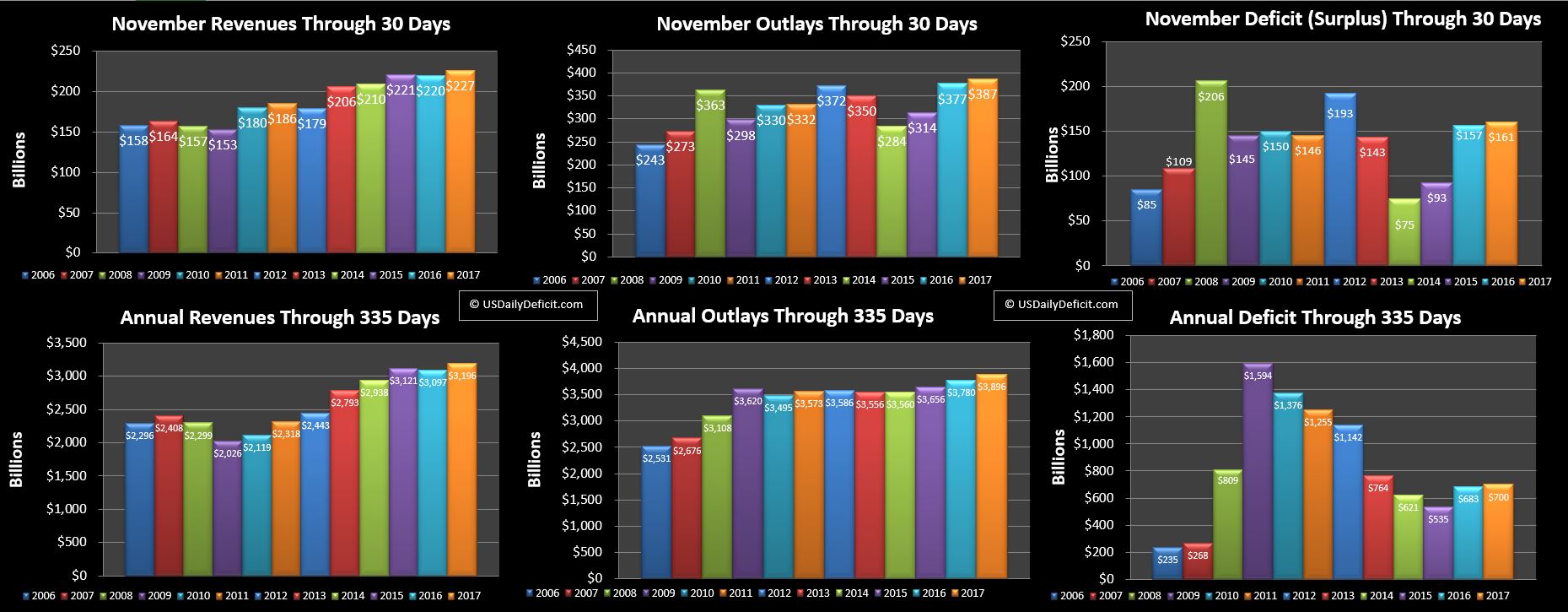

The US Cash Deficit for November came in at $161B compared to $157B last year pushing the 2017 cash deficit through 11 months to $700B, $17B over last year’s $683B.

No real surprises here… revenues and outlays are up about 3%, and with the bigger base of outlays, we have a small increase in the deficit through 11 months.

December, as a quarter end should bring in quite a bit of extra revenue and should post just a small deficit assuming all of the timing issues flow through the same… last year was just $14B… my current model has this December at a $9B cash deficit.

So… with 11 months in the books, absent a surprise, it looks like the deficit will surpass $700B and continue growing for the second year in a row. There is a lot of uncertainty about 2018…I am still trying to wrap my mind around the tax cuts, but my wild guess with very little analysis would be tax cuts keep revenue growth flat… and outlays grow at 3-4%… that would put the 2018 deficit at a little over $800B… if revenues decrease we could be knocking on $1T a year in just a few years time.

Leave A Comment