECRI’s WLI Growth Index which forecasts economic growth six months forward remains in expansion. This is compared to RecessionAlerts similar weekly leading index.

Analyst Opinion of the trends of the weekly leading indices

Both ECRI’s and RecessionAlerts indices are indicating modest growth six months from today.

Current ECRI WLI Level and Growth Index:

Here is this week’s update on ECRI’s Weekly Leading Index (note – a positive number indicates growth):

Weekly Leading Index Ticks Up

ECRI’s U.S. Weekly Leading Index (WLI) ticked up to 146.7 from 146.3, leaving updated WLI growth virtually unchanged at 2.6%.

For more on the cyclical outlook, please see links below for insights from our other forward-looking data that’s been made public:

– download ECRI’s “China Data Disappoints, As Expected”

– read ECRI’s “Inflation Cycle Locked Into Downturn”

– read ECRI’s “Why So Many (in the West) Are Pissed Off”

For a closer look at the performance of the U.S. Weekly Leading Index, see the chart below:

Comparison to RecessionAlert Weekly Indicator

RecessionAlert also produces a weekly forward indicator using different pulse points that ECRI’s WLI. Here is a graph from dshort.com which compares the two indices. These indices are now showing slightly different trends.

Coincident Index:

ECRI produces a monthly coincident index – a positive number shows economic expansion. The October index value (issued in November) shows the rate of economic growth improved.

z ecri_coin.png

ECRI produces a monthly inflation index – a positive number shows increasing inflation pressure. Inflation pressures are receding

U.S. Future Inflation Gauge:.

z ecri_infl.PNG

ECRI produces a monthly Lagging index. The October economy’s rate of growth (released in November) showed the rate of growth slowed.

Leave A Comment